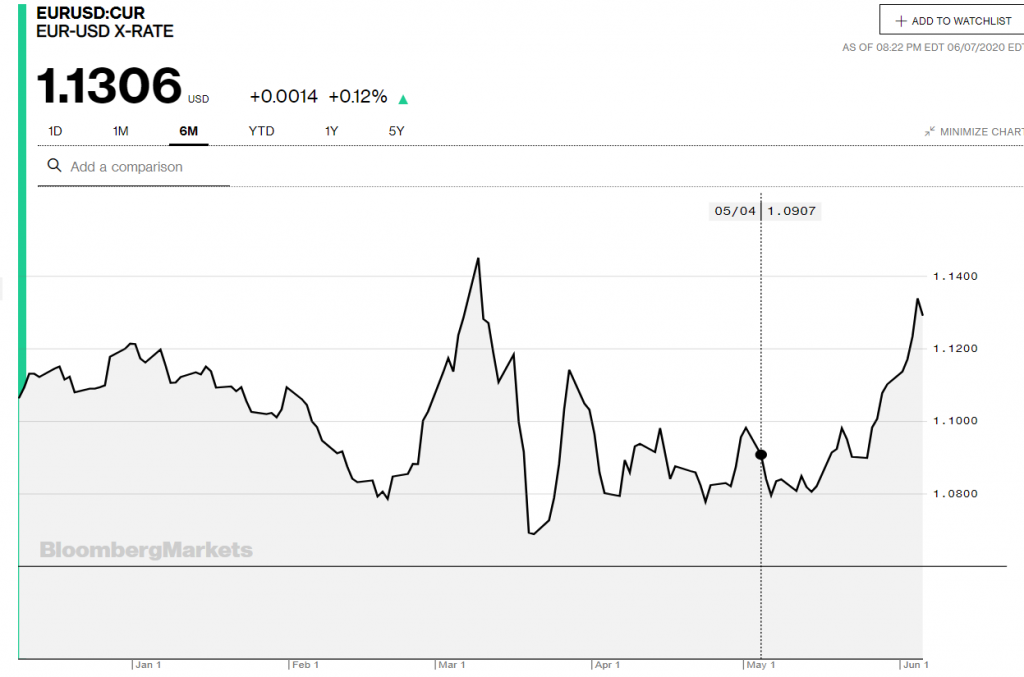

After 8 straight days of gains, the Euro finally pulled back, slipping to 1.1286 from 1.1336 Friday. Germany’s Factory Orders slumped to -25.8% in May from -15.6% April, and worse than median forecasts of -20.0%. This coupled with the surprise gain in US Jobs pulled back the shared currency. EUR/USD hit an overnight high at 1.13838 before dropping to its New York close. Today sees German Industrial Production data which is expected to fall to -16.0% in May from April’s -9.2%.

Germany’s 10-year Bund yield was up 7 basis points to -0.28%, just one basis point lower than the climb in the US 10-year rate. However, the difference in the climb in both rates last week was 17 basis point higher in favour of the US. This will result a further pullback for the EUR/USD pair.

EUR/USD has immediate support at 1.1270 (overnight low at 1.12785) followed by 1.1230. Immediate resistance can be found at 1.1330 and then 1.1380. Look to sell rallies in a likely 1.1220-1.1320 range today.