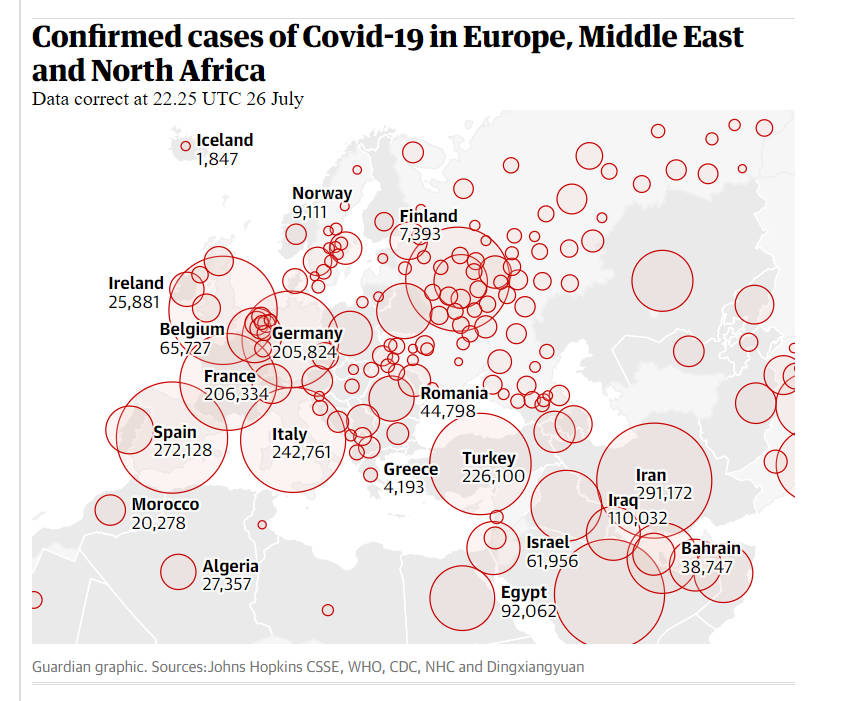

Summary: Total Coronavirus cases in the US soared to above the 4 million mark with deaths climbing to 149,771. Preliminary factory and services output underwhelmed in the US while those of Australia, Europe and the UK were mostly upbeat. The passing of a US Stimulus package bill saw further delays. Tensions between China and the US continued to escalate which soured risk sentiment and weighed on equities. This time safe-haven flows were diverted out of the US Dollar into the traditional darlings, the Yen and Swiss Franc. While the Dollar’s weakness extended against most of its rivals, the downside momentum slowed. Against the Japanese Yen, which outperformed FX, the US Dollar slumped to an overnight and 4-month low at 105.682 before rebounding to close at 106.10, a loss of 0.7%. The Euro advanced further, up 0.5% to 1.1655 from 1.1595 Friday despite a growing and feared second wave of new Covid-19 cases in Spain. France and Germany have also seen new cases rise. The Australian Dollar finished little changed at 0.7100 after slipping to 0.70638 overnight on the generally weaker Greenback. USD/CHF weakened to 0.9208 from 0.9257 as traders favoured the haven Swiss Franc. Sterling rallied to 1.2797 (1.2737). Apart from upbeat UK Manufacturing and Services PMI’s, Retail Sales were better-than-expected. Wall Street stocks fell as US virus cases continued to surge. The DOW ended lower at 26,654 (27,002), a loss of 0.81%. The S&P 500 slipped 0.8% to 3,213 (3,237 Friday). The US 10-year bond yield was at 0.59% (0.58%).

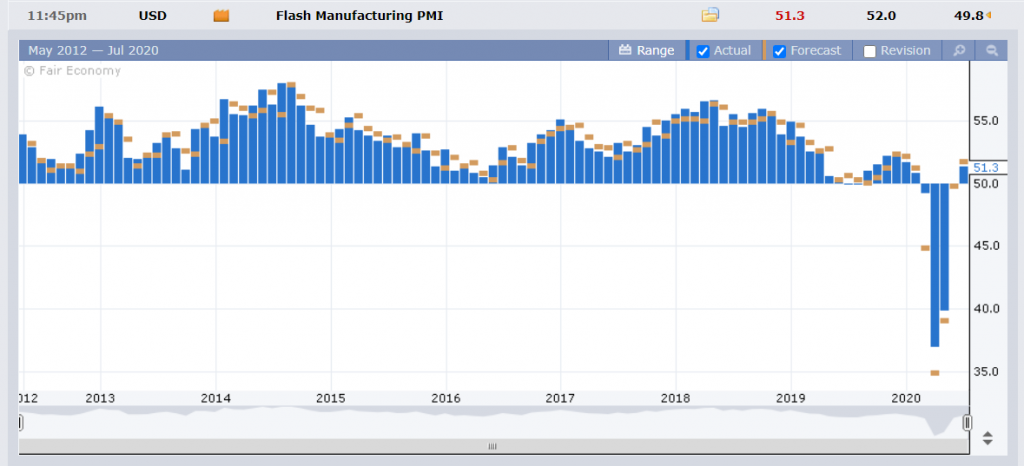

Data released Friday saw Australia’s Flash Manufacturing PMI at 53.4, just missing forecasts at 53.6. Australia’s Services PMI’s though bettered expectations at 58.5 against 53.2. Euro area Manufacturing and Services PMI’s mostly beat forecasts. Eurozone Flash Manufacturing PMI rose to 51.1 from 47.4, beating forecasts at 50.0. UK Retail Sales jumped to 13.9% from 12.0%, beating expectations of 8.3%. US Flash Manufacturing PMI was at 51.3, missing forecasts at 52.0. US Services PMIs were at 49.6, below expectations of 51.0. US New Home Sales rose to 776,000 units, beating median expectations of 700,000.

On the Lookout: While today’s data releases are rather light, the US releases its Headline and Core Durable Goods Orders. The week ahead is a heavy one with the highlight the Federal Reserve’s FOMC meeting and rate announcement (early Thursday morning Sydney time). Friday is a data dump day with China reporting its factory output data. US and Euro area GDP reports are also due for release this week (Thursday). Canada’s GDP report is on Friday.

The US Congress is struggling to come up with a relief package bill and further delays could push the Dollar’s downside momentum faster. Tensions between China and the US will continue to be monitored, as well as coronavirus developments around the globe. In Europe, a second wave is hitting Spain and Germany.

Trading Perspective: While the Dollar continues with an overall weak tone, the downside momentum appears to be slowing against some of its rivals. The lower US Dollar is getting overstretched. While coronavirus cases have been soaring in the US, there are a growing number of infections in Europe and other parts of the world that indicate a second wave. This may prove to be the catalyst for the correction phase to begin for the overstretched Greenback. While there has been a material sentiment shift against the US Dollar, market positioning in the futures market have been net long Euros since March, as an example.