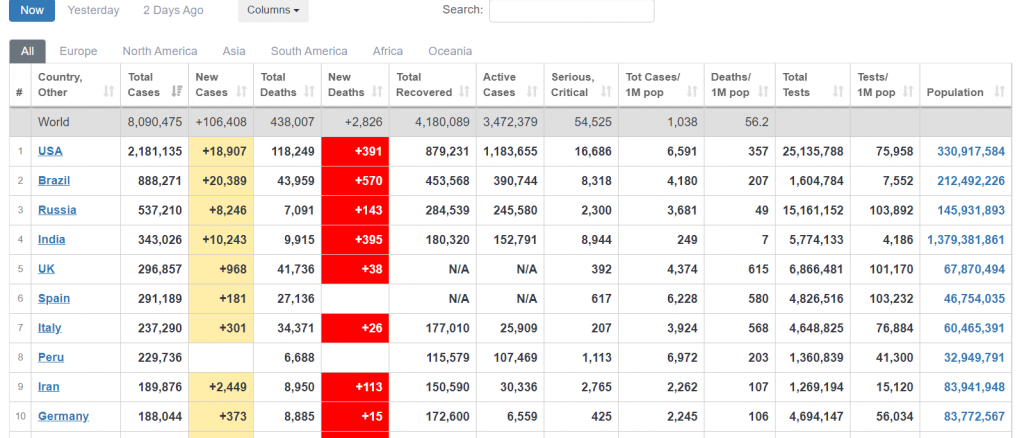

Summary: The US Federal Reserve announced that it would buy a diversified and broad portfolio of corporate bonds to shore up liquidity. Which saw a rebound in risk assets and currencies which were weakening due to the alarming rise in new Covid-19 cases in many US states, Beijing, Tokyo, Brazil, and India. The latest count of total global coronavirus cases as at this time of writing was 8,090,745. The Dollar Index (USD/DXY), a favoured gauge of the US currency’s strength against a basket of 6 major rivals, fell 0.6% to 96.674 (97.089). Risk FX leader, the Australian Dollar saw the biggest bounce, up 0.84% against the Greenback to 0.6920 (0.6840 open yesterday). Traders ignored the earlier release of weaker-than expected set of Chinese economic data (Retail Sales, Industrial Production and Fixed Asset Investment). The Euro rallied back above the 1.1300 level, finishing at 1.1320 (1.1235 yesterday), a gain of 0.65%. Against the Yen, the Dollar was flat at 107.35 ahead of today’s Bank of Japan policy meeting where the central bank is widely expected to keep interest rates unchanged. The British Pound climbed 0.68% to 1.2605 (1.2520) on the broadly based weaker US Dollar and into today’s UK Employment data. Emerging Market and Asian currencies were mostly up against the Greenback. The USD/CNH (Offshore Dollar-Chinese Yuan) pair was at 7.0740 in late New York, little changed from 7.0755 yesterday. Against the Canadian Loonie, the US Dollar eased to 1.3605 from 1.3635 yesterday despite a large fall in Canada’s Manufacturing Sales.

Wall Street cheered the Fed action, investors lifted the DOW 1.2% to 25,845 (25,575). The S&P 500 rebounded 1.32% to 3,078 (3,038).

The benchmark US 10-year bond yield was up 2 basis points to 0.70%. Germany’s ten-year Bund yielded -0.45% from -0.44%. Japanese 10-year JGB’s finished at -0.01% from 0.00% yesterday.

China’s trifecta first-tier economic data saw Retail Sales slump to -2.8%, missing forecasts at –2.3%. Industrial Production dropped to 4.4%, underwhelming expectations of 5.0%. China’s Fixed Asset Investment fell to -6.3% against forecasts of -6.0%. Canada’s Manufacturing Sales plunged –28.5% from a downwardly revised -9.8 % (-9.2% initially), missing forecasts at -20.2%. The US Empire State Manufacturing Index beat forecasts with at -0.2 against -30.0 and a previous -48.5.

On the Lookout: While the Federal Reserve’s bond buying will put a cap to US interest rates and managed to lift risk appetite and push the US Dollar lower, the rising coronavirus toll is concerning. The fresh outbreaks reported yesterday in Beijing and Tokyo were relatively small but the risk is that there is a spike. In some US states new cases hit daily record highs while the numbers in Brazil and India continue to rise. Many efforts to reopen economies have hit the pause button, and the risk of a reversal and its impact on the wider economy will be a huge concern for investors and risk. Markets will monitor these developments closely.

Meantime today sees the RBA’s minutes of its last meeting kick off events and data releases. The Bank of Japan’s Monetary Policy Statement and Rate Announcement follows (1 pm Sydney time). The BOJ’s Press Conference is held later (4.00 pm Sydney). European data kick off with Germany’s Final CPI and ZEW Economic Sentiment Index. The Eurozone also releases its ZEW Economic Sentiment Index. UK Labour data are released next with Claimant Count Change (Unemployment Claims), Average Weekly Earnings (Wages), and Unemployment Rate. US Headline and Core Retail Sales are in the spotlight today, both sets of data expecting improvements. Anything less than what is expected, 7.9% in Headline Retail Sales from -16.4% and 5.5% from -17.2% in Core Sales will see risk appetite sour. Finally, US Capacity Utilisation and Industrial Production reports round up the day.

Trading Perspective: Yesterday’s FX moves saw high volatility with the currencies forming a wide range. We can expect further consolidation within these established ranges today. The spotlight will be on the US Headline and Core Retail Sales reports for the economic picture. Any further spikes in Covid-19 cases in the new hotspots of Beijing, Tokyo, several US states (Florida, Texas, Arizona, Oregon, Utah, Maryland and Tennessee), Brazil and India, plus any other surprises will see risk assets and currencies smacked back down again. Interesting times indeed, tin helmets on, get ready for the ride.