The Euro bounced off its 1.0895 New York close to 1.0980 in early Asian trade following the announcement from the ECB that it is launching at EUR 750 billion pandemic emergency program (PEPP). According to FX Street, the European Central Bank will introduce a new temporary asset purchase program of private and public sector securities to counter serious risks to the monetary policy transmission mechanism.

Germany’s 10-year Bund yield was up 19 basis points to -0.25% while US 10-yaer rates were at 1.19%, up 11 basis points. This rate differential will narrow again and that will support the shared currency against King Dollar.

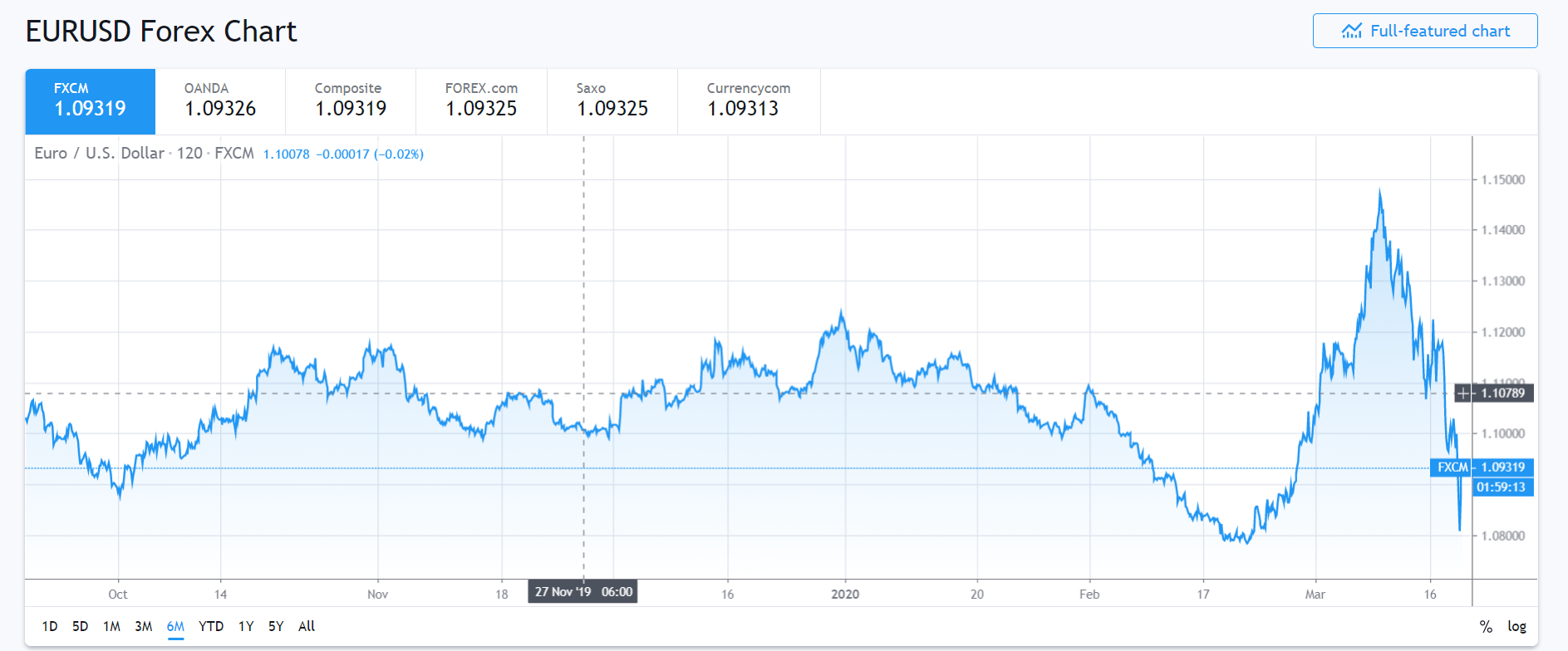

EUR/USD hit an overnight and one-month low at 1.0800 before rebounding to close at 1.0895 in New York. The Euro jumped to 1.0980 before easing to settle at its current 1.0955 in choppy trade.

EUR/USD has immediate resistance at 1.0980 followed by 1.1030. Immediate support can be found at 1.0900 followed by 1.0870. Look for a likely trade today of 1.0885-1.1035. Prefer to buy dips.