Summary: Upbeat economic data from better-than-forecast Services PMI’s (China, Europe, and the U.S), and a smaller than expected drop in US private payrolls (ADP) boosted the market’s risk-on mode. Equities outperformed FX with Wall Street stocks firmer at the New York close mid-week. The Dollar’s decline extended but slowed against most rivals in late trade as violence subsided in US protests. The Euro soared 0.45% to 1.1230 (1.1168 yesterday) to finish as best performer into today’s ECB policy meeting. The European Central Bank is widely expected to increase monetary stimulus, which is already built-into the shared currency’s level. Elsewhere, the Bank of Canada kept its monetary policy unchanged. There was no press conference and the USD/CAD pair was little changed at 1.3500 from 1.3515 yesterday. The Australian Dollar eased off its peak at 0.6984 to close at 0.6922 despite a smaller-than-expected decline in Q1 GDP. Sterling slipped to 1.2573 after hitting 1.2615, near 5-week highs. Against the haven Yen, the Dollar rose modestly to 108.90 in late New York from 108.70 yesterday. The Kiwi was up 0.5% to 0.6425 from 0.6365 yesterday.

Wall Street stocks extended their winning streak as optimism about the economy recovery picks up.

The DOW rose 2.1% to 26,275 (25,748) while the S&P 500 added 1.28% to 3,121 (3,085). US Treasury yields were higher. The benchmark US 10-year bond yield ended at 0.75% from 0.69% yesterday. Germany’s 10-year Bund yield rose to -0.36% from -0.42%.

Australia’s Q1 GDP contracted to -0.3%, smaller than the -0.4% forecast. China’s Caixin Manufacturing PMI rose to 55, beating expectations at 47.4. Germany’s Final Services PMI rose to 32.6 in May from 31.4 in April, and forecasts at 31.4. Other Euro area Services PMI’s most beat expectations. The Eurozone Final Services PMI climbed to 30.5 in May from the previous 28.7. The US May ISM Non-Manufacturing PMI was up to 45.4 from 41.8, beating forecasts at 44.0. US ADP Non-Farms Private Payrolls in May fell to -2.76 million, bettering expectations of –9.0 million and an upwardly revised previous -19.557 million (-20.236 million).

On the Lookout: The upbeat global economic data released saw a continuous build in risk appetite, boosting stocks and weighing on the US Dollar. However, the Greenback’s decline slowed after better-than-forecast US ISM Non-Manufacturing and a smaller then forecast fall in ADP Non-Farms Payrolls. President Trump’s threat to unleash the military quelled the violence in many American cities which has marred protests due to the killing of a African American civilian in police custody.

The better than expected fall in US private employment augers well for tomorrow’s US Payrolls report. Today’s main event is the ECB’s monetary policy meeting, statement and press conference. The economic data calendar kicks off with Australia’s May Trade Balance and Retail Sales. European reports start with Swiss CPI (May), Eurozone Retail Sales, and UK Construction PMI. US data sees Weekly Unemployment Claims which are expected to fall to 1.82 million from last week’s 2.123 million. US and Canadian Trade Balance round up today’s reports.

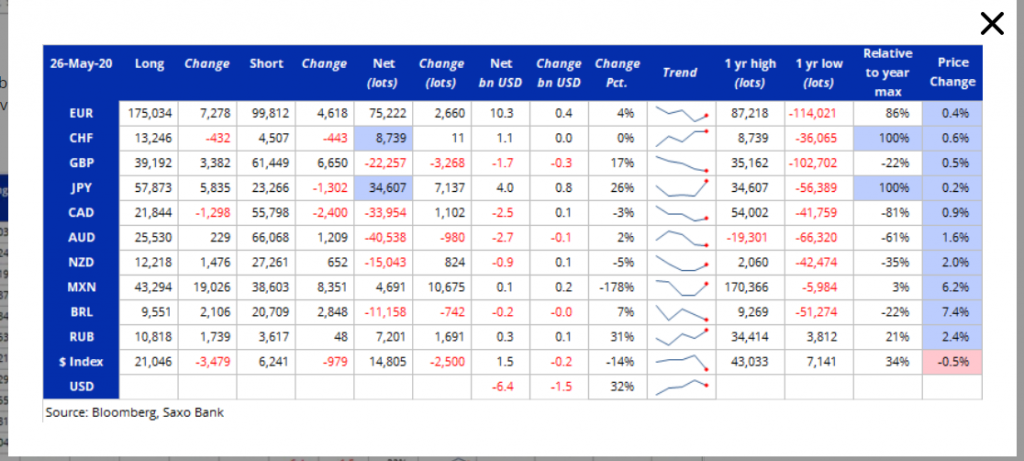

Trading Perspective: Expect the US Dollar to consolidate at current levels after its big drop this week. Currencies that rallied most against the Greenback led by the Australian Dollar hit their peaks last night. The latest Commitment of Traders/CFTC report for the week ended May 26 saw speculators from large hedge funds resume their overall US Dollar selling against 10 IMM currencies. According to Saxo Bank, the most notable was a rise in JPY long bets to total +JPY 34,607 from the previous week’s +JPY 27,470. Net speculative Euro long bets stayed elevated. We look further into this in our individual currency reports.