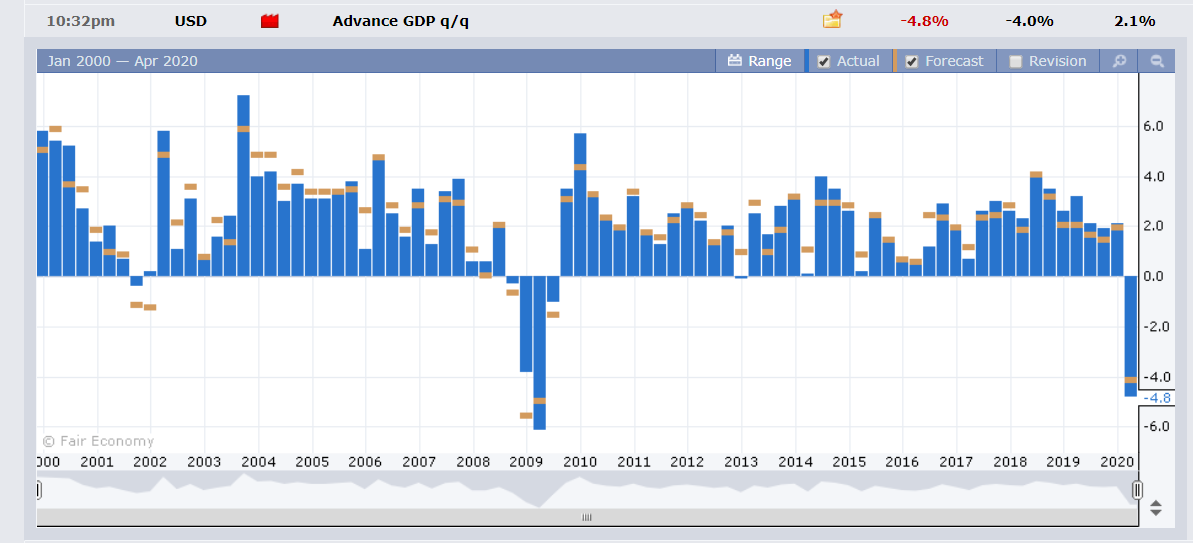

Summary: It was one of those days filled with events and data releases that did not disappoint. US Q1 2020 GDP fell by 4.8%, worse than median forecasts of a 4% contraction, and following a 2.1% expansion rate in Q4 2019. It was the steepest decline in over a decade. The Dollar’s reaction was limited, easing against its major rivals, falling most against Commodity and Emerging Market currencies. The Federal Reserve left interest rates unchanged which was widely expected. Fed Chair Jerome Powell reiterated that the US central bank will remain vigilant and do what it takes to shore up the economy which has been battered by business closures due to the coronavirus outbreak. Equities soared as pharmaceutical company Gilead reported that its antiviral drug Remdesivir, helped improve symptoms in Covid-19 patients who had taken the drug earlier. Risk sentiment improved which also weighed on the Greenback. The Euro was up 0.33% to 1.0880 in late New York (1.0823) ahead of today’s Eurozone GDP report and the ECB’s policy rate meeting and press conference. Sterling rose against the broadly based weaker US Dollar to 1.2470 from 1.2425. Commodity currencies soared with the Australian Dollar extending its gains a further 0.82% to 0.6555 (0.6495). A rebound in West Texas Intermediate Crude oil prices by 25.5% (USD 15.29) saw the USD/CAD pair tumble to 1.3885 from 1.3992. The US Dollar eased marginally by 0.12% against the Japanese Yen to 106.62 (106.86). Emerging Market currencies rose the most against the US Dollar. The South African Rand jumped 2.45%, USD/ZAR ended at 18.1130 from 18.6530. The Dollar finished 1.04% against the Indian Rupee to 75.27 (76.10).

Better earnings and the Gilead report saw Wall Street stocks surge. The DOW was 2.7% higher at 24,745 (24,145) in late New York while the S&P 500 soared 3.3% to 2,960 (2,870). Global bond yields were little changed. The key US 10-year bond rate was last trading at 0.63% from 0.61% yesterday.

Other data released yesterday saw Australia’s Q1 Trimmed Mean CPI at 0.5% against forecasts of 0.3%. US Pending Home Sales dropped to -20.8 worse than forecasts at -13.3%.

On the Lookout: The Dollar’s reaction to last night’s events and data releases was not huge. However, the worse than expected contraction in the US GDP for the January-to-March period lessens the chance of a V-shaped recovery. This will keep a lid on the Greenback for now. The spotlight now falls on the rest of the world, beginning with the Eurozone’s Q1 GDP and the ECB meeting outcome and press conference that follows. Today’s data deluge will be closely monitored. The main event is the ECB meeting and announcement. The ECB is expected to leave interest rates unchanged but expect President Christine Lagarde to keep a dovish stance.

Japan kicks off a busy Asian reporting day with its Preliminary Industrial Production, Retail Sales data. Later in the day, Japanese Consumer Confidence and Housing Starts follow. China releases its April Manufacturing and Non-manufacturing PMI reports for April, with both forecasting improvements from the previous month. New Zealand sees its ANZ Business Confidence Index. Australian Private Sector Credit and Quarterly Import prices follow. Europe kicks off with French, Spanish and Eurozone Flash Q1 GDP, German Unemployment Change, Italian Preliminary CPI. Swiss Retail Sales follow next. The Eurozone GDP is forecast to contract -3.7% from +0.1% the previous quarter. Canada’s monthly GDP follows. Finally, the US reports its Weekly Unemployment Claims, Personal Spending, Core PCE Price Index, Personal Income and Chicago PMI.

Trading Perspective: We may well be approaching the time where while the US data is bad, the rest of the world may be worse. We start off with Europe and the release of the Eurozone’s Q1 GDP. Europe went into lockdown ahead of the United States, in mid-February. Any number larger than the expected contraction of -3.7%, say around -4% or greater will see the Euro plunge. Which will lift the US Dollar against its other major peers. The Aussie and Kiwi outperformed and will continue to do so in the current environment. However China’s data today could put the breaks on any further gains.