Summary: The Euro hit one-week highs against the US Dollar to 1.13488 (1.1265 yesterday), advancing for the second day running following upbeat Euro area and Eurozone Flash Markit PMI’s (Purchasing Manager’s Index). In choppy trade, the Dollar Index (USD/DXY) a favourite gauge of the Greenback’s strength against a basket of 6 foreign currencies eased to 96.692 from 97.033. Earlier in the day, US officials reaffirmed the trade deal with China after Peter Navarro, White House trade adviser said the pact was over. The upbeat global PMI’s overshadowed the still rising Covid-19 cases. The Australian Dollar finished with modest gains at 0.6928 from 0.6911 yesterday in a highly volatile 117 pip range. The swings in risk appetite from the Navarro drama were mirrored by the Aussie Battler. Against the Yen, the Dollar fell to its lowest level since May 6 (106.07) before climbing to settle at 106.55 (106.92 yesterday). Sterling rallied to 1.2520 from 1.2470 on upbeat UK PMI’s and the broadly weaker US Dollar. The USD/CAD pair bucked the trend, climbing to 1.3550 (1.3525) on weaker oil prices. The US also threatened to impose a tariff in aluminium imports from Canada if Ottawa do not voluntarily restrict exports. Ahead of today’s RBNZ policy meeting, the Kiwi was firmer against the US Dollar at 0.6495 (0.6475 yesterday). Wall Street stocks pared gains. The DOW was up 0.08% to 26,112 (26,100). The S&P 500 was at 3,125 (3,122).

Data released yesterday saw Australia’s CBA Manufacturing PMI climb to 49.8, beating forecasts at 49.3. Australia’s Services PMI climbed to 53.2 from May’s 26.9. Japan’s Jibun Bank’s Flash Manufacturing PMI dipped to 37.8 from 38.4. Germany’s Flash Manufacturing PMI rose to 45.8 in June, beating forecasts at 41.7. Other Euro area Manufacturing and Services PMI’s (Italy, France) also beat expectations. The Eurozone’s Markit Flash Manufacturing PMI rose to 46.9, bettering expectations at 43.8. UK Flash Manufacturing PMI was up to 50.1, beating forecasts at 45.2. The US Flash Manufacturing PMI climbed in June to 49.6 from 39.8 in May. US New Home Sales surged to 676,00 units in June, from a downwardly revised 580,000 in May, beating median expectations of 630,000.

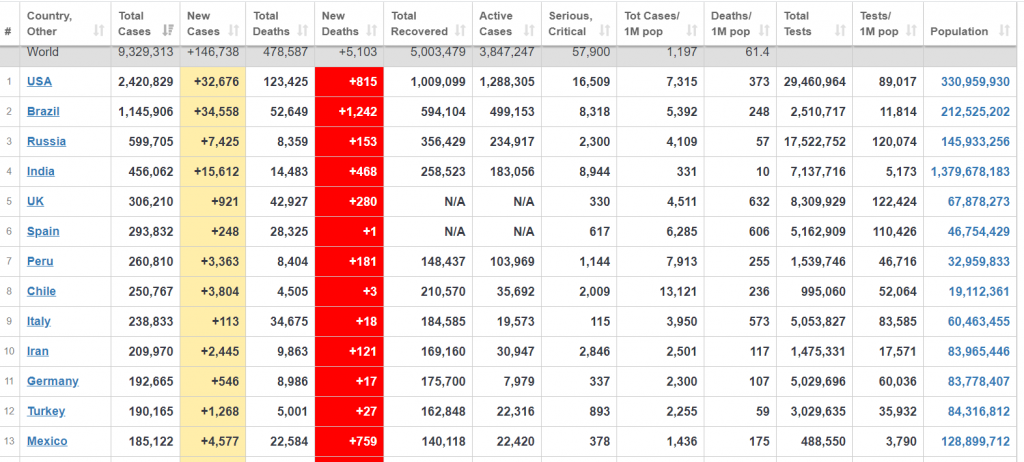

On the Lookout: The upbeat economic data bolstered the recovery in the midst of still-rising coronavirus cases. At the New York close, stocks pared their gains. We can expect Asia’s markets to open mixed. Today’s economic calendar is relatively light. Markets will continue to monitor the global Covid-19 situation, with particular focus on the rising cases and death tolls.

The RBNZ monetary policy meeting and rate announcement is today’s main event. The Reserve Bank of New Zealand is expected to keep rates unchanged. Markets are also looking for a more upbeat outlook from Governor Graeme Orr after New Zealand ended its lockdown almost 2 weeks ago.

Japan kicks off the day’s data with its BOJ Summary of Opinions (projection of inflation and economic growth). Japan also releases its SPPI (Services Producer Price Index, a leading indicator of consumer inflation). European reports start with Germany’s IFO Business Climate, Switzerland’s Credit Suisse Economic Projections, and the Swiss National Bank’s Quarterly Bulletin. Finally, the US releases its HPI (House Price Index).

Trading Perspective: The currencies have pulled back their losses against the US Dollar as risk appetite rose. The risk-on, Dollar lower; risk-off, Dollar higher inverse relationship still dominates FX, and should continue to do so in the short term. The still-rising coronavirus cases should not be ignored. In Australia, news reports saw the number of new infections climb to 20 in the state of Victoria, the country’s second most populous state. The new hotspots of Brazil, Mexico and India continue to see a marked rise in new cases. New infections in many of the US southern and western states keep climbing. This should keep a floor to the US Dollar against its rivals.

FX needs to also be aware of the market’s positioning on the Greenback, which is still at the biggest short since May 2018.