Summary: Plans by several countries to ease restrictions on businesses that were closed due to lockdowns brought about by the coronavirus outbreak cheered markets, lifting risk appetite. The US Dollar fell against most rivals as demand for the have currency eased. The Euro was up 0.09% at 1.0827 after reaching a high of 1.0860 overnight. Among the countries that have planned to reopen businesses were Italy, with the world’s second highest rate of infections. The Aussie Dollar outperformed, jumping 1.5% to 0.6461 (0.6395) as several Australian states said they would ease social distancing rules this week. Against the Yen, the Dollar eased 0.25% to 107.26 (107.50) after trading to a low at 106.99. The Bank of Japan expanded its stimulus to aid companies hit by Covid-19 while pledging to keep borrowing costs low. The move was widely expected by traders. Sterling rallied on the broad-based US Dollar weakness to 1.2430, up 0.6% from 1.2365 yesterday. The Canadian Loonie rallied 0.45% against the US Dollar despite a slump in Oil prices. USD/CAD was trading at 1.4025 (1.4095) in late New York. US Oil (WTI) fell 24% to USD 12.90/barrel while the broader Brent Crude was down 7% to USD 23.05. Concerns about an oversupply and lack of storage space saw volumes fall in futures contracts, sharply weakening prices.

Wall Street stocks rose to 6-week highs. In late New York, the Dow was trading at 24,125 (23,770), up 1.45%. The S&P 500 rose 1.35% to 2,877 (2,837). Several US States took steps to ease coronavirus restrictions despite warnings from several health experts that it might be too early.

US bond yields climbed as treasuries dropped. The benchmark US 10-year bond yield climbed 6 basis points to 0.66%. Germany’s 10-year Bund yield was up 2 basis points to -0.46%.

There were no major economic data releases yesterday while US company earnings start to pick up this week.

On the Lookout: Markets will continue to monitor coronavirus updates as countries start to ease rules and restrictions. Economic data release pick-up today.

Japan reports on its Unemployment Rate (April) which is forecast to rise to 2.5% from 2.4%. Also due for release is the Bank of Japan’s Annual Core CPI report. Europe kicks off with Spain’s Unemployment Rate, forecast to climb to 15.6% from 13.8% the previous month. The UK releases its CBI (Conference Board) Realised Sales. The US follow with its Goods Trade Balance, and its Conference Board Consumer Confidence reports. Economists expect the US CB Consumer Confidence to drop to 88.3 from 120.0. US Richmond Manufacturing Index rounds up the day’s reports.

Trading Perspective: Optimism on the easing of restrictions and reopening of economies saw risk assets climb while US treasuries and the Dollar eased. Some analysts see this rise in risk appetite as premature, with economic data releases in the days ahead showing how far and wide the damage from Covid-19 has grown. Any return to risk-off will see the Dollar uptrend re-emerge.

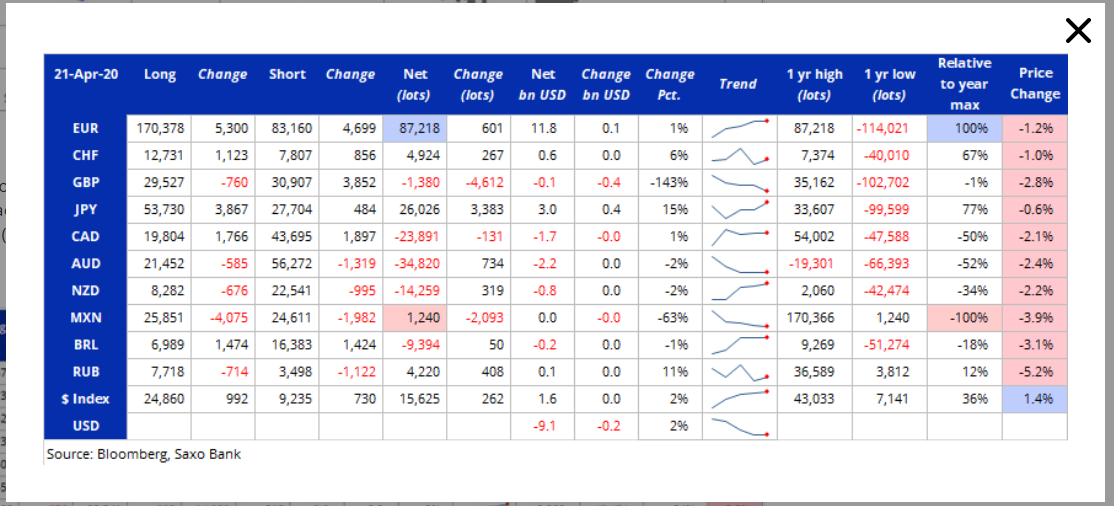

Market positioning also supports a US Dollar rally. The latest Commitment of Traders/CFTC report saw speculative short Dollar bets maintained, although the pace has been reduced. According to Saxo Bank in its latest report, “the main and almost solo driver behind this change has been the turnaround in the Euro.” Speculators turned from their short Euro bets and built long positions to their biggest total since June 2018. Against the other currencies, position changes were limited.

Markets Cheer Limited Lockdown Easing, Dollar Dips, Stocks Rise

Risk-On Boosts Aussie; Euro Up, Loonie Climbs Despite Oil Drop