Summary: This is quite surreal. Despite facing the worst economic crisis since WWII and growing risks related to the US-China trade war, the stock market has performed extremely well in the quarter that just ended. The Dow Jones and the Nasdaq recorded their best quarterly performances, respectively, since 1987 and since 1999.

The explanation for why the equity market is in such a strong position is related to the continued and massive inflow of central bank liquidity since the beginning of March (along with the global fiscal stimulus, reaching a total of about 20% of world GDP) and the belief in a V-shaped recovery.

While central banks should remain the main stabilizers of financial markets in the summer period, the risk of a market downturn is not negligible due to the strong disconnection between the market and the real economy. Trade remains skirmish between the United States and China following the passing of Hong Kong’s security law this week.

China: Timid signs of recovery

Over the past few weeks, there were new modest signs of recovery in China. The authorities have refrained for quite a while to open the credit tap widely, but it seems that things have changed. Based on the evolution of total social financing (TSS), which corresponds to the broad measure of liquidity and credit in the economy, China’s stimulus is finally arriving. Still, it will take time before it hits the rest of the world – at least 6 to 9 months.

The 12-month rolling sum is reaching a new record at 22tr CNY (Chart 1), and it is likely to increase further in the coming months as the PBOC is adopting a fine-tuning policy to ease monetary policy and access to credit. In its most recent move, taking effect from today, the PBOC has decided to lower the interest rates of reloans, supporting agriculture and small firms by 0.25ppt and lowering the rediscount rate by 0.25ppt to 2%.

The stimulus is already benefiting the economy but on a slow path. This is brightly clear that there is no V-shaped recovery in sight and that the economy will take time to get back to normal. The official NBS non-manufacturing PMI rose to a 7-month high of 54.4 in June from 53.6 in May, and the manufacturing PMI edged higher to 50.9 from 50.5 in the previous month. In order to have a V-shaped recovery, PMI data close to 100 would have been necessary – which is not the case.

Looking into details, new export orders keep falling (Chart 2) but less than in previous months, which tends to indicate that global trade stabilization is about to materialize on the back of the reopening of the economies of China’s main trade partners. For the time being, Chinese firms are mostly focusing on destocking and cost reduction to increase profitability, which translates into fewer imports and falling employment. The rise in unemployment will probably be one of the top issues for China in the coming years.

Adding to that, the grim outlook for the service sector, notably for catering and restaurants, which confirms that there is no demand-side recovery yet, reflecting the importance of the hysteresis effect on the economy.

That being said, we think the worse is certainly already behind China on the economic front, supposing the coronavirus epidemic remains contained and that the new strain of influenza recently found in pigs in the country with pandemic potential won’t lead to a new outbreak.

Rest of the world: The great divergence

In the rest of the world, things are looking challenging, and uncertainty remains like in China regarding the evolution of local consumption. But like in China, recovery is slowly happening in parts of the world that are reopening from the great lockdown. Looking at fatalities per capita, most of Europe, with the notable exception of Sweden and the United Kingdom, is doomed to further reopen the economy while evidence is growing that the United States will have no other choice but halting reopening, following the recent example of Arizona that closed bars and cinemas again. In the short-term, it appears obvious that countries that will be able to reopen the first will have a competitive advantage on others.

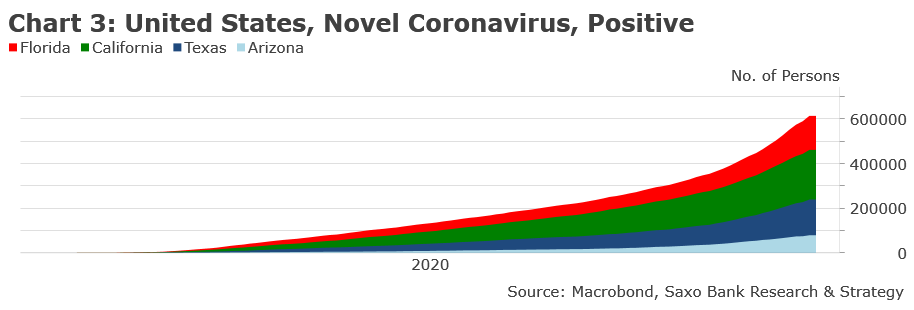

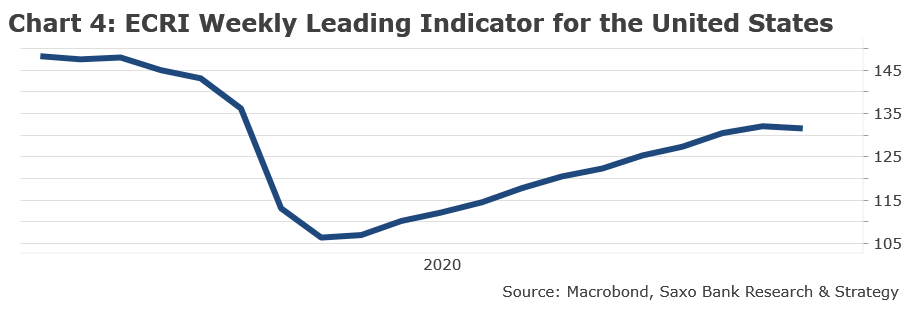

In the United States, the health crisis is reaching worrying levels, with a strong increase in contamination in Florida, Texas, and California (Chart 3). The states of New York, New Jersey, and Connecticut record one of the highest mortality rates per capita at a global level. The V-shaped recovery narrative is also facing a major setback. The ECRI weekly leading indicator, which has proved to be a very reliable indicator to assess the evolution of the economy in COVID times, is turning down again (Chart 4).

We believe that Chair Powell perfectly summarized the situation when testifying before the Committee on financial services of the U.S. House of Representative on June 30: “The path forward for the economy is extraordinarily uncertain and will depend in large part on our success in containing the virus. A full recovery is unlikely until people are confident that it is safe to reengage in a broad range of activities”.

In other words, the outlook for unemployment is also very grim in the United States. Based on LendingTree small business survey (May 2020), only 50% of small businesses say they are bringing back all employees for all hours once they will be able to reopen. The risk is that long-term unemployment will rise, thus increasing further preexisting social and racial tensions.

In Europe, the health crisis is broadly contained, and downside risks are slowly vanishing. As expected, the German government and the Bundestag have backed the ECB’s bond-buying program, thus preventing a political crisis from emerging in the middle of the summer regarding the participation of the Bundesbank. In addition, statistics confirm that the credit channel is still wide open, which differs strongly from the normal recession, with euro area bank loans to corporate over the past three months increasing the most since the euro was created. It is mostly due to the implementation of state guarantee schemes for loans in many euro area countries.

However, the Union is not out of the woods yet. The risk of divergent recovery within the euro area is real, with Southern European countries at risk of massive wealth and job destruction due to their strong exposure to tourism that could ultimately lead to a debt trap. As it is also the case for China and the rest of the world, we will have more visibility from September on the path of the recovery once the tourist season will be over in Europe and that all companies will be able to assess the real cost of the pandemic on their business.

Calendar of July 2020

July 2: NFP report covering the month of June.

Around July 8: Cabinet reshuffle in France and announcement of a new stimulus package.

July 17-18: Physical EUCO meeting in Brussels to discuss the European recovery fund “EU Next Generation”.

July 29: FOMC meeting. No major announcement expected.