Summary: The Dollar came roaring back on safe-haven demand after data saw a massive hit from the coronavirus outbreak on US Retail Sales and manufacturing activity in New York. Fears that the damage from Covid-19 on the global economy would be long and drawn-out rose after the IMF downgraded growth more than expected. The Dollar Index (USD/DXY), a favoured gauge of the Greenback’s value against a basket of 6 major currencies, rose to 99.976 highs, before settling at 99.567 (98.879 yesterday), up 0.7%. Risk assets and currencies tumbled. The Aussie Dollar plunged 1.85% to 0.6320 from 0.6442, after hitting an overnight low of 0.6284. Against the Japanese Yen, one of the traditional safe havens, the Dollar was up moderately to 107.45 from 107.23. Sterling slumped 0.9% to 1.2530 from 1.2630 while the Euro settled lower at 1.0912 (1.0980) in late New York after falling as low as 1.08567. USD/CAD, under pressure yesterday, reversed, soaring 1.62% to 1.41324 at the NY close from 1.3885. The Bank of Canada held rates steady at an all time low of 0.25% as widely expected. The BOC added corporate and provincial bonds to its QE program. Brent Crude Oil slipped anew to USD 30.25 (USD 32.30) as recent OPEC production cuts were expected not enough to support prices in a global demand glut. The US Dollar extended its climb against the Emerging Market currencies. USD/ZAR (US Dollar- South African Rand) jumped 2.06% to 18.675 (18.300). Wall Street stocks slumped. The DOW was 2.4% lower in late New York to 23.449 (24,035) while the S&P dropped 2.67% to 2,777 (2,855). US bond yields plunged with the benchmark 10-year rate down 12 basis points to 0.63%. Germany’s 10-year Bund yield fell to -0.47% from -0.38% yesterday. Australia’s 10-year bond yielded 0.90% from 0.91% yesterday.

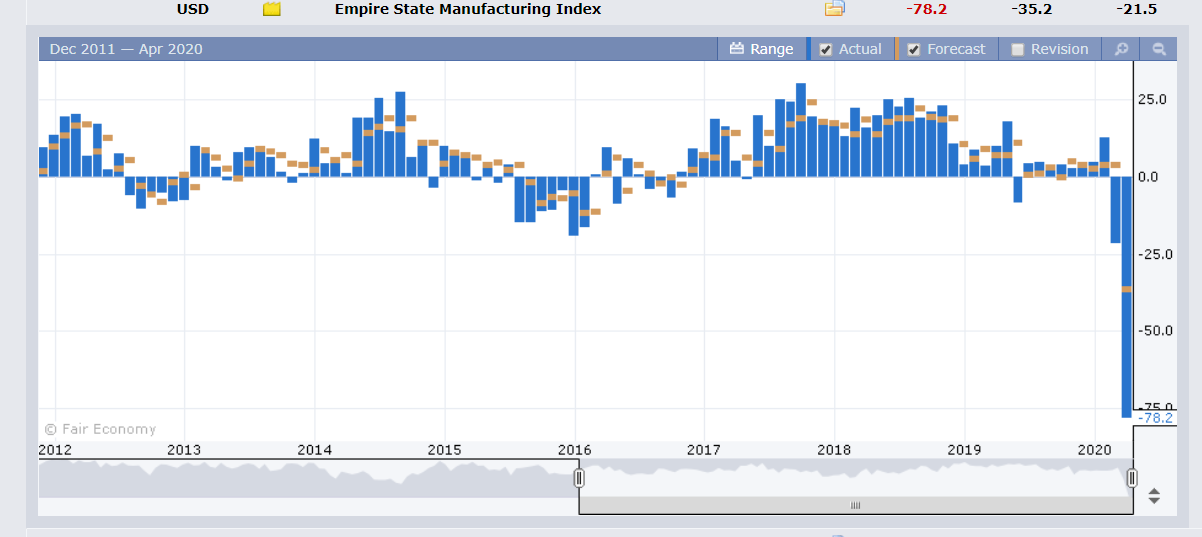

Data released yesterday saw Australia’s Westpac Consumer Sentiment fall to -17.7% in March from -3.8% in February. US March Headline Retail Sales plunged to -8.7%, a record drop and lower than expectations of -8.0%. February’s Sales were down -0.5%. The Empire State Manufacturing Index (factory activity in New York State) slumped to an all-time low at-78.2, more than double median forecasts at -35.2. US Capacity Utilisation slipped to 72.7, missing forecasts at 73.7 while Industrial Production was lower to -5.4% against expectations of -4.1%.

Coronavirus fatalities reversed the recent flattening with infections hitting 6-day highs in Spain while the death toll in the US climbed above 30,000.

On the Lookout: Asian markets will take the lead from the US with asset markets and stocks falling while the US Dollar will remain supported overall. Traders will focus on the economic data releases today. This morning’s spotlight will be on the Australian Employment report (11.30 am Sydney time).

The Australian economy is forecast to have lost between 33,000 to 40,000 jobs in the period up to March 19 from February’s +26,700. Economists expect Australia’s Unemployment rate to climb to between 5.4% and 5.5% from February’s 5.1%.

Other data releases today see Germany’s Final CPI and WPI (Wholesale Price Index) for March. Swiss PPI follows. Canada releases its Manufacturing Production and ADP Private Employment Change data. Finally, US reports released are Building Permits, Housing Starts and the Philadelphia Fed Manufacturing Index.

Trading Perspective: FX volatility picked up to where it left off prior to the long Easter weekend. We can expect more of the same in the days ahead. The US Dollar closed on a strong note despite giving back some of its gains in late New York trading. FX spotlight will be on the latest Covid-19 infections and fatalities as well as upcoming economic data.

We reported last week that market positioning had seen a build in US shorts, particularly against the Euro. This week’s COT report will be particularly interesting. Despite the Dollar’s fall against the Majors yesterday, we also observed the USD/EMS kept climbing. This particular dynamic needs monitoring. Expect the Dollar to consolidate its gains with high volatility within the recent ranges.