Summary: Trading was subdued on Friday despite the release of further weak economic data amidst plans of some countries to ease lockdown restrictions soon. FX volatility eased anew, as currencies continued to consolidate last week. USD/JPY, moderately lower in New York at 107.50 from 107.62 traded a total range of 39 pips, in contrast to around 200 pips in late March. Equity market swings have since subsided as stocks steadied. The spotlight this week will be on three central bank rate decisions (BOJ, FED, ECB) as well as Q1 GDP data from Europe and the US. Also scheduled this week are US Consumer Confidence, Chinese and US ISM PMI’s, as well as further earnings from big US name companies. The Bank of Japan’s interest rate decision follows a short meeting today. At the close in New York on Friday, the Euro climbed 0.4% to 1.0825 from 1.0777 Friday. Sterling was little changed at 1.2365 (1.2371). Brexit news entered the spotlight on the weekend after EU Chief negotiator Michel Barnier warned that negotiations have been disappointing with no progress being made. On the coronavirus front, Italy announced its plans to restart its economy on May 4. UK PM Boris Johnson is scheduled to chair his first Cabinet meeting today. Johnson is expected to announce plans for and easing of the lockdown before the May 7 deadline according to the Telegraph. The Australian Dollar closed at 0.6395, up from 0.6372 Friday. Australia and New Zealand will begin reopening their economies which should be positive for their currencies. AUD/USD dipped in early Asia to 0.6385 following unconfirmed reports that North Korean leader Kim Jong-Un has died due to failed cardiac surgery.

Wall Street stocks settled higher on Friday. The DOW rose 1.26% to 23,770 from 23,490 while the S&P 500 gained 1.7% to 2,838 (2,795 Friday). Global bond yields were mostly flat.

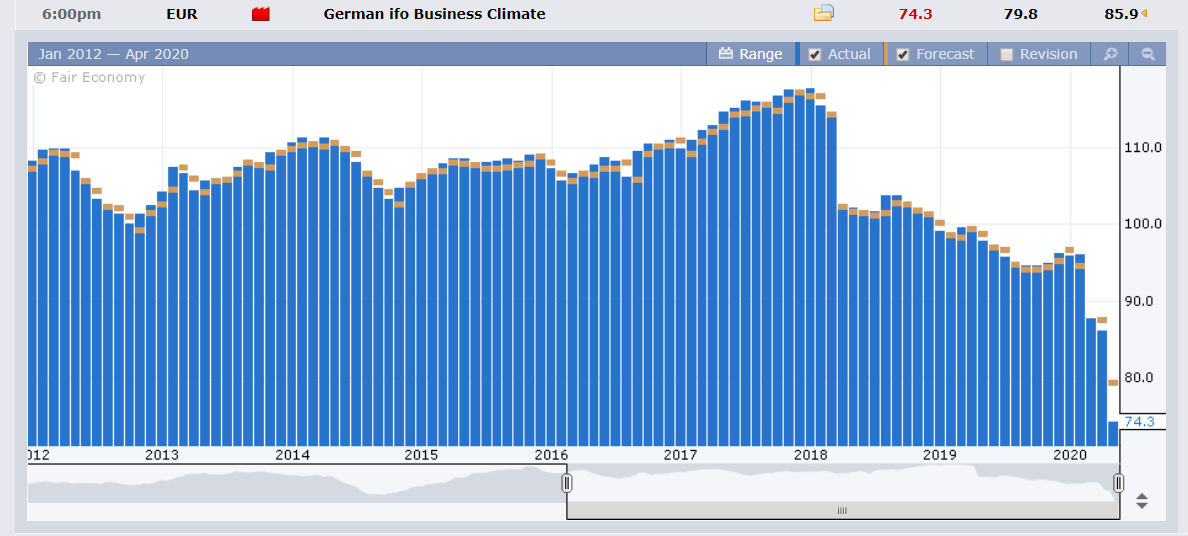

Data released Friday saw Germany’s Ifo Business Climate slump to 74.3 from 86.1 the previous month, and missing expectations of 79.8. Britain’s Retail Sales (April) fell to -5.1% from -0.3%, worse than expectations of -4.5%. US Durable Goods Orders plunged -14.4% in April from +1.1% in March, missing expectations of -12.0%.

On the Lookout: Today’s main event is the Bank of Japan’s shortened Policy Rate meeting (9.50 am Sydney time). The BOJ is expected to keep its Policy interest rate unchanged at -0.1%. But reports have highlighted the possibility of unlimited bond buying. The Japanese economy has been experiencing a deep economic slump due to the coronavirus outbreak. Japan also releases its Unemployment rate. European data kick off with the UK’s Nationwide House Price Index and CBI Realised Sales followed by Spain’s Unemployment Rate. The US reports on its Goods Trade Balance S&P Case Shiller Composite 20 House Price Index, and Conference Board Consumer Confidence report.

Trading Perspective: Expect FX to consolidate in Asian trading today with a negative bias to risk appetite. Which should be modestly supportive for the US Dollar, except against the Japanese Yen, which awaits the BOJ’s shortened meeting today. The Euro looks likely to retreat following its rebound on Friday. The Australian and New Zealand Dollars advanced further as their governments move toward easing restrictions this week. Both currencies face stiff resistance to march north with US Dollar safe-haven strength capping gains. Last week we highlighted that speculative market positioning was short of US Dollar bets. With a busy week ahead and the spotlight on three rate announcements, plus primary economic data and further earnings from big name US companies, (Amazon, Apple, Google, Facebook, Microsoft, General Electric, Shell, Exxon-Mobile, Starbucks etc), expect volatility to pick up.