Summary: The market’s spotlight remained on the coronavirus curve which continued to flatten mainly in Europe and the United States. Which underpinned risk sentiment and lifted stocks, while the US Dollar traded lower against the majors. China’s Trade Balance returned to a Surplus in March, from February’s Deficit, but fell short of expectations in CNY terms. The Australian Dollar rallied above the 0.6400 mark, settling at 0.6442 in late New York, up 0.65%. Sterling extended its advance to 1.2633 from 1.2580. The Euro approached 1.1000, finishing near two-week highs at 1.0987 from 1.0910. USD/JPY slipped 0.46% to 107.20 (107.75) on the broad-based Dollar weakness. Against the Canadian Loonie, the US Dollar was modestly lower at 1.3885 (1.3900) after Brent Crude Oil prices slumped 5.45% to USD 32.30 (USD 33.55). Despite the OPEC deal reached over the weekend to cut output, supply concerns amidst falling demand due to the coronavirus weighed on oil prices. Gold prices soared anew with the precious metal hitting late 2012 highs (USD 1,747) before easing to settle at USD 1,726 in late New York. Wall Street stocks lifted on the positive risk sentiment. The Dow added 2.5% to 24,035 (23,425) while the S&P 500 climbed 3.05% to 2,855 (2,770). Treasuries were steady. The key US 10-year bond yield closed at 0.75% from 0.77%. Germany’s 10-year Bund yield dipped to -0.38% from -0.36%.

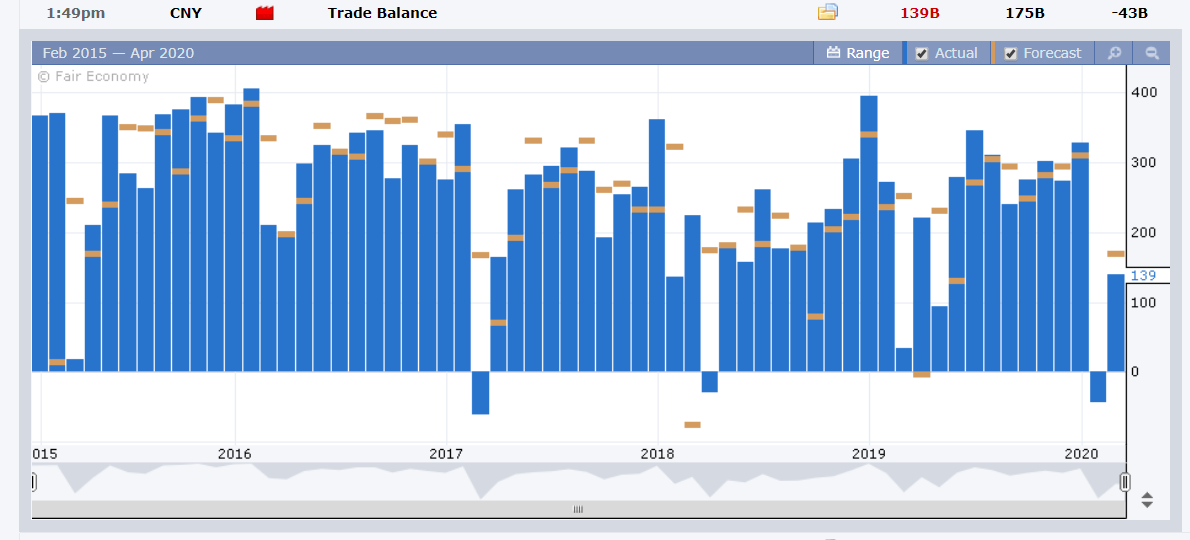

China’s Trade Balance rose to +CNY 139 billion in March, improving from February’s -CNY 43 billion, but lower than expectations of +CNY 175 billion. Australia’s NAB Business Confidence Index slumped to -66 in March from February’s upwardly revised -2 (from -4).

On the Lookout: The coronavirus curve continued to flatten in most of Europe and parts of the US and lifted the market’s mood. In the US, President Trump and his advisers are looking to ease lockdowns and get the economy in parts of the country to re-open. Meantime economic data in the coming months due to the virus outbreak is expected to be horrible. The US earnings season kicks off this week. Traders sold US Dollars against the Majors for on the positive risk sentiment while tonight’s US Retail Sales data and Fed Beige book will be much worse than the previous month’s reports. The Bank of Canada meets on interest rates as well and is expected to keep policy unchanged. With the deep slide in Oil prices, and a large loss of jobs last month, the BOC will remain accommodative, keeping a dovish slant.

Other data releases are: New Zealand’s March Food Price Index, Australia’s Westpac Consumer Sentiment from Australasia. European reports see France’s Final CPI. US data released today are: Headline and Core Retail Sales (March), Empire State Manufacturing PMI, Capacity Utilisation, and Industrial Production. The Bank of Canada is expected to keep policy unchanged and its Overnight Rate at an all-time low of 0.25%.

Trading Perspective: While the US Dollar fell against the Majors and Risk currencies (AUD, NZD), the Greenback fared better against the Emerging Market currencies. USD/EMS were mostly higher for the second day running. There have been Covid-19 flare-ups in countries that eased restrictions early, China, Korea and Japan. In the more densely populated Asian countries like India, Indonesia, and the Philippines, a lack of testing kits keep official statistics on the low side and a much larger breakout in these countries is possible.

These factors are all supportive for the US Dollar, and an uneven performance of the Greenback, ie lower against the Majors, but higher against EM currencies cannot continue. One side will have to give, as my Emerging Market trading experience has taught me. We take a look at the latest market positioning to give us further clues.