Summary: US markets finished another choppy session after chances for a planned Senate vote to approve a USD 2 trillion relief package faded as markets closed on Wednesday. US stocks pared gains with the Dow slipping from 21,240 to 21,127 in late New York. Covid-19 continued to expand with the biggest increases taking place in the U.S. and Europe. FX traders sold the Greenback for the 2nd day running with eyes on tonight’s US Unemployment Claims, expected to blow-out to between 1-4 million from 281,000 last week. The Dollar Index (USD/DXY) fell 1.05% to 100.961 from 101.90 yesterday. Sterling jumped to 1.1973 overnight and 1-week highs before closing to settle at 1.1887, up 0.64%. The Australian Dollar jumped to 0.60734 overnight, a 15 day high before easing to 0.5958. Against the Canadian Loonie, the US Dollar slumped 1.63% to 1.4205 from 1.4490 yesterday. Canada’s government approved a stimulus package of CAD 27 billion to ease the economic impact of the coronavirus outbreak. Brent Crude Oil prices steadied to USD 29.90 (USD 29.00). The Euro advanced to 1.0877 from 1.0760 on the broad-based US Dollar weakness. The Dollar dipped against the Japanese Yen to 111.20 (111.60).

Global bond yields steadied. The benchmark US 10-year rate was 2 basis points higher to 0.86%. Germany’s 10-year Bund yield closed at -0.27% from -0.33%. Japan’s 10-year JGB yield was at 0.03% from 0.02% yesterday.

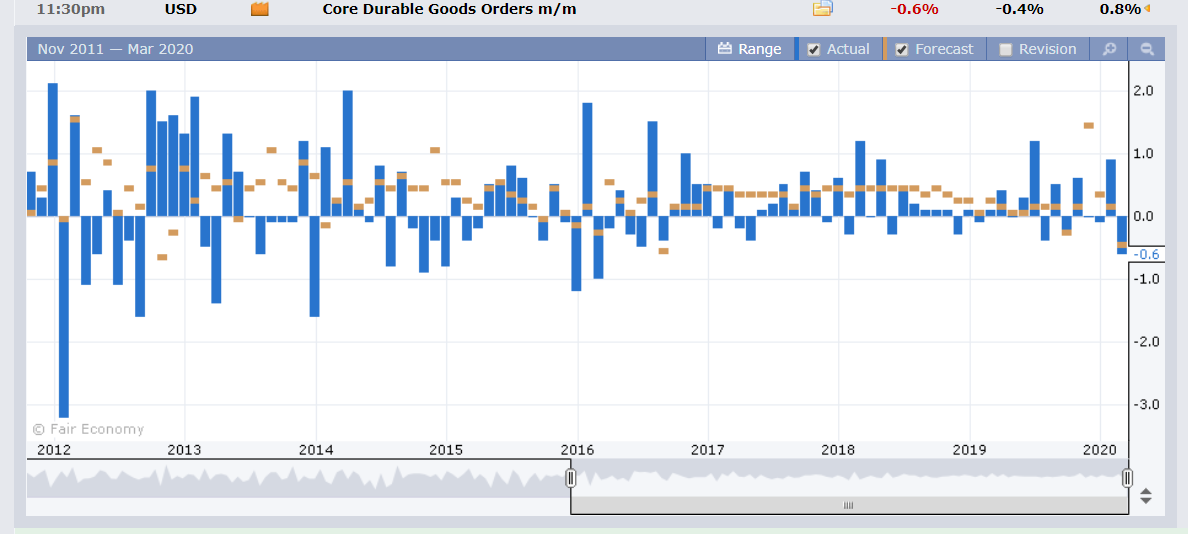

UK Core CPI rose to 1.7% on an annual basis, higher than forecasts of 1.5%. US March Core Durable Goods Orders (excluding transportation items) underwhelmed at -0.6% against expectations of -0.4% and February’s 0.8%.

On the Lookout: Markets will turn their focus today on the US Unemployment Claims which is expected to see an unprecedented number, many from the hospitality sector, due to the shutdown of the economy. Economists forecast a range of between 1 million to 4 million claims filed, the largest layoff of American workers over a short period of time. The previous week saw unemployment claims rise to 281,000 from 211,000. Tonight also sees US Final GDP (Q4 2019) and US Goods Trade Balance,

Today’s other event is the Bank of England monetary policy meeting and statement. The BOE is not expected to change its Official Bank rate currently at 0.1%.

Caution persists in asset markets as the US Senate agreed to vote on the US 2 trillion package on Friday.

Trading Perspective: The Dollar dropped for the second day running on expectations of a large rise in US Jobless Claims which are released tonight. Forecasts range from 1 million to 4 million workers claiming for Unemployment benefits. It could be a case of sell the rumour, buy the fact first up for the Greenback should the number be closer to the 1 million mark. A number of 3-4 million will see US Dollar selling accelerate. The Dollar Index (USD/DXY) would break below 100, and the Euro above 1.0900. In the meantime, expect consolidation within recent ranges which have been wide.