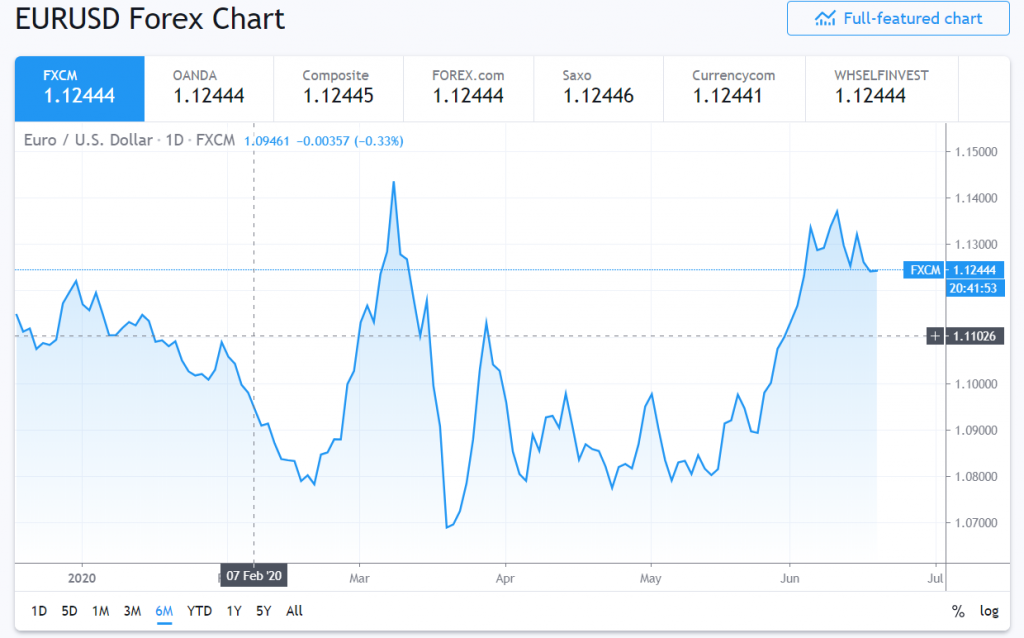

The Euro extended its two-day decline, finishing at 1.1240 in New York after trading to an overnight low at 1.1207. EUR/USD traded to a peak of 1.1294 in a choppy session. Overall US Dollar strength weighed on the shared currency. Eurozone CPI data yesterday matched forecasts but the market’s risk aversion stance due to a rise in global Covid-19 cases weighed on the shared currency.

Meantime, Germany’s Far Right AFD (Alternative for Germany) party announced fresh legal action over the European Central Bank monetary easing yesterday. The opening of this second front legal battle will weigh on the Euro, even as the ECB seeks to resolve a separate six-week dispute with the German Constitutional Court.

EUR/USD has immediate support at 1.1230 followed by 1.1210 and 1.1170. The 1.1170 level is strong and a clean break through will see the Euro lower. Immediate resistance lies at 1.1270 followed by 1.1300 and 1.1330. Look for another choppy day in the Euro with a likely range today of 1.1180-1.1280. Prefer to sell rallies.