Summary: We are onside with consensus in expecting no change in monetary policy this week. Now the German court challenge has been defused, and the ECB can focus on the future of its bond purchases.

Technical discussions should concern the likely slowdown in the path of bond purchases this summer, further flexibility in the PSPP (Public Sector Purchase Programme) parameters, and early talks about the Strategy Review that is due next year, especially regarding climate change. The ECB is likely to remain on alert as the second economic wave of the COVID-19 pandemic, characterized by business restructuring and permanent closures, is about to hit the Eurozone and fragilize the banking sector.

Timeline of the ECB’s response to the crisis:

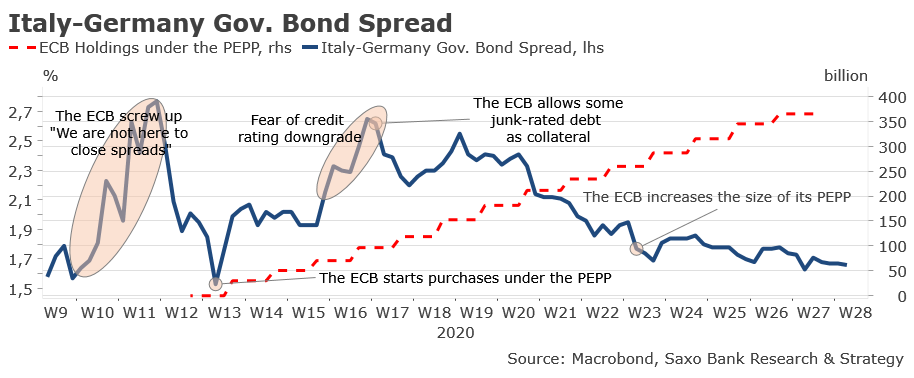

March 12: The ECB decides to expand its QE programme by €120bn until the end of 2020, with a special focus on private sector bonds, such as corporate bonds, and to offer more favorable terms for the already planned TLTRO III with a rate up to -0.75%.

March 18: “Whatever it takes” moment. The ECB unveils its Pandemic Emergency Purchase Programme (PEPP) of €750bn until the end of 2020 with a high degree of flexibility: the 33% limit DOES NOT apply, and the ECB can purchase debt across all the yield curve, including Greek debt under the waiver. The QE program reaches a total of €1050bn until the end of the year (including previous measures and the relaunch of QE by Draghi in 2019).

April 7: The ECB decides a very significant easing of its collateral requirements, including an expansion of eligible credit claims (ACCs) to SME loans, Greek debt (waiver), and a 20% reduction in haircuts.

April 22: The ECB accepts some junk-rated debt as collateral for loans to banks (Important caveats: the bonds must be rated as investment-grade on April 7).

June 4: The ECB increases the €750bn envelope for the PEPP by €600bn to a total of €1350bn. All asset categories eligible under the existing asset purchase programme (APP) are also eligible under the new programme.

June 25: The ECB creates a Eurosystem repo facility to provide liquidity in EUR to central banks outside the euro area. This is a precautionary measure to alleviate potential euro funding difficulties due to the pandemic.

The timely response to the pandemic by the ECB successfully managed to close the governments’ financing gap in the Eurozone. Despite the depth of the recession and the large negative shock to the level of public debt, Italy is able to finance COVID-19 expenses at a very low cost without requesting financial help from the ESM. The 10-year Italy-Germany government bond spread is basically back to pre-COVID levels, at 1.66% versus a crisis peak at 2.77% in mid-March.

The ECB’s greatest success is that it has avoided a remake of the 2012 debt crisis, by absorbing almost all new public debt related to the pandemic, and by providing as much liquidity as necessary to the market, thus preventing the emergence of a liquidity crisis. Much has been said about Christine Lagarde’s appointment as president of the ECB. Still, we need to recognize, myself included, that we were probably too critical and that she has brilliantly managed the crisis, almost making us forget about Draghi.

The ECB has managed to “fill the gap” in the Eurozone.

Now the German Constitutional Court challenge has been defused, and the ECB can focus on the future of its bond purchases. Technical discussions are likely to concern:

- The slowdown in the path of the bond purchases, which usually happens during the summer season (July and August), and might be the main point of interest for investors this week;

- Further flexibility in the PSPP parameters, especially regarding the 33% issuer limit. This issue needs to be addressed soon as there are many indications that the limits for German government bonds must be quite close.

- As part of the Strategy Review due in 2021, early talks about how the ECB could help fighting climate change – a topic that has been at the heart of Lagarde’s speeches lately.

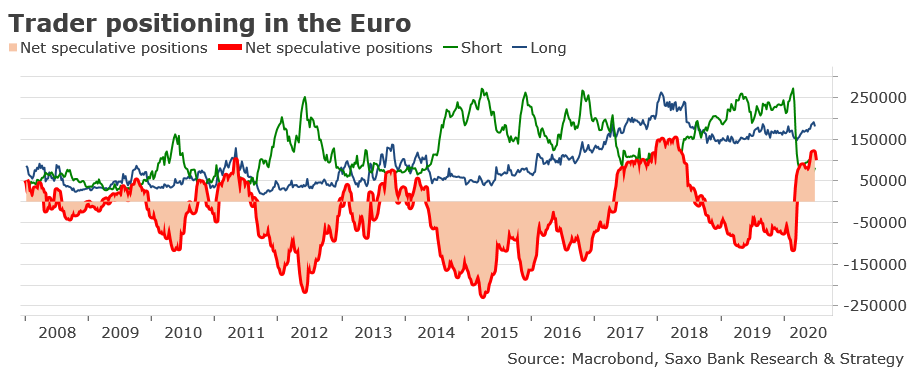

Due to the ECB firepower and hopes for EU deal on the recovery plan “Next Generation EU” this week at the physical EUCO meeting on July 17 and 18, the sentiment of investors has significantly improved over the past weeks regarding European financial assets, and especially the euro.

Speculators are betting on a higher euro as they take their long position close to their annual high point, currently at 180,387 contracts. This move also reflects aversion against the USD due to the health crisis in the United States and the impact on the greenback of the Federal Reserve flooding the markets with US dollars. At least in the short term, the euro should keep performing well.

The ECB’s timely action and hopes for the EU deal on budget and recovery plan have driven positive sentiment of investors regarding the euro.

However, there is no room for complacency. Downside risks remain elevated for the coming months. The ECB is likely to remain on alert as the second economic wave of the COVID-19, characterized by business restructuring and permanent closures, is about to hit the Eurozone and fragilize the banking sector.

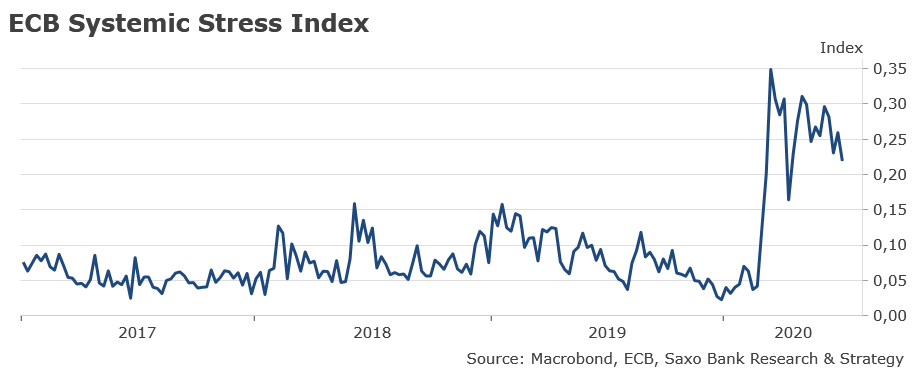

Though the ECB systemic stress indicator has receded from its annual peak reached in mid-March, it is still in the risk-zone territory at 0.21, confirming that further support from the ECB might be needed to limit financial issues that could slow down the recovery.

It will be of prime importance to monitor well risks on the banking sector related to payment deferrals that have been granted to consumers and businesses in order to cope with the crisis. These risks will only become apparent over time and might cause a sharp increase in the ratio of non-performing loans in the most vulnerable countries.

Euro area systemic stress remains in risk-zone