Summary: A degree of volatility returned to FX trading although the end-result was a flat finish to the Dollar Index (USD/DXY) which is a favoured gauge of the Greenback’s value against a basket of 6 major currencies. USD/DXY finished at 96.58, little-changed from yesterday’s 96.65. The battle for risk continued with the alarming number of new coronavirus cases in many US states forcing California’s Governor to order indoor activities to close statewide. Earlier, CNBC reported that US health officials expect drug makers to produce a coronavirus vaccine by the end of the northern hemisphere summer boosted equities and weighed on the Dollar. The Euro advanced 0.4% against the Greenback to 1.1345 (1.1305) after peaking at 1.1375. Sterling, however reversed lower to finish at 1.2555 (1.2635) after 4 straight days of gains. Brexit talks between the EU and the UK have yet to produce any breakthroughs. The Dollar rallied against the Japanese Yen to 107.25 from 106.95 yesterday. Against the Canadian Loonie, the Dollar was higher to 1.3612 from 1.3585. The Australian Dollar was modestly lower to 0.6942 from 0.6955 yesterday. The CBOE VIX (Fear) Index jumped 18% to 32.19, its highest since June 26. Wall Street stocks finished mixed after initially climbing. The DOW ended flat at 26,090. (26,100) while the S&P 500 lost 0.94% to 3,158 (3,192).

The benchmark US 10-year bond yield was at 0.62% from 0.64% yesterday.

Data released saw the US Federal Budget deficit in June climb to an all-time high at -USD 864.1 billion from -USD 398.8 billion in May and higher than expectations of -USD 860.0 billion. There were no other major data releases yesterday.

On the Lookout: Today sees a data deluge which should set the tone for FX and equities. A few minutes ago, New Zealand’s Visitor Arrivals in June rose 82.3% from May’s drop at -98.9%. The Kiwi was little changed at 0.6540 following the release. The UK’s BRC Retail Sales Monitor for June rose to 10.9% in June from 7.9% in May. Sterling hardly budged.

Australia kicks off with its NAB (National Australia Bank) Business Confidence Index. China follows with its Trade Balance denominated in CNY and USD. The breakdown of Imports and Exports will be scrutinised. Japan rounds off Asian data with its Revised Industrial Production report. European economic reports kick off with Germany’s Final June CPI. The UK follows next with its June GDP, Construction Output, Goods Trade Balance, Industrial Production and Manufacturing Production data. Swiss PPI follows. Finally, Eurozone Industrial Production, ZEW Economic Sentiment and Germany’s ZEW Economic Sentiment round up Europe’s data contribution.

The US sees its Headline and Core CPI report for June.

Trading Perspective: Traders will be monitoring China’s Trade Balance and the breakdown of imports and exports as well UK GDP, Manufacturing Output, and the US CPI report.

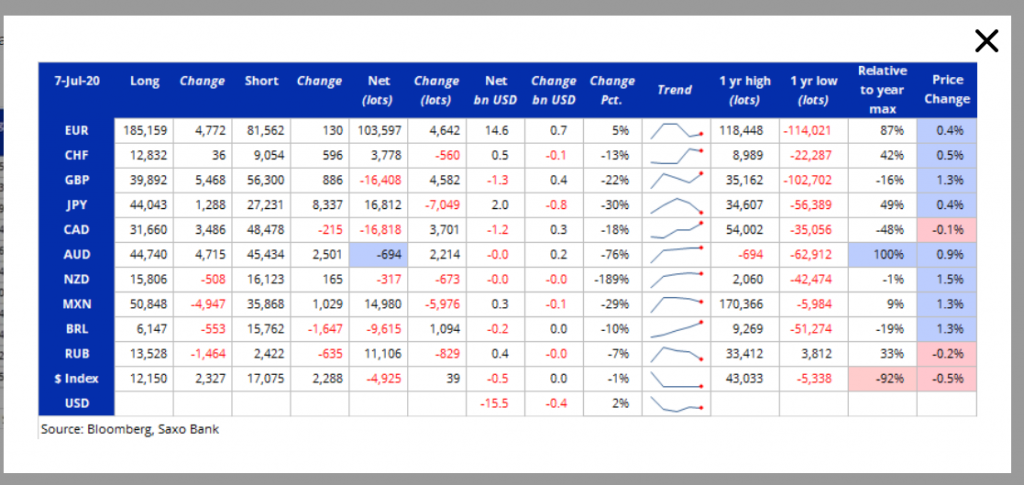

The latest Commitment of Traders/CFTC report (week ended July 7) saw hedge funds and large speculators as small sellers of US Dollars. The holiday shortened week saw two main highlights. A build up of Euro long bets to multi-year highs and a net reduction of Aussie shorts to virtually zero.

What this all means is that the Euro has more room to turn lower. For the Aussie, it becomes a more evenly balanced out market and the recent rise in a second wave of COVID-19 cases in Victoria and parts of NSW will weigh on the currency.