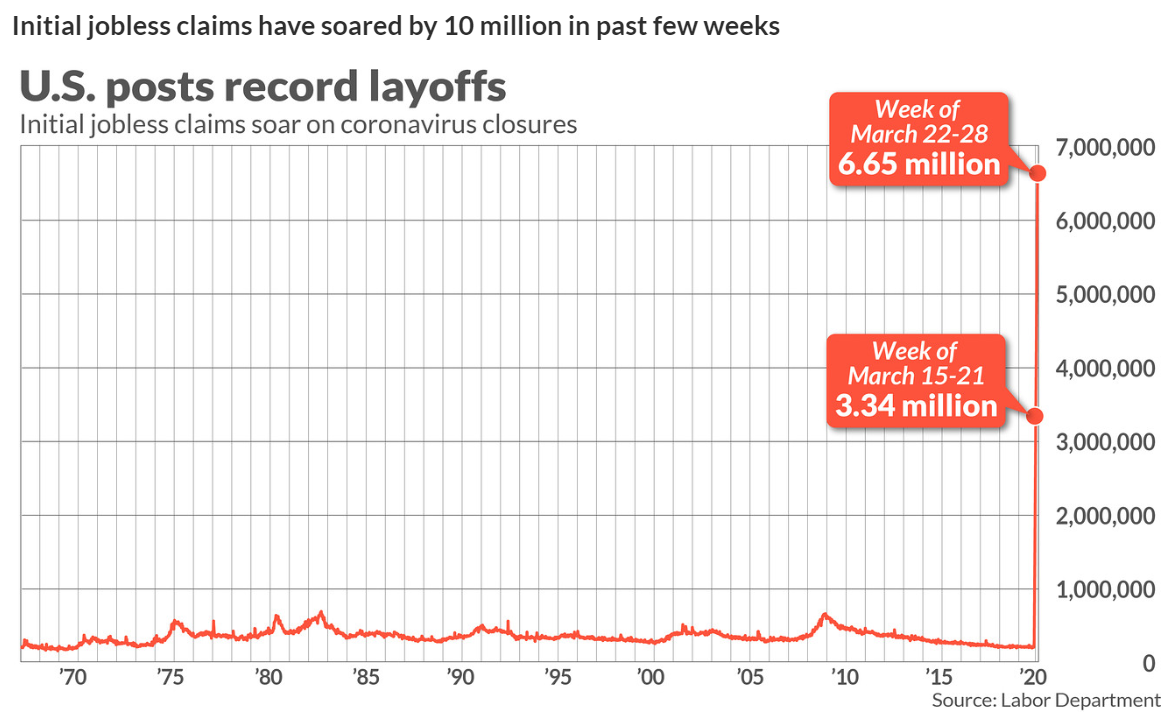

Summary: The Dollar ended higher against most majors despite another dreadful spike in Weekly US Jobless Claims to a record 6.648 million, from 3.3 million the previous week. It was a new all-time high and bigger than the median estimate of 3.5 million from economists. The Euro fell 0.92% to 1.0848 (1.0955) as total Covid-19 cases surpassed 1 million with the death toll above 50,000. Four European countries (Italy, Spain, France and the UK) account for 60% of deaths. The fall in the shared currency lifted the Dollar Index (USD/DXY) 0.49% above 100 to 100.163 (99.487 yesterday). The Australian Dollar retreated to 0.6047 from 0.6080 after dropping to an overnight low at 0.6007. Against the Yen, the Dollar climbed to 107.90 (107.00). Sterling was little changed in late New York at 1.2390 (1.2395). Canada’s Loonie had another volatile trading session, USD/CAD climbing to 1.42982 overnight high before falling to 1.4135 at the New York close as Oil prices surged. Brent Crude Oil prices jumped over 20% to USD 30.38 (USD 25.55) after President Trump tweeted that he spoke to his Russian counterpart Putin and the Saudi Crown Prince to work on cutting oil production. Saudi Arabia called for an emergency OPEC+ meeting. The Dollar eased against the Emerging Market currencies after recording strong gains this week. The higher Oil prices boosted Wall Street stocks. At the close of New York trade, the Dow was up 2.2% to 21,360 (20,960). The S&P 500 rose 2.5% to 2,525 (2,475). Global bond yields steadied. The key US 10-year yield closed unchanged at 0.61%. Germany’s ten-year Bund yielded -0.44% (-0.47%). Japan’s 10-year rate dipped to -0.03% (-0.01%).

Other data released yesterday saw Spain’s number of unemployed people surge to 302,300, far surpassing forecasts of 27,700. Eurozone PPI slumped to -0.6% in March from +0.4% previously. Canada’s Trade Deficit eased to -CAD 1 billion in March from February’s -CAD1.7 billion, bettering forecasts of -CAD 2.3 billion. US March Factory Orders were flat at 0.0%, below expectations of 0.2%.

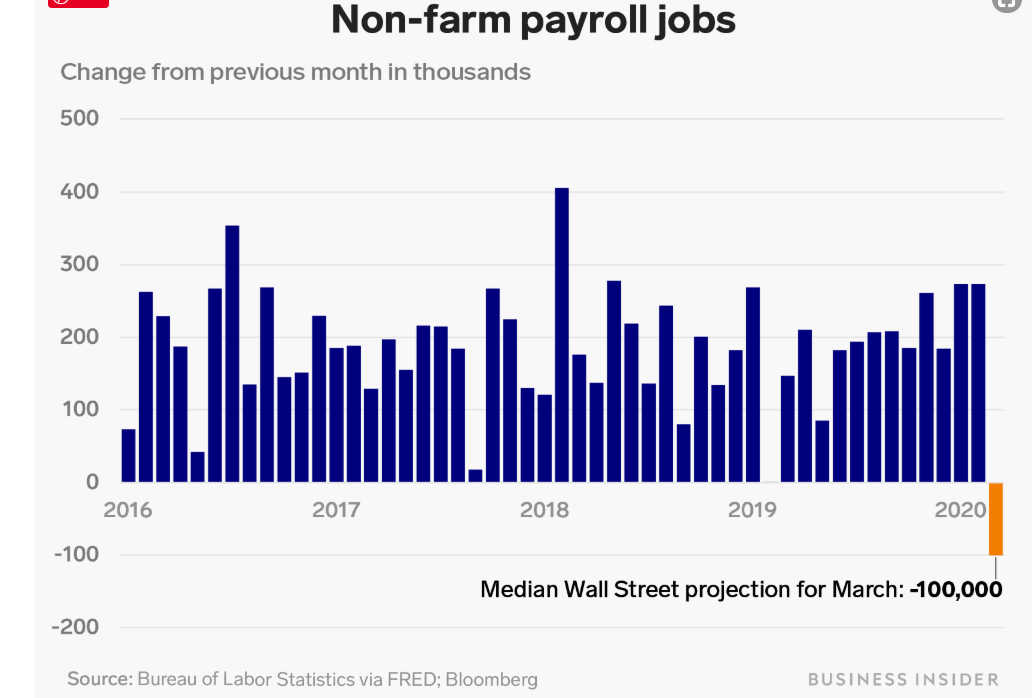

On the Lookout: The spotlight turns to the US Payrolls report for March which is expected to show the first contraction of jobs since 2010 as coronavirus lockdowns spread. Economists expect the Non-Farms Payroll to decline 100,000 from February’s addition of 273,000 jobs. March’s Unemployment rate is forecast to climb to 3.8% from 3.5%. Wages (Average Weekly Earnings) are expected to drop to 0.2% from 0.3%.

Other data released today are: China’s Caixin Services PMI report, and Australia’s Final Retail Sales. Europe sees Euro area (Spain, Italy, France, Germany) and the Eurozone Services PMI reports. Eurozone Retail Sales follow. The UK releases its Final Services PMI report. Other US data released today are Final Services PMI and the ISM Non-manufacturing PMI. Watch this last number, the job losses in the service industry is forecast to see ISM Non-manufacturing PMI’s fall to 43.5 from 57.3.

Trading Perspective: The Euro underperformed the majors, falling to an overnight low at 1.08206, before climbing to settle at 1.0847. Against the Emerging Market currencies, the Dollar eased following its strong rally this week as the costs of raising US funds stabilised further. Confirmed cases of Covid-19 in the United States rose to over 200,000, the most worldwide.

Against this backdrop, the latest Commitment of Traders/CFTC report for the week ended 24 March saw net speculative USD shorts increase to a total USD 6.6 billion. The negative US Dollar increase was due strong buying in the Euro, which saw Euro long bets climb to +EUR 61,290 contracts or the equivalent of USD 8.3 billion, the highest since June 2018, according to Saxo Bank’s report. Which is one of the reasons for the Euro’s fall overnight. With much uncertainty around, no FX trader wants to keep a position for any length of time.