Equity Markets

The International Monetary Fund (IMF) has predicted in its 2020 World Economic Outlook that the economic impact of the COVID-19 pandemic will result in the “worst recession since the Great Depression”.

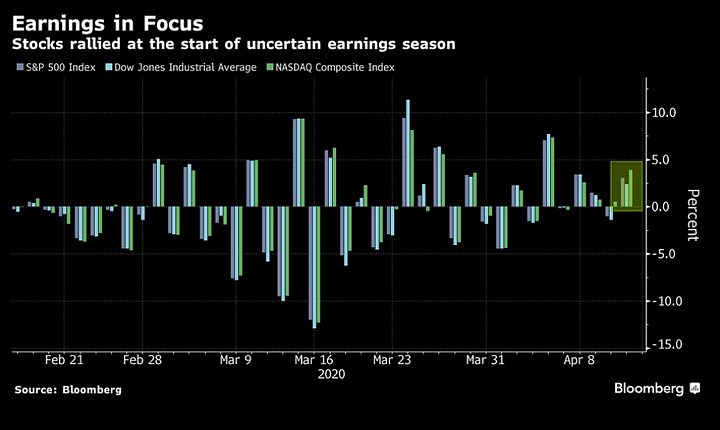

Even though attention remains on the COVID-19 cases, investors are focusing on the earnings season to get a sense of the damage caused by the pandemic. US stocks edged higher on Tuesday led by gains in many sectors. However, a handful of big tech firms, including Microsoft, Amazon and Apple, in addition to reports that the President will make important announcements in the coming days, has driven gains on Wall Street:

- Dow Jones Average Industrial added 559 points or 2.39% to 23,950

- S&P500 rose by 84 points or 3.06% at 2,846

- Nasdaq Composite ended 323 points or 3.95% higher at 8,516

|

The overnight gains on Nasdaq Composite helped the index to step out of the coronavirus bear market.

|

On the earnings front, more than 50 companies reported their quarterly updates on Tuesday. However, the immediate attention will be on the US banks and financial firms this week. Two of the world’s biggest banks stood out yesterday:

JP Morgan’s first-quarter profit plunged and the Chief Executive Officer warned of the likelihood of a fairly severe recession which has prompted the necessity to build credit reserves of $6.8B to cover potential loan losses from the pandemic. The company’s share price pared gains seen in the morning and finished the day 2.74% lower to $95.50.

Wells Fargo’s earnings results were also impacted by a $3.1B reserve build, which reflects the expected impact that these unprecedented times could have on customers. The company’s share price ended 3.98% lower to $30.18.

One notable stock on the upside was the pharmaceutical and consumer good giant, Johnson & Johnson. The high demand due to the pandemic allowed the company to report strong quarterly earnings. Despite lowering its forecast for the rest of the year, the company’s share price rose by 4.48% to $146.03.

|

The focus will remain on bank stocks as Citigroup Inc., Bank of America Corp, and GoldmanSachs Group Inc. report earnings today.

|

Currency Markets

Major currencies were stronger against the US dollar as traders assessed the improvement in the number of coronavirus cases despite many countries extending lockdowns into May. As risk sentiment improves, the US dollar is losing its haven appeal compared to its major peers.

A better-than-expected increase in trade surplus and above-forecast exports and imports in China has set a positive tone in the FX market on Tuesday.

- Trade Balance (USD) came in at +19.9B vs +18.00B expected.

- Exports (YoY): -6.6% vs-15.0% (expected)

- Imports (YoY): -0.9% vs-8.0% exp(expected)

The British Pound was among the best performing G10 against the US dollar. The Sterling extended its recovery and the GBPUSD pair rose above the 1.26 level mostly on the back on a weaker greenback, the slight improvement in risk sentiment and on the news that the UK Prime Minister is recovering from the coronavirus.

The Australian Dollar has firmed and stayed resilient around 64 US cents despite significantly weak NAB Business Confidence and Conditions. The Antipodean is finding support by a combination of upbeat Chinese trade data, the risk-on environment and a weaker US dollar.

Oil Market

Despite the historic oil production cut by OPEC+ countries and coordinated move by G20 countries in trying to stabilise the oil and gas industry, investors are susceptible that the cut will be enough to compensate for the collapse in demand driven by the pandemic. Raised the price for the US.

Crude oil prices fell after API reported a significant build of 13.143 million in crude oil inventory for the week ending April 10. As of writing, WTI and Brent Crude are currently trading in the vicinity of $20 and $28 respectively.

Gold

Despite the historic oil production cut by OPEC+ countries and coordinated move by G20 countries in trying to stabilise the oil and gas industry, investors are susceptible that the cut will be enough to compensate for the collapse in demand driven by the pandemic.

Gold Market

Gold continues to rise despite the improvement in risk. The overall outlook for gold remains positive as investors are bracing for the hard economic times ahead. The early positive signs on the virus cases might alleviate the panic and bring a degree of calm but the uncertainties will prevail as such a global lockdown triggered by a health pandemic is unprecedented. As of writing, the XAUUSD pair is currently trading at the $1,724 level.