Summary: A warning by Dr. Anthony Fauci, director of the US National Institute of Allergy and Infectious Diseases that a premature opening of the economy could lead to Covid-19 outbreaks saw Wall Street stocks slump while the Dollar was mostly lower. The CBOE Volatility Index (VIX), also known as the fear index or gauge, jumped 19.8% to 33.04, its largest one-day rise in over three weeks. Reports of new coronavirus clusters in China, South Korea, and Germany where lockdowns have been lifted added to investor’s anxiety. In FX, the Dollar was mostly lower after US treasuries rose and bond yields eased. The Euro rebounded to 1.0848 after hitting an overnight low of 1.07843, up 0.34% against the Dollar. Sterling though, came under selling pressure, falling to 1.2260 (1.2335) as UK Prime Minister Boris Johnson and his government try to bring Britain out of their lockdown. The US Dollar fell back against the Yen to 107.15 from 107.65 as the key US 10-year bond yield dropped to 0.67% from 0.71%. Risk currencies retreated. The Australian Dollar lost 0.26% to 0.6470 (0.6490) while the Kiwi (New Zealand Dollar) dipped 0.2% to 0.6075 (0.6088) ahead of today’s RBNZ policy meeting and rate announcement. Against the Canadian Loonie, the Dollar rose 0.4% to 1.4075 (1.4015). The Dollar Index (USD/DXY), a favoured gauge of the Greenback’s value against a basket of major currencies, slipped 0.23% to 100.04 (100.19). Fedspeak saw a dire outlook from several regional heads. Bloomberg reported that Governor and FOMC member Randal Quarles warned that “the Fed could curtail Wall Street banks’ ability to pay dividends by cranking up the amount of capital needed to maintain due to the coronavirus crisis.” Dallas Fed President Robert Kaplan said the economy will need more fiscal stimulus if the unemployment rate continues to rise.

The DOW was 2.58% lower to 23,594 (24,215) while the S&P 500 fell 2.77% to 2,847 (2,927).

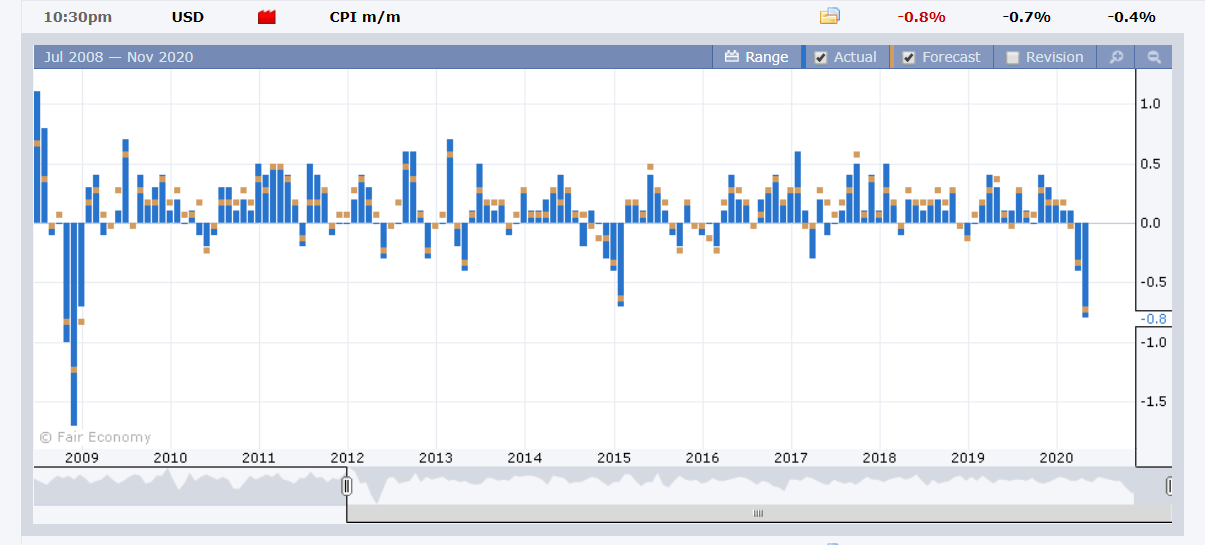

Data released yesterday saw US Headline CPI in April drop to -0.8% from March’s -0.4%, lower than median forecasts at -0.7%. It was the biggest decline since 2008. Core CPI slumped to -0.4% from -0.1%, under most forecasts at -0.2%. China’s Annual CPI in April fell to 3.3% from 4.3%, underwhelming forecasts at 3.7%. Chinese PPI (annual) fell to -3.1% from -1.5%, missing forecasts at -2.6%.

On the Lookout: Events and data releases pick up today beginning with the RBNZ’s Official Cash Rate decision and Statement (12 noon, Sydney time). Which puts the spotlight on the Kiwi (NZD/USD). New Zealand’s Official Cash Rate currently stands at 0.25%, just above zero which would make a cut unlikely. If Governor Graeme Orr and his colleagues do ease, it would most likely come via additional QE. New Zealand has begun to reopen businesses and schools and it may not be necessary for the RBNZ to ease. Instead they may opt to leave the door open to additional easing. Which should steady the Bird (NZD/USD).

The other big event is Fed Chair Jerome Powell’s update on the economy at a webinar (11 pm Sydney time). While markets expect the Fed to provide additional stimulus, the big question is whether they will go to negative rates. US yields have bounced back after Friday’s Payrolls report.

UK Q1 GDP heads today’s data releases. Prior to that, Asia sees Japanese Bank Lending, Current Account and Economic Watchers Sentiment Index; Australia’s Westpac Consumer Sentiment and Q1 Wage Price Index. The UK also releases its monthly Manufacturing Production, April GDP, Construction Output, Industrial Production and Goods Trade Balance. US reports round up the day with Headline and Core PPI.

Trading Perspective: Risk appetite will continue to dominate FX. Current fears of another wave of Covid-19 breakout amidst attempts to reopen economies, China-US/Coalition trade war and dire economic data releases will continue to weigh on sentiment. While the Dollar Index (USD/DXY) was lower, the Greenback put in a mixed performance against its rivals, rising against risk currencies (AUD,NZD,CAD) while lower against the traditional havens (JPY, CHF), including the Euro. Sterling fell ahead of key UK Q1 GDP today. Expect this theme to continue in Asia. Best way to trade these markets is defensive, keeping in mind levels from trading ranges, market positioning and staying flexible. We look at the individual currencies.