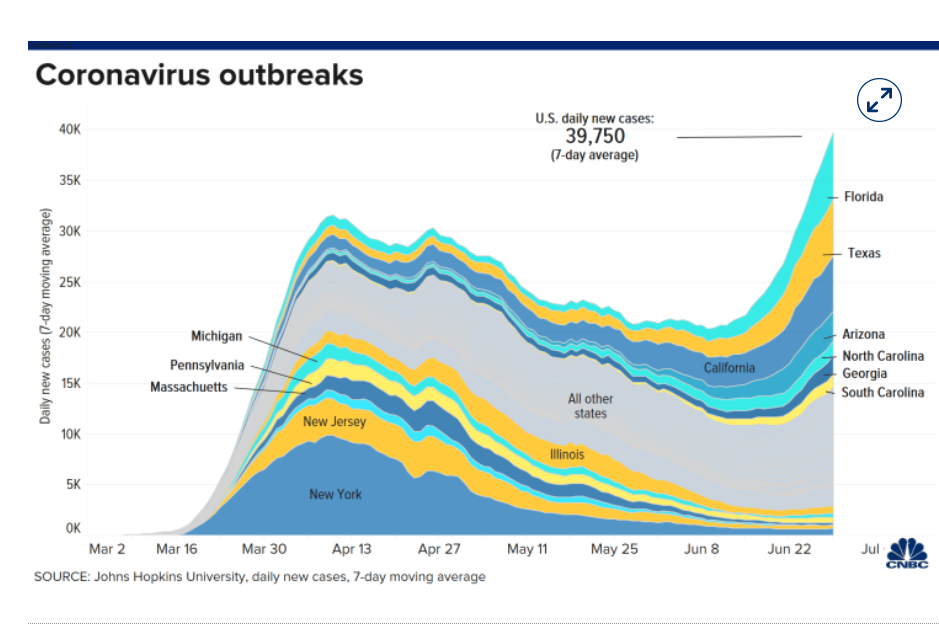

Summary: FX finished Q2 2020 with a whimper more than a bang as uncertainty loomed heading into Q3. Global economic data released yesterday was mixed, markets choosing to celebrate a perky US Consumer Confidence report which saw a sharp rebound in June. Rising Covid-19 infections continued to cast a shadow over a recovering economy. Top US epidemiologist Doctor Anthony Fauci told a Senate committee that daily new covid cases in the US could surpass 100,000 if the outbreak continues on its current trend. Fed Chair Jerome Powell said that “the path of the economy is highly uncertain,” in his testimony before the House Financial Services Committee. The Euro ended little changed at 1.1235 from 1.1240 yesterday. Sterling climbed 0.72% to 1.2395 in late New York (1.2295 yesterday). Flows from end-of-month adjustments saw a downward correction in the EUR/GBP cross from 0.9142 to 0.9062, resulting in the moves of the two currencies. The Australian and New Zealand Dollars outperformed, both currencies hitting near 2-week highs. Equities and risk assets rallied as the 2nd quarter ended. AUD/USD closed 0.45% higher at 0.6905 (0.6868). The Aussie Battler shrugged aside overnight reports that Victoria, the country’s second most populous state shut down 10 areas outside Melbourne. The Kiwi finished at 0.6458 (0.6418), up 0.37%. Against the safe-haven Yen, the Greenback rallied to 108.00 from 107.60. The US Dollar finished mixed against the Emerging Market currencies. The USD/ZAR (Dollar-South African Rand) pair rose 0.4% to 17.3660 (17.2520). Against the Thai Baht, the Dollar was marginally higher to 30.90 from 30.83 yesterday. Wall Street stocks advanced. The DOW finished up 0.66% to 25,805 (25,635) while the S&P 500 rallied 1.29% to 3,098 (3,060). The benchmark US 10-year Treasury yield climbed 4 basis points to 0.66%. Germany’s 10-year Bund yielded -0.46% from -0.47% yesterday. Japan’s 10-Year JGB rose one basis point to 0.01%.

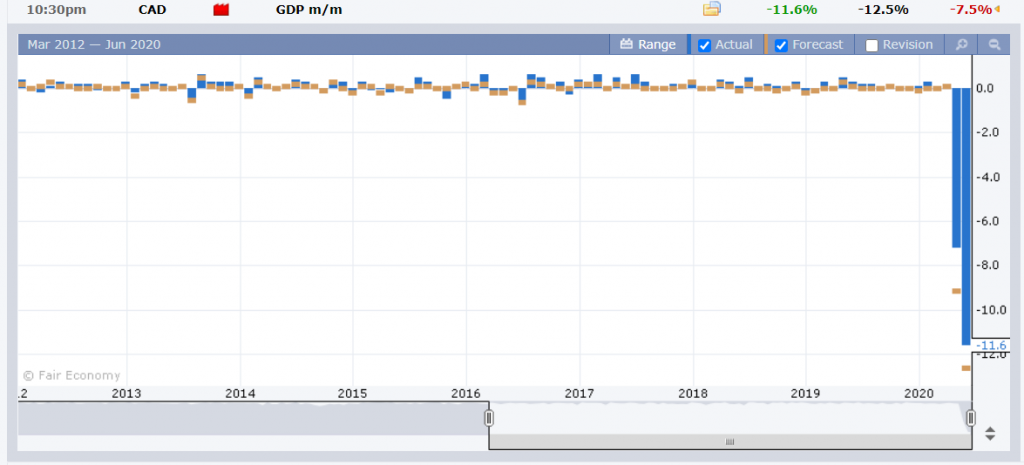

China’s Manufacturing PMI rose to 50.9 in June, beating forecasts at 50.4, while Non-Manufacturing PMI was up at 54.4, bettering expectations at 53.3. The UK’s Final Q2 GDP fell to -2.2%, missing forecasts at -2.0%. The Eurozone’s Flash Headline CPI rose to 0.3% from the previous month’s 0.1%, beating forecasts at -0.1%. EZ Core CPI matched expectations at 0.8%. Canada’s April GDP slumped to -11.6% bettering expectations of -12.5% but worse than March’s downward revised -7.5%. US Chicago PMI dropped to 36.6, missing forecasts at 42.0 while Consumer Spending in June rose to 98.1, beating expectations of 90.1 and a downward revised 85.9 for May.

On the Lookout: Uncertainty prevails as markets enter the 3rd quarter with the Covid-19 resurgence casting a shadow over recent gains in economic performances. Investors shrugged off warnings from the World Health Organisation and leading US top infectious disease specialist Dr Anthony Fauci on the rising number of new covid infections.

Today’s economic calendar sees another data dump ahead of tomorrow’s early release of the US Payrolls number ahead of the 4th of July long weekend. Australia kicks off with its AIG Manufacturing Index (June) and Building Approvals. New Zealand reports on its Building Consents. Japan follows next with its Tankan Manufacturing and Non-Manufacturing PMI’s, Final Manufacturing PMI Index, and Consumer Confidence. China releases its Caixin Manufacturing PMI. European reports start off with Germany’s Retail Sales, Spanish, Italian, German and Eurozone Final Manufacturing PMI’s. Switzerland and the UK report their Final Manufacturing PMI’s. The US rounds up today’s data releases with its Challenger Job Cuts, ADP Private Non-Farms Employment Change and Construction Spending.

Trading Perspective: The US Dollar saw its safe haven flow support wane as the second quarter ended, with modest losses against most of its Rivals. The rally in equities supported the risk currencies Aussie, Kiwi and Canadian Loonie. The Euro was virtually flat while Sterling saw a good bounce from its recent sell-off. The USD/JPY pair climbed in the mostly risk-on environment. With the resurgence in global Covid-19 infections growing even faster in some parts of the world than it did in April/May, the threat of a derail in the budding recovery is real against covid 19. This would see flows back into the safe haven US Dollar.