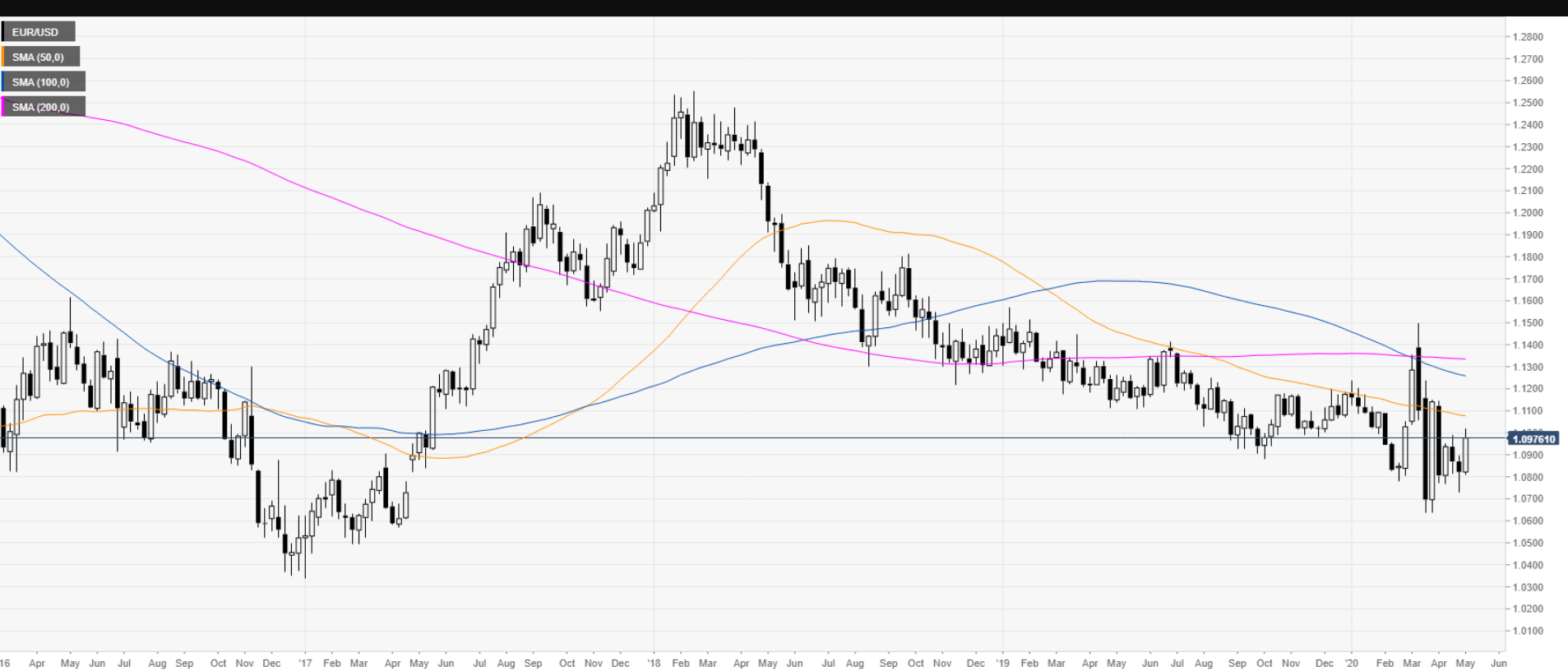

The Euro finished in New York at 1.0980, up 0.22% from its Friday opening at 1.0950. EUR/USD traded to an overnight and 4-week high at 1.10189 before easing. In early Asian trade, the shared currency slipped to 1.0953 before settling.

EUR/USD has immediate support at 1.0935 (overnight low 1.09345) followed by 1.0900 and 1.0870. Immediate resistance on the day is found at 1.1000 and 1.1020. Expect EUR/USD trading to continue subdued amidst a weakening of Commodity and Emerging Market currencies. Today sees the release of Euro area Manufacturing PMI’s as well as the EU economic forecasts and Eurozone Sentix Investor Confidence Index.

Look for the Euro to trade within a likely range today of 1.0920-1.1020. Let’s remember that speculative long market positioning in the Euro has been near their biggest totals since mid-2018. That has yet to correct itself. Prefer to sell any rallies above 1.1000. The next big move in the shared currency is south, not north.