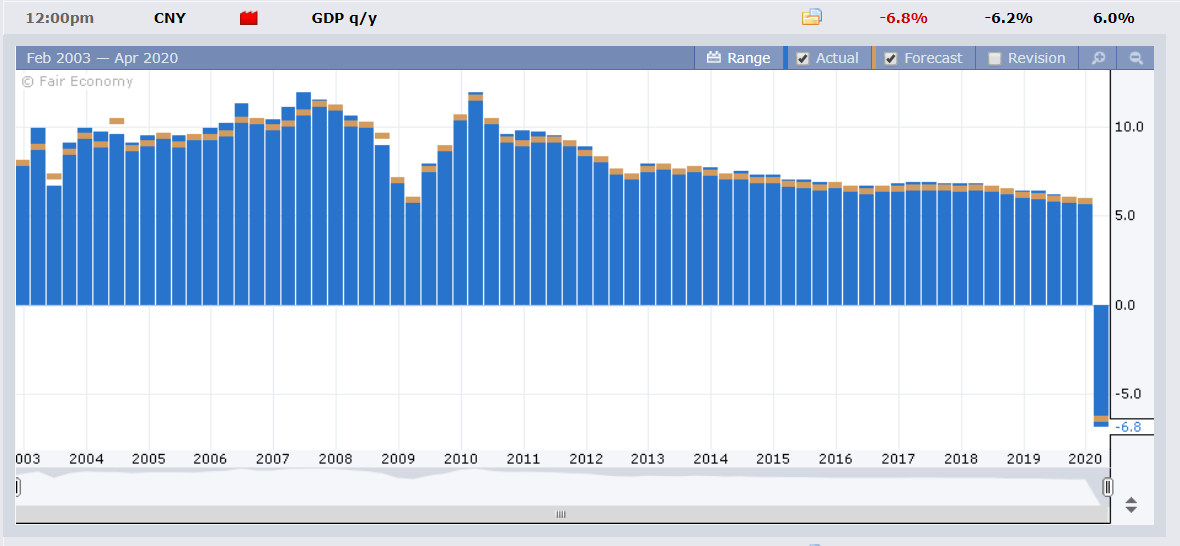

Summary: The Dollar eased against its rivals following two days of safe haven-based gains as the US made plans to reopen the economy, with others due to follow. Markets ignored more dismal economic reports after Thursday’s horrid US Jobless Claims that hit 22 million in a month. Data released on Friday from China saw its economy contract in Q1 2020, the first contraction since the country began publishing the report in 1992. The coronavirus pandemic showed signs of easing in some of the world’s hotspots while the US led other countries with plans to reopen their economies and relax lockdowns. Risk sentiment was stronger, equities rallied, and the US Dollar eased. FX volatility was muted which resulted in relatively narrow trading ranges. The Euro reversed its fall, advancing 0.41% against the US Dollar to 1.0875 from 1.0838 Friday. Sterling rebounded to 1.2506 (1.2450) despite a Times report that saw UK PM Boris Johnson tell colleagues that he is very cautious about easing lock-down restrictions. The Australian Dollar led commodity currencies higher, rallying to 0.6363 (0.6322) in late New York. Against the Canadian Loonie, the US Dollar eased to 1.4008 from 1.4108. The Dollar eased against the Japanese Yen to 107.55 (107.92). US Stocks gained for the 2nd day running, the DOW climbed 1.64% to 24,627 (23,817). The S&P 500 closed at 2,879, up 1.4% from Friday’s 2,830 for a gain of 1.38%. Bond yields were mostly higher.

The benchmark US ten-year treasury yielded 0.64% (0.62% Friday). Germany’s 10-year Bund yield was unchanged at 0.30%. Japan’s 10-year JGB rate was up one basis point to 0.01%.

Data released Friday saw China’s Q1 GDP contract to -6.8% from the previous quarter’s +6.0% expansion, missing expectation at -6.5%. Fixed Asset Investment underwhelmed, falling to -16.1% against forecasts of -15.1%, but better than the previous month’s -24.5%. Industrial Production bettered forecasts, falling -1.1% against -7.3%. China’s March Retail Sales dipped to -15.8% from the previous -20.5%, missing expectations of -10.0%. The US Conference Board’s Leading Index bettered forecasts at -6.7% against -7.1%.

On the Lookout: As cases and fatalities from Covid-19 slow, and countries look to relax lockdowns, the spotlight moves to the economic reports in the week ahead. Today kicks off with New Zealand’s Q1 CPI report. The UK reports on its Rightmove House Price Index. Japan’s Trade Balance follows. Euro area reports start off with Germany’s Producer Price Index followed by the Eurozone’s Current Account and Trade Balance. Finally, Canada releases its Wholesale Sales (March) data.

Tomorrow sees the release of the RBA’s latest monetary policy meeting minutes followed by a speech from Governor Philip Lowe. UK Employment and German ZEW Economic Sentiment Index are also scheduled for release. This week’s highlights are on Thursday where Australia, Japan, France, Germany, the Eurozone, UK, and US report their Manufacturing and non-manufacturing PMI’s.

Trading Perspective: Expect more consolidation ahead in Asia this morning as markets continue to monitor various countries responses to the coronavirus pandemic slowdown. More stimulus efforts to aid economies are in the pipeline. Talks in the US between the US House Speaker Nancy Pelosi and Treasury Secretary Mnuchin were optimistic about reaching a deal to top up funds aimed at assisting small businesses stay afloat. Germany prepares for a limited reopening today.

Further stabilisation is good for equities and negative for the Dollar. Risk-on takes away the safe-haven support for the Greenback. The spotlight falls in the upcoming economic data.