Summary: The Dollar fell against its rivals weighed by dismal US economic data while risk appetite steadied after a speech by President Trump on China saw no mention of new tariffs. The Euro led the FX rally against the Greenback, climbing to 1.1145 overnight and near late March highs before settling at 1.1107 (1.1070 Friday morning). The Euro extended its advance last week boosted by expectations that the ECB will expand its asset purchase program. Sterling rose to 1.2351 from 1.2315 on broad-based US Dollar weakness to finish its best week in May. The Australian Dollar pared its climb to 0.6665 (0.6635 Friday) after trading to a new marginal peak at 0.6683 in late New York. Yesterday, China’s NBS Manufacturing PMI slumped to 50.6 from 50.8, missing forecasts at 51.1. USD/JPY was the only FX pair to buck the trend with a modest gain of 0.10% to 107.80 (107.65). Japan’s Retail Sales and Preliminary Industrial Production were both worse than forecast. Against Canada’s Loonie, the US Dollar was little changed at 1.3765 (1.3770) after dropping to 1.3714, the lowest since March 12. The Greenback finished lower against the Offshore Chinese Yuan (USD/CNH) to 7.1320 (7.1700 Friday). Asian and Emerging Market currencies ended higher against the Greenback buoyed by month-end demand. Oil prices closed the month higher. Both Brent Crude and West Texas Intermediate (WTI) were 4.39% up. US stocks settled. The DOW was up 0.02% to 25,518 (25,515) while the S&P 500 climbed 0.5% to 3,058 (3,045).

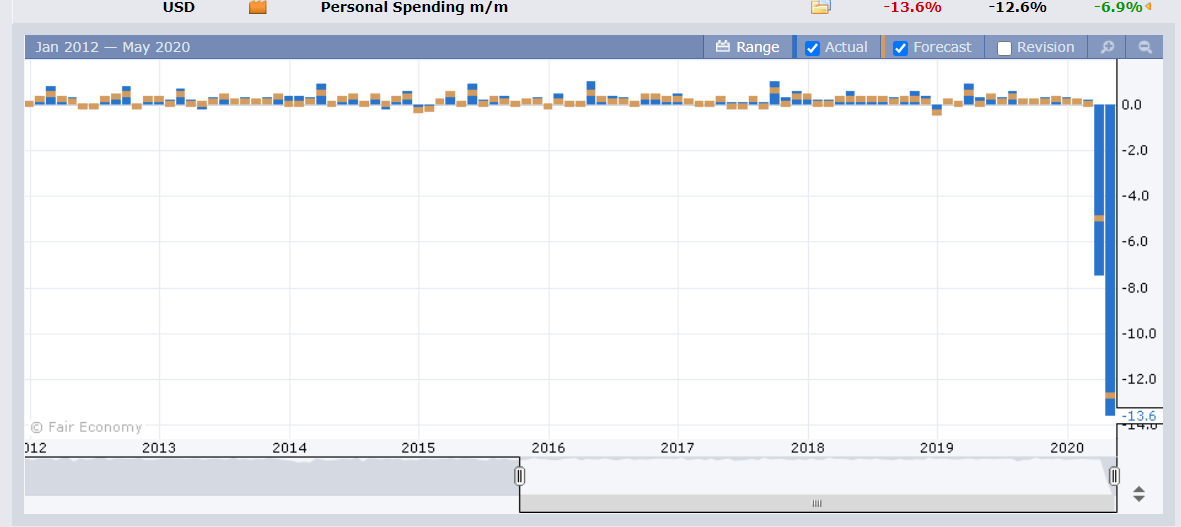

Data released Friday saw Japan’s Unemployment Rate improve climb to 2.6% from 2.5% but beat forecasts at 2.7%. Japanese Preliminary Industrial Production fell to -9.1%, worse than the -5.5% expectations. Retail Sales slumped to -13.7% from -4.7%, underwhelming forecasts at -11.2%. French Consumer Spending slumped to -20.2%, missing median expectations at -14.5%. German Import Prices fell to -1.8%, against forecasts of -1.5%. Canada’s GDP in May fell to -7.2%, bettering forecasts of -9.0%. US Core PCE Prices dropped to -0.4% missing forecasts at -0.3%. US Personal Spending slipped to -13.6% from -7.5%, missing forecasts at -12.6%. Chicago PMI dropped to 32.3 from 35.4, missing expectations at 40.1. The US Trade Deficit climbed to -USD 69.7 billion from – USD 64.2 billion.

On the Lookout: The week ahead into a new month sees a busy data calendar which kicks off today and culminates on Friday with the US Payrolls report. Today sees global factory activity data releases. While risk appetite steadied on the weekend, the South China Morning Post stated in a report that US-China tensions were “set to worsen” as moderates lose out to hardliners with the latter stressing the “combat spirit.”

Over the weekend, protests in the US became increasingly violent and troops had to be deployed in many American cities to assist local Police.

Today kicks off with Australia’s AIG and Commonwealth Bank Manufacturing PMI’s followed by Japan’s Jibun Bank Manufacturing PMI. China’s Caixin Manufacturing PMI report (May) round up Asia’s data releases. Europe sees Spanish, French, Italian, German and Eurozone Manufacturing PMI’s released. The UK reports on its Manufacturing PMI. Finally, the US releases its Final Manufacturing PMI and ISM Manufacturing PMI followed by US May Construction Spending.

Trading Perspective: The Dollar retreated against all its rivals bar the Yen after the release of dismal US data. Risk assets have gained as investors remain convinced that central banks will continue to provide liquidity which has resulted in a lower Greenback. The Euro has led the charge because FX is convinced that the ECB will expand its asset purchase program regardless of questions from the German Constitutional Court. On Friday, the Euro peaked at 1.1145 before slipping to finish at 1.1108, its highest close since March 30. The week ahead sees global factory and services activity (today and tomorrow), the ECB rate policy meeting and announcement (Thursday) and US Payrolls (Friday). The RBA has its rate policy meeting and statement tomorrow.

US-Chinese tensions look likely to rise this week from the latest developments. Risk will turn fragile, which should be Dollar supportive. We look at the various currencies.