Summary: Fresh stimulus talk from the White House lifted risk while the US Dollar reversed its four-day rally against its rivals. Optimism rose on reports that the US is preparing a new stimulus package of up to USD 1 trillion which will include an extension to unemployment and a return to work incentives. Markets shrugged aside a World Health Organisation announcement that saw the biggest single day increase in Covid-19 cases worldwide (+183,000) on Sunday. The Greenback was also pressurised by a report that saw US Existing Home Sales in May drop to their lowest level in 9.1/2 years. The Australian Dollar led the currency rally against the Greenback, soaring to finish 1.23% up in New York to 0.6912 (0.6835 yesterday). Sterling jumped to 1.2468 where it closed, from 1.2350 yesterday. Britain reported the lowest rise in new coronavirus cases since its lockdown in March. The Euro rebounded off its lows near 1.1175 yesterday to finish up 0.87% at 1.1265. Bloomberg reported that the Spanish government is considering pledging up to EUR 50 billion in additional loan guarantee. Against the Yen, the Dollar was up a modest 0.17% to 106.92 (106.87). Equities rallied. The US DOW was up 1.62% to 26,105 (25,650) in late New York. The S&P 500 closed at 3,125 from 3,075 yesterday. Global bond yields were mixed. The US 10-year yield was up 2 basis points to 0.71%. Germany’s 10-year Bund rate finished at -0.44% from -0.42% yesterday.

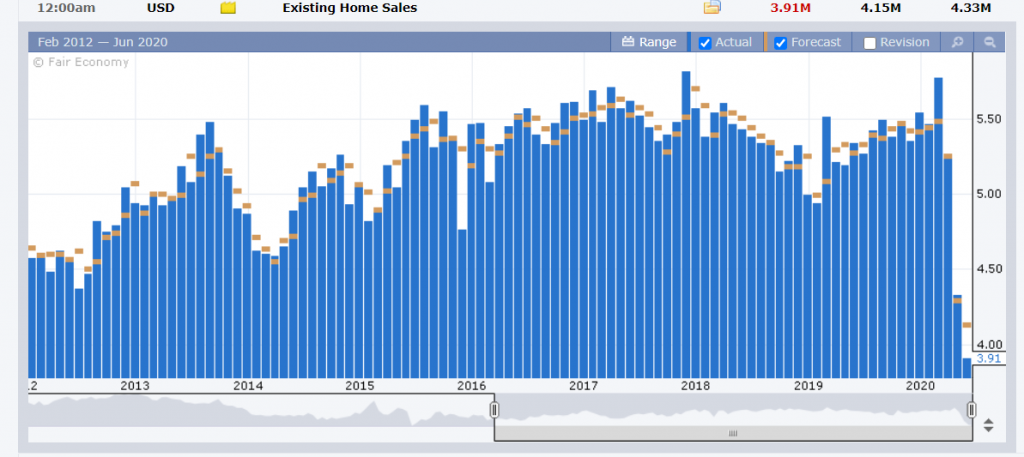

Data released yesterday saw UK Conference Board’s Industrial Orders Expectations in May drop to -58, missing forecasts at -50. US May Existing Home Sales slumped to 3.91 million units from April’s 4.33 million, missing expectations of 4.15 million. It was the lowest level in Home Sales since October 2010.

On the Lookout: Once again it boils down to the two most important factors that are moving the currency and equity markets: fresh stimulus measures versus the number of new Covid-19 cases. The latest bazooka from the White House aimed at the coronavirus pandemic with its rising new cases is a stimulus of up to USD 1 trillion plus which is taking shape. Upcoming data will matter as markets see the toll of the pandemic on global economies.

Today sees the release of global Manufacturing and Services PMI’s. Australia’s Commonwealth Bank PMI, just released, saw June Manufacturing Activity climbed to 49.8 against expectations of 49.3 and a previous 44.0. Australian June Flash Services PMI rose to 53.2 from 26.9 in May, beating forecasts of 25.7. The Aussie spiked to a near one-week high at 0.6929 from 0.6915.

Other data released today see Japan’s Jibun Bank Preliminary Manufacturing PMI. Europe sees the release of French, German and the Eurozone Preliminary June Markit Manufacturing and Services PMI’s. The UK follows with its Markit Manufacturing and Services PMI’s for June. Finally, the US reports its Markit Manufacturing and Services Preliminary PMI’s for June. US New Home Sales and the Richmond Fed Manufacturing Index round up the day’s reports.

Trading Perspective: Will worldwide fresh stimulus measures bazooka be able to offset the rising coronavirus numbers as the second wave in developed nations start? It is hard to imagine that the worst is over yet with this pandemic until a vaccine in found. In many of the developing countries, the rapid rise in Covid-19 is still in its first phase. India, Brazil, Mexico continue to record big numbers of new cases.

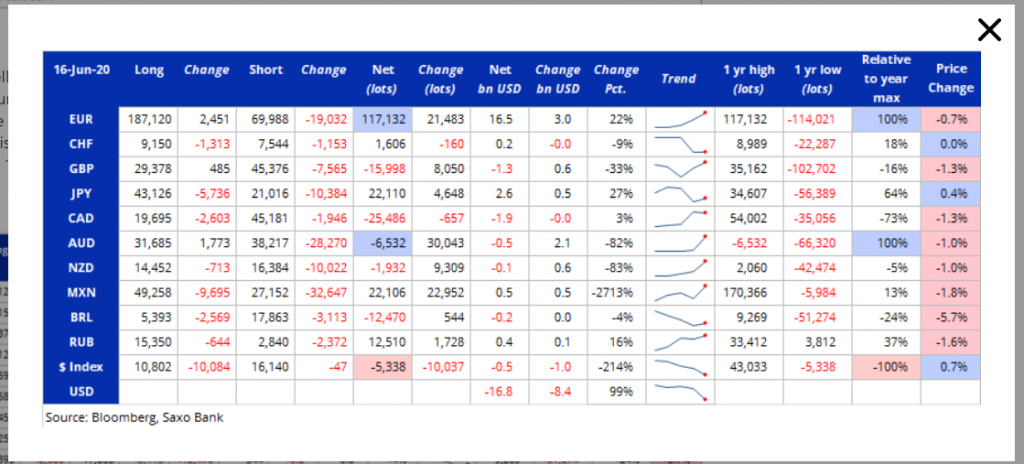

Meantime the latest Commitment of Traders CFTC report for the week ended June 16 saw net speculative US Dollar short bets almost double according to Saxo Bank. The latest week saw net short USD bets jump by USD 8.4 billion to total -USD 16.8 billion. This is the biggest total of net short US Dollar positions since May 2018. According to Saxo Bank, the heavy selling of Greenbacks was broad-based, benefitting the Euro and the Australian Dollar the most. We take a look at the individual currencies in their reports.