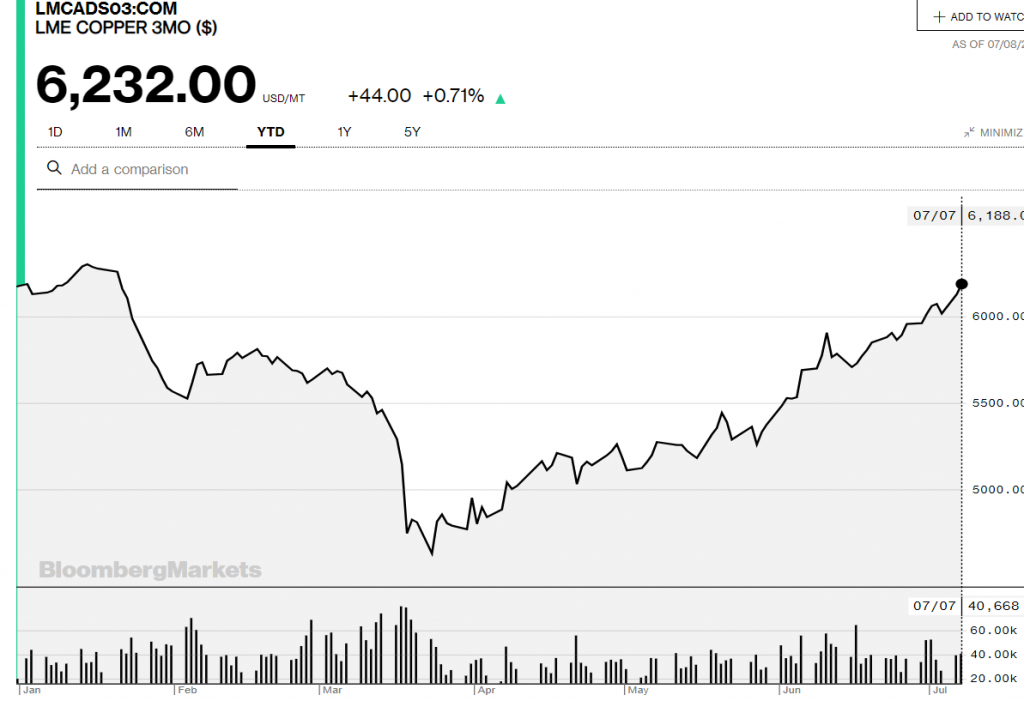

Summary: The Dollar stumbled, hitting 2-week lows as Gold jumped to highs not seen since 2011 (USD 1,818.). The yellow metal continued its grind higher as interest rates remain low in the current monetary expansion. Base metals rallied with Copper prices hitting highs not seen since January. In quiet trade, FX ignored a US daily record of over 60,000 new Covid-19 cases bringing the total to over 3.1 million. Sterling climbed to overnight and 3-week highs at 1.2623 before easing to 1.2615 in late New York from 1.2542 Wednesday. UK Chancellor of the Exchequer Rishi Sunak pledge GBP 30 billion to head off rising unemployment by paying companies to re-hire workers and cut taxes for hospitality firms and homebuyers. The Euro rallied 0.49% to 1.1334 (1.1275 yesterday) at the New York close trading to its 3-week high at 1.13518. Against the Canadian Loonie, which finished as best-forming currency, the Greenback tumbled to 1.3510 (1.3602). Canada’s 10-year bond yield jumped 6 basis points to 0.57% as the central government in Ottawa forecast its largest budget deficit since the Second World War. The Australian Dollar rebounded to 0.6985 (0.6945), despite the resurgence of Covid-19 cases in Victoria and the lockdown in Melbourne. Australia’s post pandemic recovery compared to that of the US and other global hotspots remains healthy. The rise in Base metal prices also supported the Battler. The Greenback also reversed lower against most Emerging Market currencies. The USD/ZAR pair (Dollar-South African Rand) plunged 1.4% to 16.9300 (17.1555) on overall US Dollar weakness and the higher Gold and Commodity prices. USD/CNH (Dollar-Offshore Chinese Yuan) slid just under the 7.00 mark to 6.9990 from 7.0255 yesterday. China’s stock market rose 1.74%. The DOW finished up 0.79% to 26,115 (25,900) while the S&P 500 gained 0.92% to 3,175 (3,147).

Economic Data released yesterday saw Japan’s Current Account Surplus climb to +JPY 0.82 trillion, beating forecasts at +JPY 0.71 trillion. Japan’s Economic Watcher’s Sentiment rose to 38.8 from 15.5, bettering expectations at 24.7. Switzerland’s June Unemployment Rate improved to 3.3% from the previous month’s 3.4%, beating forecasts at 3.6%. US Consumer Credit in June fell to -USD 18.3 billion, missing expectations of -USD 15.2 billion.

On the Lookout: Expect a slow start in Asia with the risk-on theme from last night to carry forward. FX and risk markets ignored the ongoing resurgence in Covid-19 new cases beginning in the US and following other current hotspots in the world. The optimism comes from anticipated further fiscal measures and growing expectations of a successful vaccine. Yesterday US virus expert Doctor Anthony Fauci said Phase 3 vaccine trials may begin at end-July and that he is “cautiously optimistic” for a vaccine by year-end.

Data released today are light. Japan kicks off in Asia with its Core Machinery Orders and Preliminary Tools Orders data. New Zealand releases its ANZ Business Confidence Survey. Australia releases its Home Loans data for May. China follows with its CPI and PPI (y/y) reports. Europe sees Germany’s Trade Balance and Current Account reports while the Euro group meetings kick off today. Canada kicks off North American reports with its June Housing Starts. The US finish off the day’s reports with its Weekly Unemployment Claims.

Trading Perspective: The Dollar failed to extend gains and reversed lower. The Dollar Index (USD/DXY) a favourite gauge of the Greenback’s value against a basket of 6 major currencies slumped 0.42% to 3-week lows at 96.476 (96.980). While we can expect some early Asian pressure on the US Dollar, there will need to be fresh impetus to drive the Greenback lower. Otherwise, as we head into the Northern Hemisphere summer season, which traditionally sees a lull in FX, consolidation will be the order of the day. The uncertainty for this latest resurgence in Covid-19 cases led by the US and other global hotspots remains. With rising new cases comes the real risk of rising new deaths despite the slowing of death rates recently.