Summary: The rapid spread of the coronavirus in the US and the world coupled with a 25% plunge in oil prices triggered by panic selling after a Saudi-Russia supply war erupted saw Wall Street suffer its biggest one-day loss since the 2008 financial crises. In early Asian trade yesterday, FX was hit by flash crashes in the major currencies. The GFC like carnage extended overnight and sent US bond yields crashing. The key US 10-year treasury rate plummeted a massive 26 basis points to 0.55% (0.76%). This sent the Dollar Index (USD/DXY), a favoured measure of the Greenback’s value against 6 major currencies, skidding 1% lower to 94.99 (96.09). The traditional safe-haven Japanese Yen skyrocketed 2.76% up against the Dollar, sending the USD/JPY pair crashing to an overnight and 3-year low at 101.183. In volatile trade, USD/JPY jumped back to 103.00 before settling to a 102.42 NY close. Japanese officials responded to the volatile move. Yoshiki Takeuchi, vice minister for International Affairs said Japan will respond appropriately when necessary to curb excessive volatility in the Yen in accordance with G7/G20 agreements. The Australian Dollar had its own flash crash, plunging 2.6% initially to 0.63111, rocketing to 0.66848, before retreating to 0.6590, down 0.5%. The Euro grinded higher to 1.14948 before slipping to close in NY at 1.1450. Sterling soared to 1.3200 amidst the broader Dollar fall, before ending at 1.3105, a gain of 0.5%. Emerging Market currencies slumped against the Greenback. Against the Russian Rouble, the US Dollar gained 9.38% to 75.00 from 68.55 yesterday.

The DOW tumbled 7.95% to 23,764 (25,815). The S&P 500 lost 7.8% to 2,735 (2,967).

Japan’s Final Q4 (2019) GDP contracted -1.8%, missing forecast of -1.7%, and the previous -1.6%.

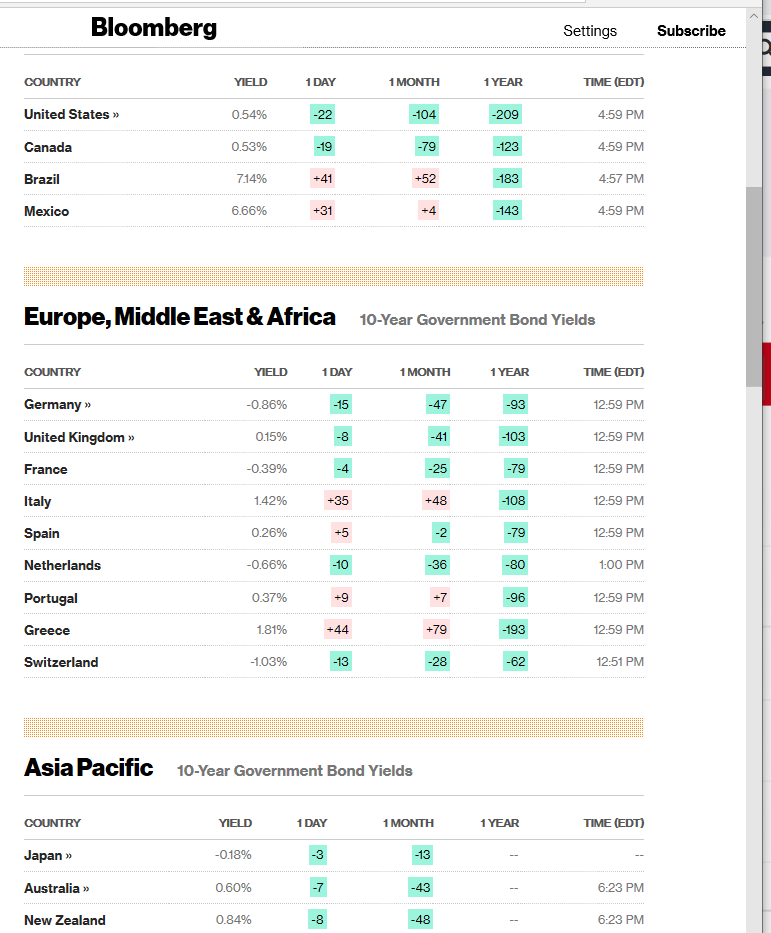

On the Lookout: The big drop in US bond yields was not matched by its global rivals. Currently, the US 10-year yield stands at 0.55%, a fall of 26 basis points. Germany’s 10-year Bund yield fell 15 basis points to -0.86%. UK 10-year bond rate lost 8 basis points to 0.15%. Japanese 10-year JGB’s yielded -0.18% from -.015% yesterday. Canadian 10-year treasury rates dropped 19 basis points to 0.53%. Australia’s 10-year bond yield fell 6 basis points to 0.61%. Interest rate traders expect the Fed to respond to the crisis with a more aggressive easing. Yesterday FX trading volumes jumped with most currencies doubling (AUD and GBP). According to a Reuters report, trading volumes in the Euro and Yen were four times its 30-day average through its Refintive platform. Traders jumped to unwind their short currency, long US Dollar trades.

Trading Perspective: The Dollar’s corrective downturn has begun and there is more to go. Further unwinding of speculative long USD bets built over the past months will be seen as US rates drop. The US rate advantage is headed for further eroding. Without its yield advantage, the Dollar cannot go higher. What can’t go up, must come down.

That said, nothing in FX goes in a straight line. We can expect more FX volatility ahead. We look at the various currencies.