Summary: Markets cheered a stock market rally in China, shrugging-off the continuing rise of new coronavirus cases in the US and other hotspots around the world. Upbeat global Services data released on Thursday from China through to Europe and the U.S. lifted optimism, boosted risk and pounded the Dollar. Yesterday the US ISM Non-Manufacturing Index in June soared to a 57.1 reading, the highest since February. May Eurozone Retail Sales jumped 17.8%, bettering forecasts. Chinese stocks soared 5.71% yesterday after authorities encouraged people to buy equities to support the recovery from the Covid-19 crisis. The Euro outperformed, climbing above 1.13 for the first time in two weeks to an overnight high at 1.1345, finishing at 1.1310 (1.1250 yesterday), a gain of 0.65%. Europe’s ongoing signs of recovery from the coronavirus crisis remains ahead of that in Asia and the Americas. Sterling was up 0.25% to 1.2490 (1.2475) on the generally weaker Greenback. No progress has been reported on the later round of face-to-face talks between the EU and UK on Brexit. The Australian Dollar jumped to 0.69876 overnight and near one-month highs before easing to settle at 0.6975 (0.6945 yesterday). The RBA is widely expected to leave interest rates unchanged at the conclusion of its meeting today (2.30 pm Sydney). Aussie traders ignored the worsening Covid-19 conditions from the outbreak in Melbourne’s suburbs which saw New South Wales close its borders with Victoria for the first time in 100 years. The outlook on the economy from the RBA takes on added significance today. The Dollar dipped against the Japanese Yen at 107.37 (107.50). Against the Canadian Loonie, the Greenback slid to 1.3518 overnight and two-week lows, climbing in late NY to close at 1.3545 from 1.3560 yesterday. The Bank of Canada’s Business Outlook Survey Index slumped to -7 from -0.7. The business sentiment index was the lowest since 2009, which was ignored by FX. Wall Street stocks rallied on the risk-on sentiment. The DOW climbed 2.1% to 26,285 (25,755) while the S&P 500 added 1.75% to 3,178 from 3,128 yesterday. Global bond yields were static. The key US 10-year note yielded 0.68% from 0.67%.

Data released Friday saw Germany’s Factory Orders in June slump to 10.4%, missing forecasts at 15.1% while May’s data was revised downwards to -26.3% from -25.8%. The Eurozone Sentix Investor Confidence Index slid to -18.2 from forecasts at -10.8. UK Construction June PMI’s rose to 55.3 from 28.9 in May and beating forecasts at 46.0. Eurozone Retail Sales jumped to 17.8%, beating expectations at 15.0%. US ISM Non-Manufacturing PMI’s soared to 57.1 from 45.4 in May, bettering forecasts at 50.0.

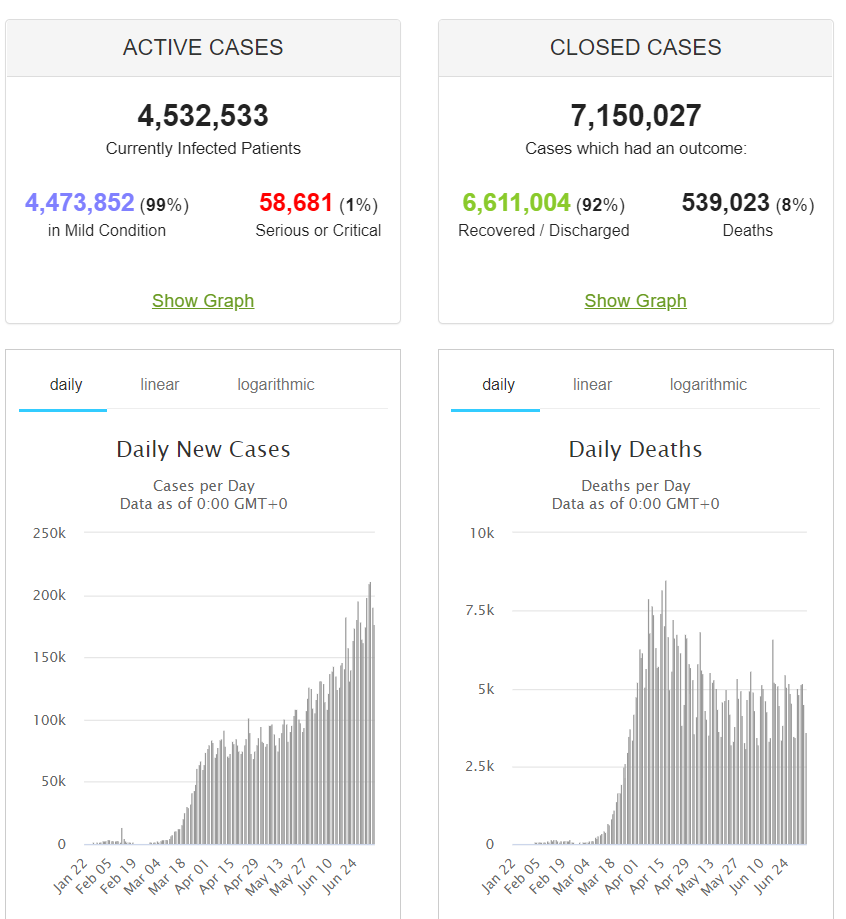

On the Lookout: Global markets continued to shrug-off current resurgence in Covid-19 infections. New coronavirus cases surged with the total cases in the US climbing above 3 million (3,022,625). The US is re-emerging as the global hotspot. While the death rate remains low in the US, almost 133,000 Americans have died due to the pandemic. How long can Wall Street and FX continue to defy this surge? The latest set of upbeat economic data were the result of the rebound in June due to the restricting of lockdowns. We have seen some countries push back and/or delay their recent reopening to businesses. Upcoming economic data released later this month will reflect those decisions. The RBA rate decision (cash rate 0.25%) and statement take the spotlight today (2.30 pm).

Data releases today kicked off earlier with New Zealand’s NZIER Business Confidence Index improving to -63 in May from the previous month’s -70.0. Australia’s June AIG Services Index dipped to 31.5 from 31.6. Both the Aussie and Kiwi hardly moved.

Japan follows next with its Average Cash Earnings and Household Spending reports. Japanese Leading Indicators follow. European data start with Germany’s Industrial Production (June), French Trade Balance, and Italian Retail Sales. The UK releases its Halifax House Price Index (June). Canada kicks off North American data with its IVEY PMI report. The US finishes the day’s reports with its JOLTS Job Openings.

Trading Perspective: While it is difficult to see this optimism continue with the rising numbers of coronavirus cases, not just in the US but in other troubled global hotspots (India, Brazil, Russia, Mexico, Pakistan etc), traders will continue to own risk (stocks) and punish the US Dollar. Some have correctly pointed out that the death-toll remains less than 5%, particularly in the U.S due to more testing. Much of the victims of the recent rise in cases are younger people, less likely to die.

This resurgence has yet to feed into the economy which will be seen in the data that lies ahead this month. Lastly, recent market positioning has pointed to a rise in net USD shorts, We examine the latest report later this week.