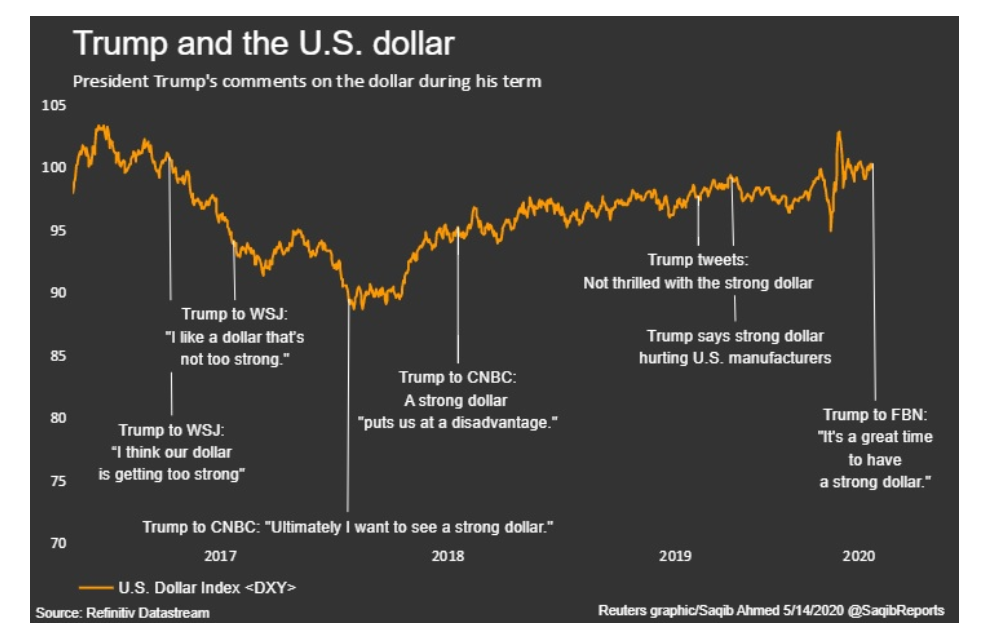

Summary: The Dollar Index (USD/DXY) a favoured gauge of the Greenback’s value against a basket of six foreign currencies ended little-changed at 100.283 (100.223) after an initial drop. The number of Americans filing for Unemployment Claims (week ended May 9) fell for the sixth straight week to 2.981 million from an upwardly revised 3.176 million (3.169 million). Jobless Claims were worse than median expectations of 2.5 million and remains painfully high. Markets ignored the number after President Trump did a 180 degree turn on his “weak” Dollar mantra, saying that “It’s a great time to have a strong Dollar. I kept it strong.” The Greenback kept most of its gains because of Jerome Powell’s perspective on negative interest rates, stating that they are not on the table, and questioning its effectiveness, and not on Trump’s remarks. The Euro slid to 1.07747 overnight and 2-week lows before rebounding to close at 1.0802 from 1.0818, down 0.16%. Sterling was flat, trading at 1.2230 in late New York from 1.2233 yesterday. The Australian Dollar slumped initially to 0.6403 after Australia’s Employment dropped to –594,300, worse than –575,000 expected, almost 40% of those full-time. Australia’s Jobless rate rose to 6.2% from 5.2% (March), beating forecasts of 8.3%. AUD/USD bounced back quickly to close higher at 0.6465 in New York (0.6455 yesterday). Best performing currency went to Canada’s Loonie as Brent Crude and WTI Oil prices soared. Against the Canadian Dollar, the Greenback fell 0.35% to 1.4038 (1.4107). USD/JPY bounced back from an overnight low at 106.774, to close at 107.27, a gain of 0.29%.

Wall Street stocks rebounded, finishing in the green on strong gains in the banking sector. The S&P500 rose 1.01% to 2,855 (2,825) while the DOW added 1.27% to 23,635 (23,305). Bond yields dipped. The US 10-year treasury rate was at 0.62% (0.65% yesterday). Germany’s 10-year Bund yield closed at -0.55% (-0.54%). Other global yields were unchanged or modestly lower.

Canada’s Manufacturing Sales in April fell to -9.2%, worse than forecasts at -4.4%. Germany’s Final CPI (April) was up 0.4% against expectations of 0.3%.

On the Lookout: Today sees a heavy calendar of economic data releases from various countries. The data releases today should set the tone for trade today in FX and risk assets.

New Zealand kicks off with its New Zealand Business NZ Manufacturing Index. Japanese PPI (April) follows. China’s trifecta of Industrial Production, Retail Sales and Fixed Asset Investment (12 pm Sydney time) are the highlight data in Asia. China also reports its Unemployment rate.

Euro area reports follow next with a deluge in data which starts with Germany’s Preliminary Q1 GDP and April PPI. France reports on its Final CPI (April). The Eurozone reports its Q1 Flash GDP, Trade Balance and Employment Change. Rounding up the day’s reports are US Core and Headline Retail Sales, Empire State Manufacturing Index, Capacity Utilisation, Industrial Production, Preliminary University of Michigan Consumer Sentiment Index and JOLTS Job Openings round up the day’s reports. Early Saturday morning, (6 am Sydney) US TICS Long-Term Purchases are released.

Trading Perspective: The Dollar managed to claw its way back after initially falling following the release of the high US Unemployment Claims report. Fed Chair Jerome Powell spoke out against the use of negative interest rates yesterday. In contrast, the RBNZ’s latest meeting saw the clear desire to go to negative rates. The Dollar Index remains poised above 100.00, however for a sustained move higher, we will need to see a breakdown in the Euro (virtually 60% of the USD/DXY weight).

Global businesses are getting back to work conscious of a second wave of Covid-19, hoping and preparing for the worst. Trade conflicts continue between China and the US, and China and Australia. Market sentiment keeps changing from risk-on to risk-off and back, depending on which time frame they are looking at.

As far as Trump’s latest remarks on the Dollar, traders said that his comments made in an interview with FOX news has no real impact on its direction. During his presidency, Trump has railed against the Dollar’s strength. Traders ignored his comments then, and the Dollar has risen almost 3% against a basket of rivals.