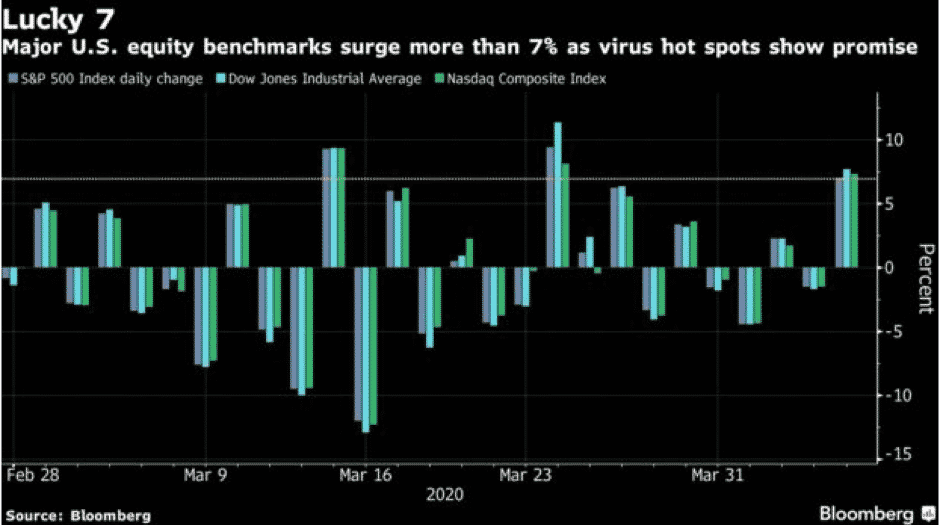

Wall Street ended in positive territory with gains over 7% as there are signs of the virus easing:

- Dow Jones Average Industrial added 1,627 points or 7.73% to 22,680

- S&P500 rose by 175 points or 7% at 2,664

- Nasdaq Composite ended 540 points or 7.33% higher at 7,913

World Equity Indices (% Change)

Risk sentiment remains fragile as it is too early to confirm that the number of cases is abating. Markets will remain news-driven until there is the confidence of the virus easing and that it has reached its peak in the US and Europe.

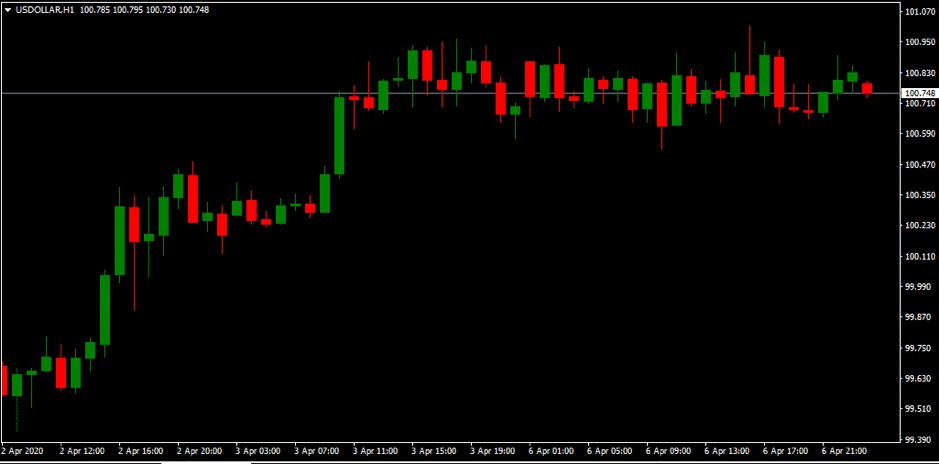

In the FX market, major currencies were mixed against the US dollar. An improvement in risk sentiment has tamed down the rally in the greenback. The US dollar index, which tracks the performance of a basket of currencies, seesawed in a tight range and has consolidated at the 100-level.

The British Pound stood out in the currency market on the reports that the UK Prime Minister, Boris Johnson, was admitted to the intensive care unit. Despite weak construction PMI data, the cable was consolidating gains around the 1.23 level, but the breaking news sent the GBPUSD lower below the 1.23 level.

Crude oil prices gapped lower on Monday as the OPEC meeting was postponed, and it is reported that it will likely take place on Thursday instead. President Trump lifted hopes of a truce between Saudi Arabia and Russia when he tweeted about his conversation with Saudi Arabia and raised expectations of substantial production cuts.

However, the rift seemed to have widened over the weekend after both parties blamed each other for the rout in the oil industry. As markets look forward to the meeting as one of the most important events for the week, the meeting is marred by various speculations. It is also reported that the US, UK, and Canada have all been invited to attend.

President Trump stated that the US had not been asked to cut production. However, the negotiations between OPEC+ members could be dependent on the US’s willingness to join the effort to stabilise the oil industry.

As of writing, WTI and Brent Crude pared some of the losses made on Monday’s open to trading in the vicinity of $26 and $29, respectively.

Despite an improvement in risk sentiment, the uncertainties prevailing in the financial markets and a weaker US dollar are driving the gold price to the upside. The XAUUSD pair is currently trading above the $1,660 level.

|

|

Indicative Index Dividends – Wednesday 08 April 2020

|

|

Index

|

Dividend

|

Index

|

Dividend

|

|

ASX200

|

0

|

WS30

|

0

|

|

US500

|

0.65

|

US2000

|

0.088

|

|

NDX100

|

0

|

CAC40

|

0

|

|

STOXX50

|

0

|

ESP35

|

0

|

|

ITA40

|

0

|

FTSE100

|

0

|

|

DAX30

|

0

|

HK50

|

0

|

|

JP225

|

0

|

INDIA50

|

0

|