Summary: King Dollar tanked as US Bond yields plunged to record lows, inflation remained subdued and the Federal Reserve was seen ready to cut rates due to the coronavirus threat. The head of the World Health Organisation (WHO) said the outbreak has the potential to become a pandemic and is at a decisive stage. The Washington Post reported the first US coronavirus case of unknown origin in Northern California. The benchmark US 10-year Treasury yield plunged eight basis points to 1.26% a record low, and its sixth straight drop. Two-year US treasury yields dropped seven basis points to 1.09%. The Euro, oversold for some time now against the Greenback, hit a peak at 1.10065, before settling at 1.0988, up 0.9% and best performing FX. The Australian Dollar, often seen as a proxy trade for China, rebounded 0.57% off fresh 11-year lows (0.65424) to close at 0.6585 in New York. The Aussie was sold aggressively during the Asian time zone after Australia’s Q4 Private Capital Expenditure fell 2.8% against an expected advance of 0.4%. Against the Yen, the overall weaker US Dollar slipped to 110.00 from 110.25. Sterling underperformed, finishing 0.12% lower against the Greenback at 1.2895 (1.2912). Against the Euro, the Pound lost 1.0%, EUR/GBP soaring to 0.8525 from 0.8440. Brexit woes continued to hurt the British currency. The UK told the European Union it was ready to walk away from negotiations in June if no progress is made toward a trade deal.

The Dollar Index (USD/DXY) slumped 0.49% to 98.512 from 99.037 yesterday. Wall Street stocks extended their rout, plunging to four-month lows. The DOW tumbled 4.5% to 25,650 (26,957) while the S&P 500 lost 4.4% to 2,965 (3,117). Other data released yesterday saw US Durable Goods Orders fall to -0.2%, beating forecasts of a 1.5% drop. Core DGO rose 0.9%, beating expectations of a 0.2% rise. US Pending Home Sales jumped 5.2% in January, well above forecasts of 2.8%. The US Housing market continued to gain momentum as mortgage rates hovered around a 3-year low.

Trading Perspective: With US treasury yields plunging to their lowest on record for the sixth straight decline, the Dollar’s downside correction gained momentum. US inflation remains low. While other bond yields dropped, US interest rates are much higher and therefore have much further to fall. The coronavirus spread has hit the US mainland and markets are expecting the Fed to cut rates to offset the impact. Money market traders are now pricing in a Federal Reserve easing in April followed by another rate cut in July.

Market positioning remains long of US Dollar bets. We reported earlier this week that the Commitment of Traders report (week ended 18 Feb) saw speculators add to their USD long bets against the majority of IMM currencies.

The coronavirus spread continues to drive markets although there are some first-tier economic reports due in today’s data deluge. Japanese Unemployment, Retail Sales, Preliminary Industrial Production kick off today’s reports. Australian Private Sector Credit follows. Euro area data sees German Import Prices, and Unemployment Change, French Consumer Credit, Preliminary Q4 GDP and Preliminary CPI. The UK reports on its Nationwide House Price Index and GFC Consumer Confidence. Canada sees its February GDP and Raw Materials Price Index data. Finally, the US reports its Core PCE Price Index, Personal Spending and Personal Income, Goods Trade Balance and Chicago PMI. Over the weekend China reports its Manufacturing and Non-Manufacturing PMI.

EUR/USD – The Euro peaked at an overnight high of 1.10065 before easing to settle at 1.0988 in late New York. Among the 10 IMM currencies in the Commitment of Traders report, the Euro has been the most oversold due to overwhelming bearish sentiment among FX traders. The shared currency has more room to correct upwards. Immediate resistance lies at 1.1010 followed by 1.1060. Initial support can be found at 1.0960 and 1.0920. Expect consolidation today with a likely range of 1.0860-1.0920. Prefer to buy dips.

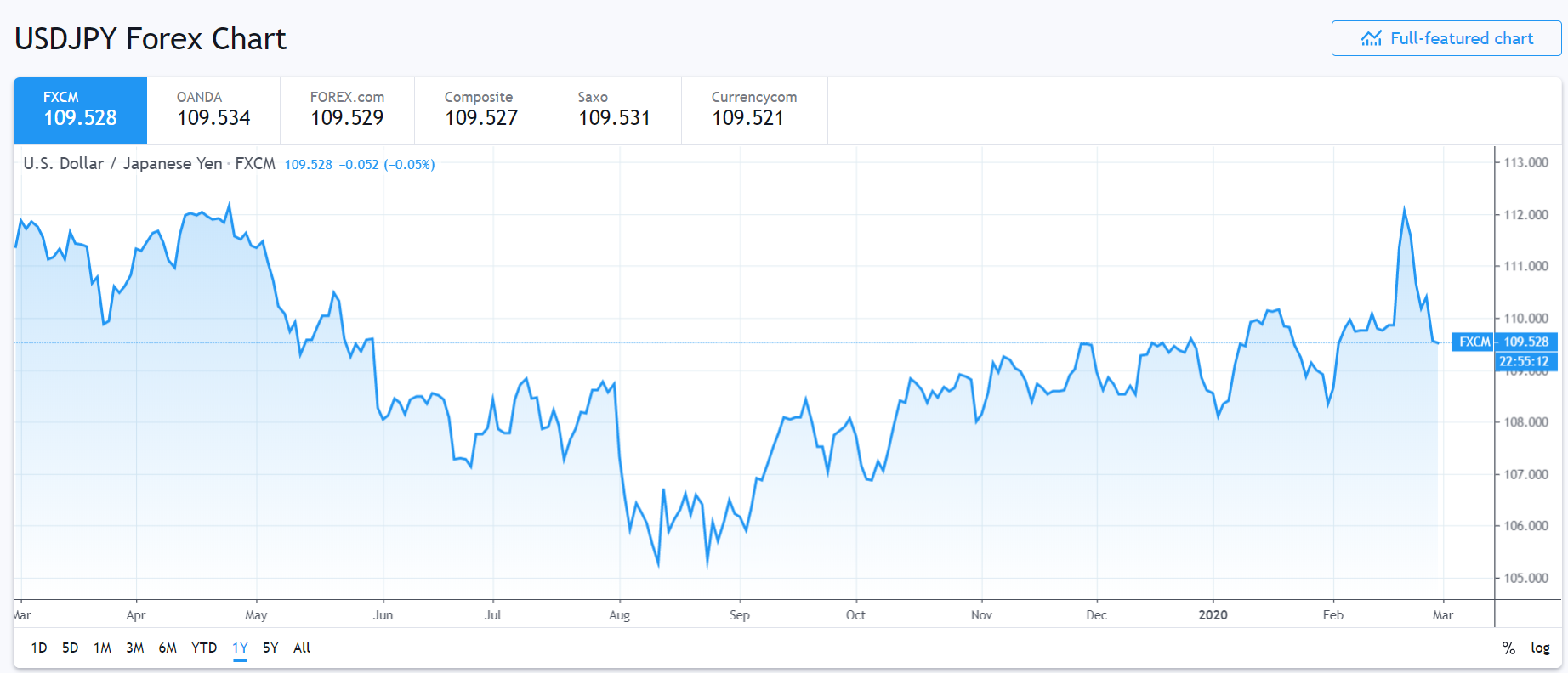

USD/JPY – The Dollar closed at 110.00 in New York, a loss of 0.34% from yesterday’s 110.25. In early Asian trade this morning, the USD/JPY pair slumped to 109.33 lows before settling at its current 109.50. Against the Yen, the Dollar has room to drop further given the plunge in the US 10-year yield. Japan’s 10-year JGB was down 2 basis points to -0.12% in contrast. Immediate support today lies at 109.20 followed by 108.80 (strong). Immediate resistance can be found at 109.80 followed by 110.10. Look to sell rallies in a likely 109.20-110.20 range today.

AUD/USD – The Aussie’s rebound was limited as its China proxy status continues to constrain the Battler’s topside. The Australian Dollar has also fallen on a TWI basis and this will be of concern to the RBA. Lastly the Aussie’s main flows remain against the US Dollar. Market positioning remains short of Aussie bets. Immediate support for the Aussie today lies at 0.6560 followed by 0.6530. Immediate resistance can be found at 0.6600 (overnight high 0.65919) followed by 0.6630. Look to buy dips in a likely 0.6560-0.6630 range today.

GBP/USD – Sterling failed to advance given the US Dollar’s broad-based fall. The British Pound remained soft due to Brexit woes, closing at 1.2895 from 1.2915 yesterday. We highlighted earlier this week that speculators increased their long Sterling bets to +GBP 29,258 bets from +GBP 21,084. The Pound and the Swiss Franc were the only major currencies where the specs were short USD and long the currency. This will constrain Sterling’s topside. GBP/USD has immediate support at 1.2860 (overnight low) followed by 1.2830. Immediate resistance can be found at 1.2920 followed by 1.2970. Look for consolidation in a likely 1.2880-1.2980 range. Just trade the range shag on this one.

NZD/USD – The Kiwi closed higher against the overall weaker US Dollar at 0.6315 from 0.6300 yesterday. NZD/USD traded to an overnight high at 0.63345, which is where immediate resistance can be found. The next resistance level lies at 0.6360. Immediate support can be found at 0.6285 followed by 0.6255. Look for a likely trading range today of 0.6300-0.6350. Prefer to buy dips.

EUR/GBP – The Euro soared 1% against the Pound to finish at 0.8525 from 0.8440 yesterday. The up move was the result of a higher EUR/USD and lower GBP/USD. Market positioning saw an increase in Euro shorts and Sterling longs, which provided the double whammy for this cross to move higher. Immediate resistance can be found at 0.8545 (overnight high 0.85425). The next resistance level lies at 0.8580. Immediate support can be found at 0.8485 and 0.8455. Look to trade a likely range of 0.8475-0.8575. Just trade the range shag today.

Amidst the coronavirus scare, take care but enjoy your Friday. Happy trading all.