Summary: The US Dollar jumped against its rivals on company funding demand for the second day running despite steps by world central banks to ease market stress. Yesterday the US Federal Reserve announced the creation of several swap lines to provide US Dollar liquidity to 9 countries – Australia, New Zealand, Singapore, South Korea, Denmark, Norway, Sweden, Mexico and Brazil. The move was an effort to meet heavy demand for Greenbacks around the world as worries about the economic fallout from the coronavirus climbed. Despite the move, a favoured gauge of the Greenback’s value against a basket of six major currencies, the Dollar Index (USD/DXY) rose 1.59% to 102.75 (101.00), its highest since January 2017. The Euro, which takes 57.6% weight in the Dollar Index, plunged to its lowest in almost 2 years at 1.0655, (1.0895) before steadying to 1.0680 in late New York. Sterling’s fall was modest compared to moves in the other currencies, down 0.5% to 1.1540 (1.1585) after the Bank of England cut its Official Bank Rate to 0.1% from 0.25% in an emergency meeting. The BOE also announced an extension of QE worth GBP 200 billion. Prime Minister Boris Johnson moved to slow the spread of the virus following his soft approach in the previous week with the UK government’s announcement that it was preparing to put London in lockdown. The Australian Dollar, pummelled to a 2002 low at 0.5506 following the RBA’s emergency rate cut to 0.25% from 0.5%, rebounded in volatile trade to close at 0.5775, a modest loss of 0.4%. The price action reveals nervous sellers near the Battler’s low. USD/JPY soared to 110.80 from 105.10 on broad-based USD strength and a rebound in Oil prices and equities.

Brent Crude Oil prices recovered 13.5% to USD 28.25. Wall Street stocks rallied with the Dow climbing 0.5% t0 20,150 at the close. Stock futures though were pointing to a loss. US bond yields slipped. The key 10-year rate fell to 1.14% (1.19%). Other global bond yields were higher. Australia’s 10-year rate closed at 1.41% from 1.29%.

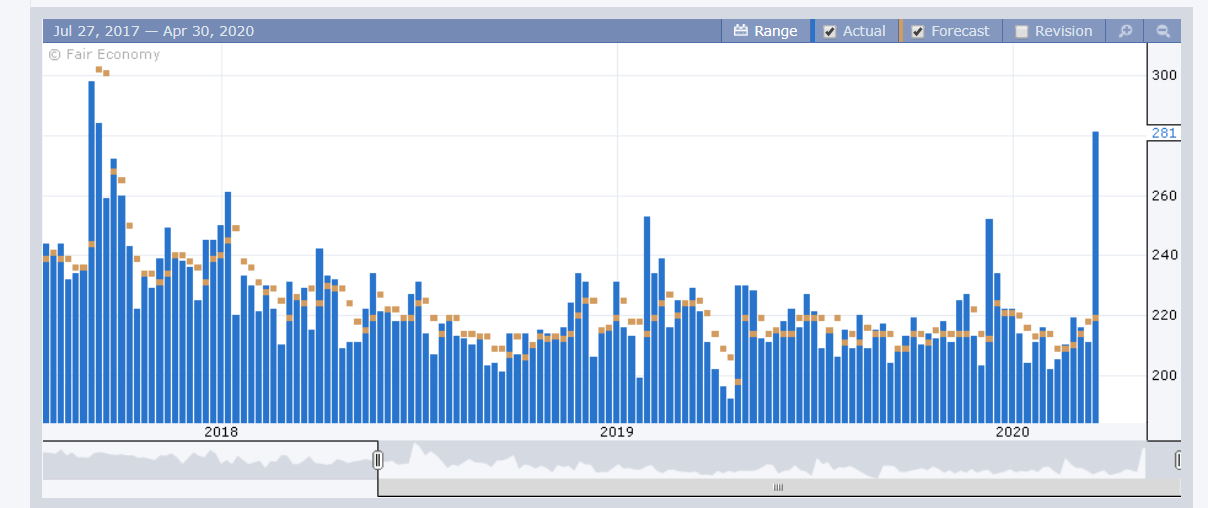

Australia’s economy created 26,700 jobs in February beating forecasts while the Jobless rate was also better, falling to 5.1% from 5.3%. The US Philadelphia Manufacturing Index slumped to -12.7, missing forecasts at +9.5 the weakest since September 2012. US New Weekly Unemployment Claims jumped to 281,000 from 211,000 and forecasts of 220,000. The New Jobless Claims hit a 2.1/2 year high, jumping by 70,000 which officials blamed on the coronavirus.

On the Lookout: The Dollar strengthened due to funding demand over worries on the impact of the coronavirus spread. The world’s central banks have taken steps to alleviate the market stress. The Fed announcement of the creation of swap lines to provide Dollar liquidity to 9 countries was an effort to meet heavy demand for Greenbacks. Despite the move, the Dollar Index jumped just over 3% in the past two days. Against the Australian Dollar and EM currencies the Dollar has risen more.

In 2009 the action by policy makers helped put a bottom on asset markets, US Dollar demand eased, and the Dollar dropped. Today the realisation is that fiscal and monetary policy cannot cure a pandemic. Markets may have to wait until the pandemic shows signs of fading.

US economic data released have pointed to a possible recession in the US. Markets have ignored this for now. At some stage, as Dollar funding demand eases, the currencies will stage a strong rally and the Greenback will find itself on the other end. Today economic data releases are few.

Trading Perspective: While the Dollar’s rally has continued unabated, its climb is starting to slow against the currencies that have been crushed by its up move. Liquidity has been thin which has led to choppy moves. Expect more of the same today.

While the Dollar remains bid, its rapid advance in less liquid and volatile conditions may see the world’s central banks moving in to “smooth” the climb.