The Euro advanced for the second day running following the release of upbeat Euro area manufacturing and services PMI’s which exceeded forecasts. The broadly based weaker US Dollar due to a rise in risk appetite also buoyed the shared currency. Overnight the EUR/USD pair spiked to an overnight and 10-day high at 1.13488 before easing to settle at its current 1.1310. US economic data also came in better-than-expected with New Home Sales and the Richmond Fed Manufacturing PMI.

Speculative market positioning in the Euro is long to its eyeballs. We reported that the latest Commitment of Traders report saw net speculative Euro long bets climb to +EUR 117,132 in the week ended June 16 from +EUR 95,649 contracts the week before. This is the biggest number of longs since May 2018. This will continue to cap any significant Euro gains.

Any fall in risk appetite due to the still-rising coronavirus infections will weigh on the Euro. This also bears watching.

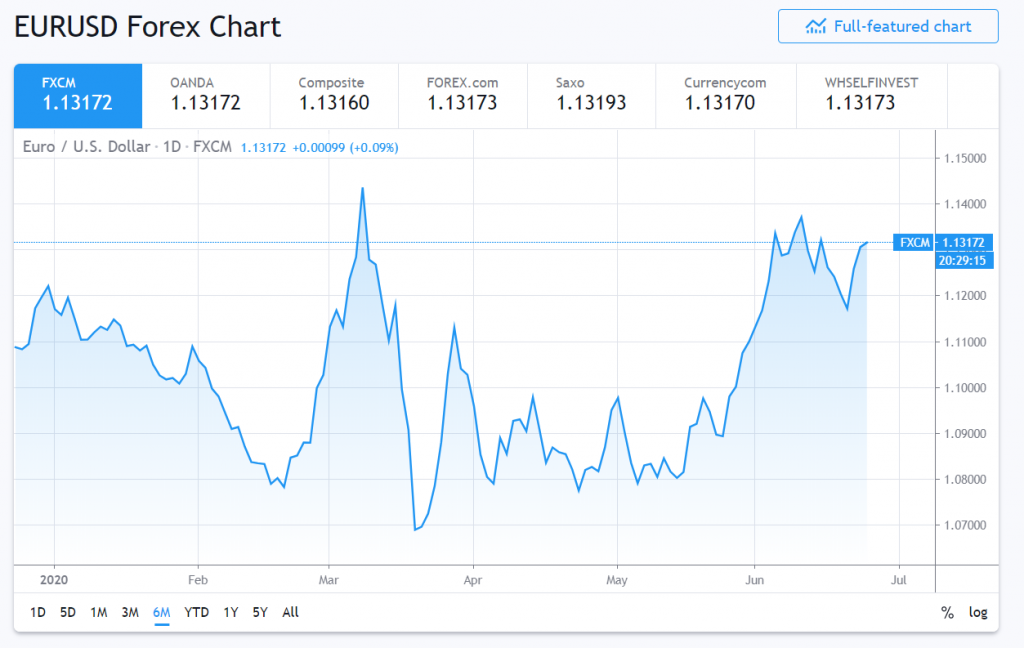

EUR/USD has immediate resistance at 1.1350 followed by 1.1380 and then 1.1410. Immediate support can be found at 1.1280 followed by 1.1240. Look to sell rallies in a likely range between 1.1260-1.1360.