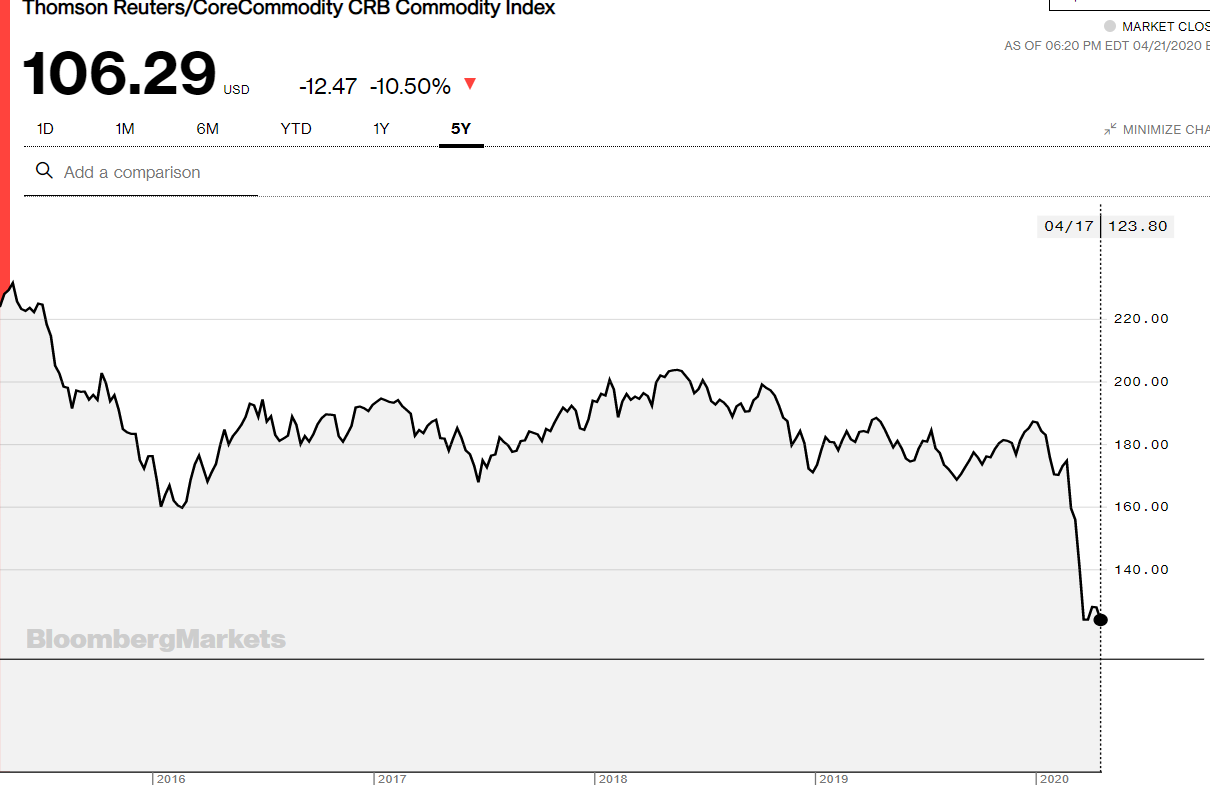

Summary: Risk sentiment remained unsettled after another tumble in oil prices, and whilst not entirely unexpected, served as a reminder of Covid-19’s destructive impact on the global economy. Brent Crude Oil prices tumbled to USD 23.00 from USD 28.50 yesterday, a loss of 23.7%. The US Dollar retained its safe-haven bid, lifting against its rivals. Commodity related and Emerging Market currencies underperformed. A blueprint for Commodity-FX, the Thompson-Reuters CRB Index plummeted to 106.29 lows not seen since the mid-1990s. The Australian Dollar slumped 0.97% to 0.6285 (0.6340) while its smaller cousin, the Kiwi tumbled 1.3% to 0.5973 from 0.6037. Against the Canadian Loonie, the Greenback rose to 1.4200 from 1.4135 yesterday. Sterling plunged to its lowest in two weeks, finishing in late New York at 1.2298 (1.2432), down 1.18%. UK Employment data came in worse than expected. Bank of England Governor Andrew Bailey said that Britain should be cautious of lifting the country’s coronavirus lockdown too early. The Euro dipped to 1.0860 from 1.0867. Elsewhere, the US Senate agreed to a USD 484 million coronavirus stimulus bill for small business and hospital relief which cushioned the fall in US stocks. The Dow ended at 23,126 from 23,629 while the S&P 500 was trading at 2,743 (2,820) in late New York. Global bond yields dropped. The benchmark US 10-year bond yield was 4 basis points lower at 0.57%. Germany’s 10-year Bund yield finished at -0.48% (-0.45%).

UK Average Weekly Earnings (Wages) underwhelmed at 2.8% against forecasts of 3.0%. The UK’s Unemployment Rate rose to 4.0% from 3.9%. US Existing Home Sales matched forecasts at 5.27 million units, falling from the previous month’s 5.76 million units.

On the Lookout: Asian markets will open mixed following the passing of a USD 484 billion interim economic stimulus packaged which cushioned the fall in stocks in late New York. Oil futures in early Asian trade rallied after two days of huge selloffs. Markets will continue to monitor all Covid-19 news releases.

Data released today are Australian Retail Sales, which is an interim release from the Australian Bureau of Statistics to cover the impact of Covid-19. European data begins with UK data: CPI (y/y), Core CPI, PPI Input (m/m), PPI Output, RPI (y/y) and HPI (y/y). Canada reports on its monthly CPI, Core CPI, and Trimmed CPI (y/y). The US releases its House Price Index.

Trading Perspective: The Dollar Index (USD/DXY) climbed to finish at 100.207 as risk sentiment rolled over and treasury prices rallied. In the majors, Sterling was the worst performing currency, on the peaking Covid-19 toll on the UK and underwhelming employment data. Commodity linked currencies led by the Australian Dollar are at risk from weakening prices.

Expect Asian markets to continue the trend with a bid US Dollar and offered Commodity and Asian Emerging Market currencies. In early Asia, oil rallied after two days of unprecedented selloffs. Risk remains unsettled and FX volatility will pick up.