Summary: Markets awoke to a manic Monday start after the US Federal Reserve slashed rates to zero in an emergency meeting. The Fed cut its Fed Funds rate to a target range of 0% to 0.25% and said it would expand its balance sheet by at least USD 700 billion in the coming weeks. Just before, the Bank of New Zealand cuts its Official Cash Rate to 0.25% from 1.0%. The New Zealand Dollar plunged 1.4% to 0.5965 from it’s New York close of 0.6068 Friday. It was the lowest trade for the Kiwi since May 2009. NZD/USD immediately bounced back to 0.6148 after the Fed cut rates. Also reports saw the Coronavirus spread climbing in the U.S. Following Friday’s frightful turnaround that saw the Dollar Index (USD/DXY) rebound 1.25% to 0.9869 from 0.9737, this morning’s early trade showed little relief for shell shocked traders. On Friday, the US Federal Reserve announced stimulus measures through bond-buying and repurchase operations. Following those measures, the US Dollar, stocks and bond yields surged. The Bank of Canada slashed its main benchmark by 50bps to 0.75% its second this month. USD/JPY skyrocketed 3.03% to 107.95 (105.35). There was no shortage of extreme FX volatility this morning. Reuters reported this morning saw the US Covid-19 death toll hit 62, while limited testing recorded nearly 3,000 cases. USD/JPY slumped to 106.70. The Euro, trading at 1.1102 in late NY, jumped to 1.1182 this morning. The Australian Dollar soared from 0.6145 to 0.6262. Sterling rebounded to 1.24 from its NY close at 1.2275. Wall Street stocks jumped. The DOW finished a whopping 10% up at 23,020 (21,600) while the S&P500 was 10.09% higher at 2,703. Bond yields jumped on Friday following the Fed’s initial stimulus moves. The benchmark US 10-year rate closing at 0.96% from 0.81%. Germany’s 10-year Bund yield soared 20 basis points to -0.55%.

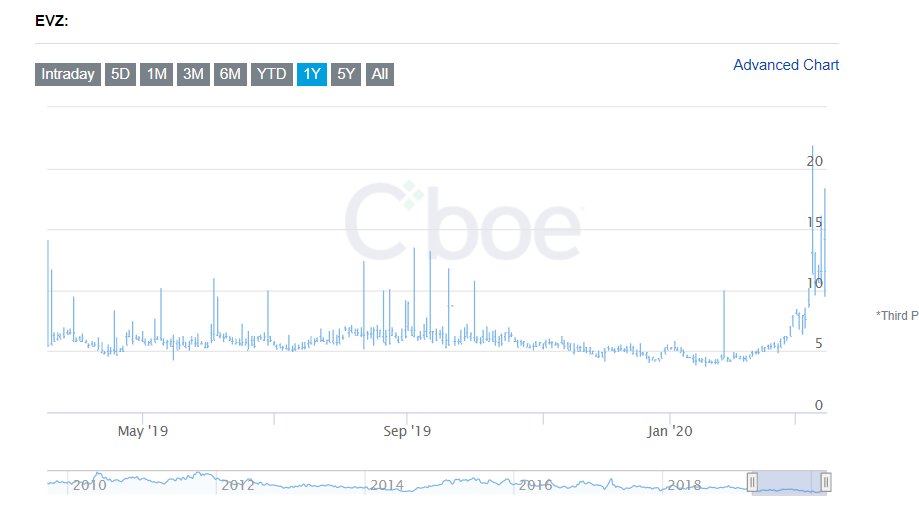

On the Lookout: Just another manic Monday indeed. Expect high volatility to continue to dominate FX and all markets. The options market signalled that currency volatility remains elevated following last weeks turbulent moves, not seen since 2008.

Following the Federal Reserve and RBNZ surprise rate cuts, the Fed announced that it and five other major foreign central banks were also cutting pricing on their swap lines to make it easier to provide Dollars to their financial institutions facing stress in credit markets. The Fed, European Central Bank, Bank of Japan, Bank of England, Swiss National Bank and Bank of Canada set up swap lines in the financial crisis. Last week the credit crunch boosted demand for the Greenback which surged almost 4% against its rivals.

Trading Perspective: The Fed’s latest move and global central bank coordination to alleviate the pressures of Dollar funding saw the Dollar plunge this morning. After its meteoric rise last week, expect more US Dollar falls. FX trading will continue to experience high volatility.

In these markets, flexibility and quick decision making are one’s best tools to neutralise the volatility.

Market positioning remains long US Dollar bets against most of the majors, which will weigh on the Greenback. US interest rates have further to fall than those of its global rivals. Which will narrow the US Dollar’s yield advantage.