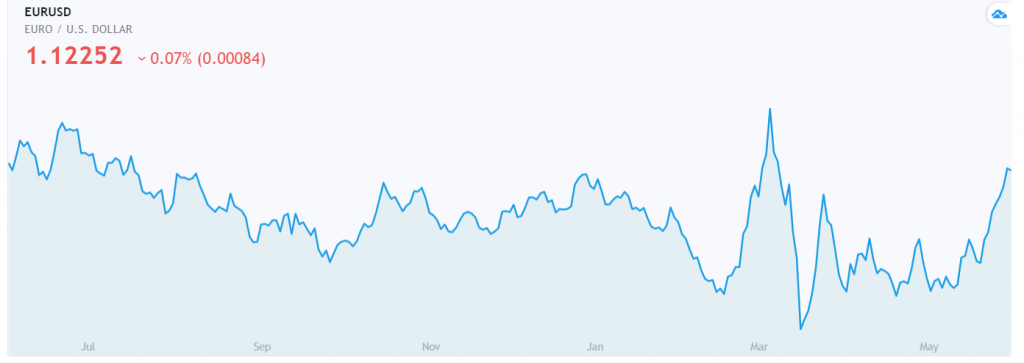

The Euro extended its advance for the 7th day in a row, rising to an overnight and early March high at 1.12575 before slipping to finish in New York at 1.1235. The improving risk appetite in asset markets which has resulted in a lower Greenback overall has boosted the Euro ( EUR/USD ). Economic data out of the Eurozone and Euro area countries have mostly beat expectations. PMI’s were revised higher, which has also supported the shared currency.

The ECB is expected to add EUR 250 billion to its Pandemic Emergency Purchase Program (PEPP) at the conclusion of its policy meeting tonight and trim the discount rate by 10 basis points. Most analysts expect a temporary dip in the Euro with more Eurozone support coming in the way of fiscal stimulus. While this could bolster the longer-term value of the Euro, the market is currently sitting long Euro bets. If the ECB were to add EUR 500 billion to its PEPP, this could put a stop to the shared currency’s recovery. Which would result in an immediate corrective move lower.

The latest Commitment of Traders/CFTC report saw net speculative Euro long bets trimmed to total +EUR 75,222 contracts in the week ended 26 May from +EUR 77,882 the previous week. Net speculative total Euro longs are still elevated and are at 86% relative to the year’s maximum according to Saxo Bank’s report. The oxygen is getting thin for the Euro at these current heights. The bulls are confident though (from most analysis that we have read). Look to sell Euro ( EUR/USD ) rallies to 1.1250/60 with a likely range today of 1.1070-1.1270.