Summary: The US Dollar edged lower against most of its rivals while stocks were mixed as Q3 kicked off. Upbeat manufacturing PMI’s recorded in China, Germany and the United States and positive test results for a coronavirus vaccine boosted risk appetite. However, the rise of Covid-19 infections in several US states continued at an alarming rate. California, which saw over 9,700 new coronavirus cases, saw its Governor order a partial shutdown. Wall Street stocks finished mixed.

The Euro edged modestly higher against the Greenback to 1.1255 (1.1235) while the British Pound was at 1.2478, up 0.69% from yesterday’s 1.2395. The Australian Dollar advanced to 0.6916 from 0.6906 while the Kiwi (New Zealand Dollar) rose to 0.6480 from 0.6460. Against the Japanese Yen the US Dollar eased to 107.45 from 107.95. The Greenback finished mixed against Asian and EM currencies. USD/THB (US Dollar-Thai Baht) climbed to 31.05 from 30.90 while USD/ZAR (US Dollar-South African Rand) was lower to 17.050 from 17.350. The DOW closed 0.35% lower to 25,697 from 25,807 yesterday. The S&P 500 gained 0.54% to 3,114 (3,098). Treasury yields were mostly higher. The benchmark US 10-Year Treasury yield was up 2 basis points to 0.68%. Germany’s 10-year Bund yielded -0.40% from -0.46% yesterday. Japanese 10-year JGB yield rose 2 basis points to 0.03%.

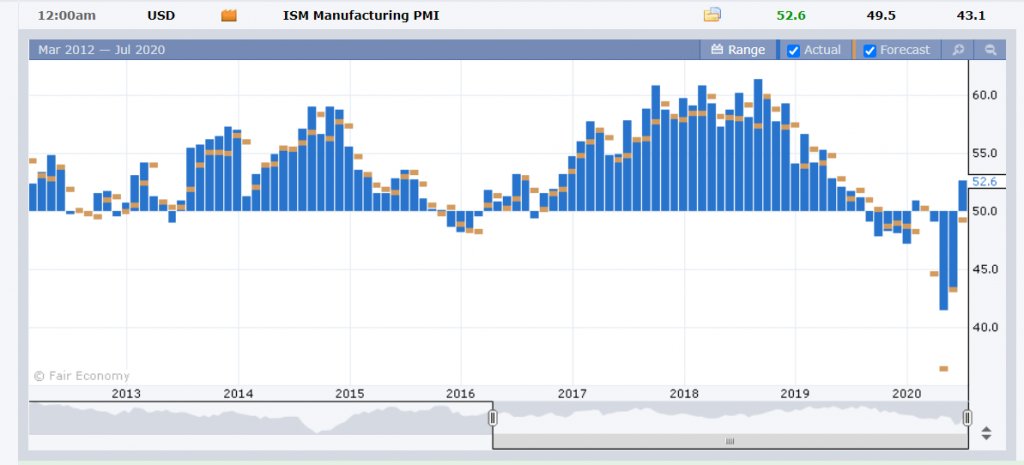

Data released yesterday saw Australia’s CBA Manufacturing PMI in June rise to 51.2 from 49.8 in May. China’s Caixin Manufacturing PMI rose to 51.2, bettering forecasts at 50.7. Japan’s Tankan Manufacturing Index dropped to -34, missing expectations at -31.0. Australian Building Approvals in June slumped -16.4%, missing forecasts at -7.0%. Germany’s Manufacturing PMI rose to 45.2 from 44.6, beating median expectations at 44.6. The Eurozone Final Manufacturing PMI climbed to 47.4, beating expectations at 46.9. UK Manufacturing PMI was at 50.1 against forecasts of 50.2. US ISM PMI climbed to 51.3 from 43.1, beating forecasts at 49.5. US ADP Private Non-Farms Employment Change dipped to 2.369 million from 3.065 million, missing forecasts at 2.85 million.

On the Lookout: Its all about the US Payrolls number which is released Thursday (tonight) instead of Friday (tomorrow) due to the Independence holiday. The focus shifts back to the US economy with the backdrop of rising new coronavirus cases and a pause in reopening from some major states.

Other data scheduled for release today kick off with Australia’s Trade Balance. European reports follow with Swiss CPI, Spanish Unemployment Change, Italian Unemployment Rate, Eurozone PPI and Unemployment Rate. Canada releases its Trade Balance and Markit Manufacturing PMI. US Non-Farms Payrolls, Unemployment Rate, Average Hourly Earnings (Wages), Trade Balance, Weekly Unemployment Claims and Factory Orders round up the day’s data.

Trading Perspective: Forecasts in US Payrolls are for a rise of over 3 million jobs created last month from 2.509 million previously. The Unemployment rate is expected to drop to 12.4% from 13.3%. Wages are expected to drop -0.8% from -1.0%. Watch for revisions to last month’s report. If the Payrolls and Unemployment rate come out worse than expected, it would be bad for equities and thus supportive of the Dollar. A good Payrolls report of say 3.5 million Jobs created could see an initial fall in the Greenback before a rebound. Keep the recent ranges in mind and trade accordingly. We take a look at some of the currencies.