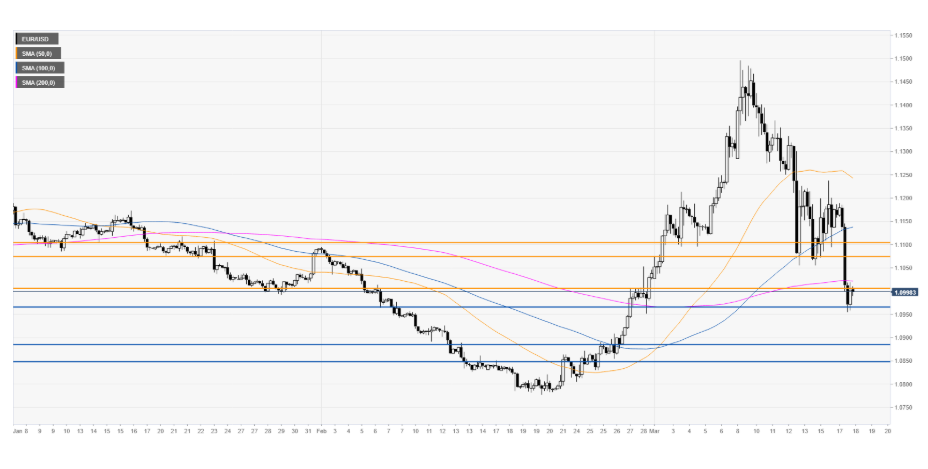

It was a case of up the stairs but down the elevator for the shared currency against its US counterpart. EUR/USD dropped to a two-week low at 1.09548 and its largest one-day decline since June 2018. The Euro rallied to finish its NY trade at 1.1005, down 1.48%. Broad-based US Dollar strength was too much strain for the shared currency, and it tumbled under the pressure.

Where do we go from here? We highlighted the fact that the US Dollar’s strength waned against the Emerging Market currencies. This is a signal that it will follow against the majors. While German and Eurozone ZEW Economic Sentiment Index’s both underwhelmed, the big drop in US retail sales is significant as this is the real economy. The Euro will hold its strong support at 1.0950.

Immediate support for the EUR/USD lies at 1.0980 followed by 1.0950. Immediate resistance can be found at 1.1030 followed by 1.1080. Look for a likely trading range today between 1.0985-1.1085. Prefer to buy dips at current levels.