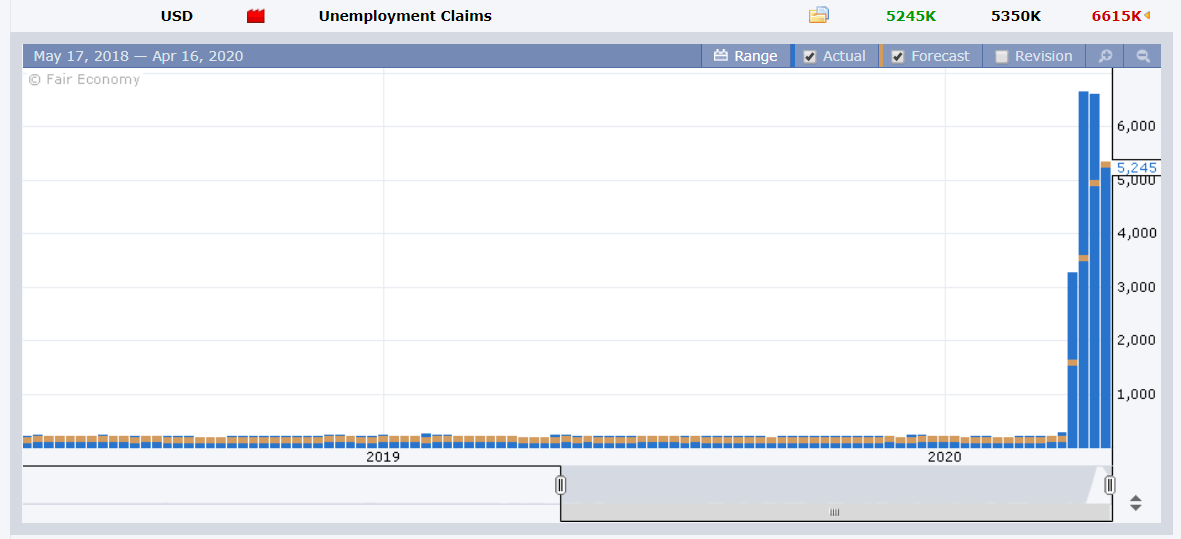

Summary: Another day, another Dollar. FX saw mixed reactions after the US Department of Labour reported that the number of Americans filing for Unemployment Claims in the week ending April 11 was 5,245,000. While the number bettered forecasts of 5.35 million and improved the previous week’s upward adjusted claims of 6.615 million (from 6.606m), the monthly total hit a record 22 million Americans seeking unemployment benefits. The Philadelphia Manufacturing Index hit a 45-year low at -56.6. Despite the worrisome data, the US Dollar maintained its dominance in FX. The Dollar Index (USD/DXY) a gauge of the Greenback’s value against a basket of six foreign currencies, rose to 99.979 (99.567). US President Trump is due to announce guidelines on re-opening the country’s economy later today. The Euro underperformed, extending its drop to 1.0840 (1.0912). Eurozone governments continued to grapple with a Euro 500 billion deal reached last week to support countries which is widely seen as insufficient. Against the Yen, the Dollar climbed 0.25% to 107.90 (107.45) as Japan extended its state of emergency to the whole country. Sterling eased to 1.2450 (1.2530). Risk currencies fared a bit better. The Australian Dollar eked out a gain of 0.23% to 0.6320 (0.6285). USD/CAD dipped to 1.4040 from 1.4080 after Oil prices rebounded off their lows.

Wall Street rallied on strong health care and technology-related stocks with the prospect of nations reopening their economies which were shut down due to the spread of Covid-19. In late New York, the Dow was up 1.6% to 23,815 (23,450). The S&P 500 rose 1.9% to 2,830 (2,780). The key US 10-year bond yield was 1 basis point lower to 0.62%.

Other data released yesterday saw Australia create 5,900 Jobs, beating forecasts of a Job loss of -40,000. Australia’s Unemployment rate rose to 5.2% from 5.1%. US March Housing Starts fell to 1.22 million units from a downwardly adjusted 1.56 million, and missing expectations of 1.31 million. Building Permits, however, climbed to 1.35 million units, beating forecasts of 1.30 million.

On the Lookout: The spotlight today will be on China’s Q1 GDP and trifecta of economic data, Industrial Production, Retail Sales and Fixed Asset Investment (March). Latest forecasts, while expected to show falls, are all better than those in the previous month.

Other data released today are Japanese February Revised Industrial Production, Capacity Utilisation, and Tertiary Industry Activity. Euro area reports kick off with Italy’s Trade Balance, and the Eurozone Final Headline and Core CPI data. Finally, the US reports on its Conference Board’s Leading Index.

Trading Perspective: The US Dollar managed to keep its title of King in the FX world despite the dismal and worrisome US economic data. Ongoing pessimism on the global economy is putting a bid on the Greenback. Markets are of the view that the rest of the world will be worse. The mood shifts from risk-on to risk-off with high volatility trading conditions.

The environment forces traders to be more discretional, have an overall view, but try not to fall in love with it. Maintain flexibility, know your levels well, establish your parameters and be aware of the market’s positioning.