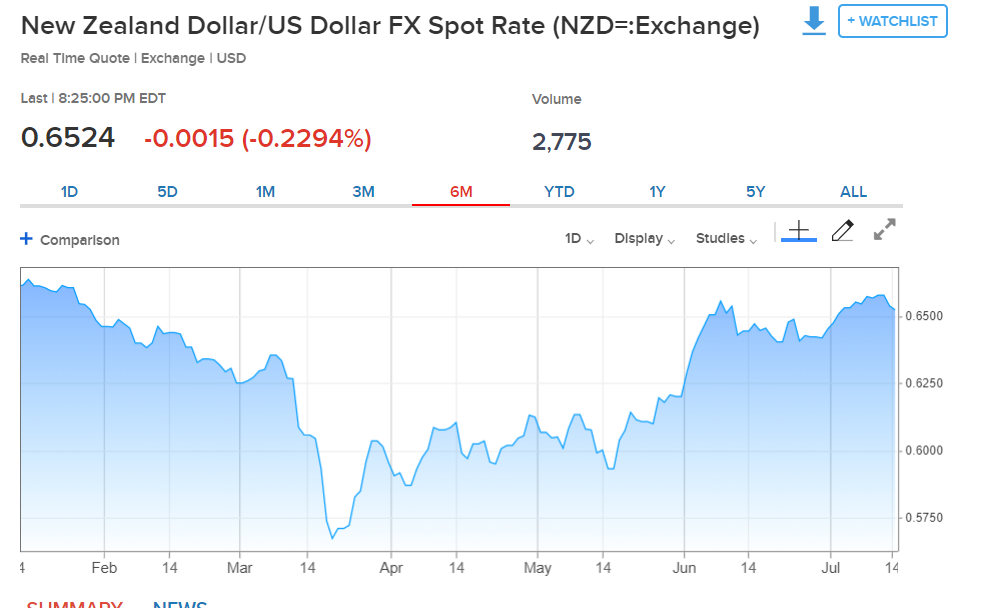

The Kiwi finished 0.49% lower at 0.6540 from 0.6575 yesterday after further attempts to push the Bird above 0.66 cents failed amidst generally bullish sentiment. The NZD/USD pair has bounced off late June lows as sentiment turned bullish on the improved risk sentiment at the start of this month. The rise in global Covid-19 infections has not abated since then which has resulted in a shaky risk environment. Expectations of further official global stimulus efforts have yet to materialise.

Market positioning in the Kiwi, like its bigger cousin, the Aussie is small net short. The latest Commitment of Traders/CFTC report (week ended July 7) saw net speculative NZD shorts total -NZD 317 from the previous week’s +NZD 356. Which is close to square and leaves room for downside movement should risk appetite worsen.

NZD/USD traded to an overnight high at 0.65936. Immediate resistance lies at 0.6570 followed by 0.6600 (strong). Immediate support can be found at 0.6510 followed by 0.6480. Look to sell rallies with a likely range today of 0.6500-70.