Summary: The Dollar Index (USD/DXY), a useful gauge of the Greenback’s value against a basket of foreign currencies bounced off two-year lows to 93.762 (93.654 yesterday) after falling to 93.493. The Euro, which takes roughly 60% of the Dollar Index’s weight retreated 0.45% to close at 1.1718 after trading to 1.1781 on Monday, the highest since September 2018. Against the Japanese Yen, the Dollar dipped further to 105.10 (105.35 yesterday) after trading to an overnight and early March low at 104.96. Sterling outperformed, climbing 0.30% to finish at 1.2933 from 1.2880 yesterday and a March 11 high at 1.2952. The UK Confederation of British Industry’s Realised Sales Index, a diffusion index based on surveyed retailers and wholesalers in July climbed to +4 beating expectations of -27 and a previous -37. The Australian Dollar was little changed at 0.7158 (0.7150) ahead of today’s release of Australia’s Q2 CPI report. Emerging Market currencies fell back against the Dollar. The USD/CNH (Offshore US Dollar-Chinese Yuan) rose to 7.0100 from 6.9990 yesterday.

Wall Street stocks dipped after US House Speaker Nancy Pelosi said that the ruling Republicans and the opposition Democrats were still far from reaching any deal on an aid package. The DOW finished 0.86% lower to 26,395 (26,625) while the S&P 500 was 0.66% lower to 3,222 (3,242). The yield on the benchmark US 10-year treasury slipped 4 basis points to 0.58%.

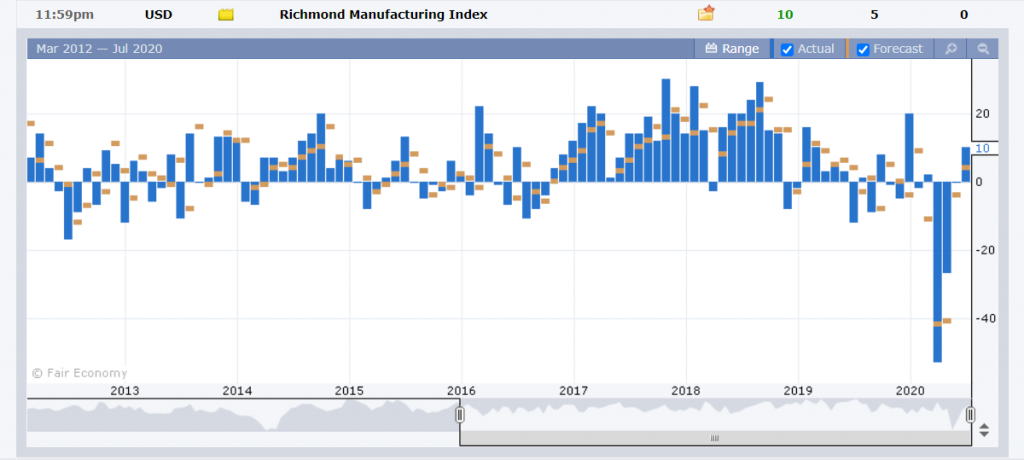

Other data released saw Spain’s Unemployment rate climb to 15.3% in July from June’s 14.4%, but bettering forecasts at 16.6%. US Richmond Manufacturing Index rose to 10 from the previous 0, beating expectations of 5. US Conference Board Consumer Confidence Index slipped in July to 92.6 from 98.3 and forecasts at 94.0.

The Federal Reserve extended their USD 2 trillion plus lending program to December from its initial expiry date in September.

On the Lookout: Today’s economic reports kick off with Australia’s Q2 Headline and Trimmed Mean CPI data. Headline CPI is expected to slump to -2.0% from Q1’s 0.3% while the Trimmed Mean inflation (which is what the RBA monitors) is forecast to dip to 0.1% from 0.5%. Switzerland releases its Credit Suisse Economic Expectations. The UK follows next with Mortgage Approvals and Net Lending to Individuals (July). The US rounds up the day’s data releases with its Goods Trade Balance, Preliminary Wholesale Inventories, and Pending Home Sales. The FOMC announcement, rate decision and Press Conference (4 am Thursday, Sydney) round up the day’s reports and events.

Fed Chair Jerome Powell is widely expected to keep monetary policy accommodative for the foreseeable future. With the coronavirus cases still rising, the US central bank will maintain that rates will stay near zero through to 2022.

Trading Perspective: While the Dollar Index managed to bounce off two-year lows, market sentiment remains decidedly bearish. The Greenback has dropped extensively in the lead-up to the Fed decision. And with traders widely anticipating a dovish FOMC, there could be little net movement. Given the extremely short US Dollar market positioning, any disappointments are likely to lead to a stronger Greenback rebound. We look at a few currencies below.

The coronavirus spread continues to hamper the US economic recovery. While Europe and other parts of the world are looking more encouraging on this front, total global Covid-19 infections are back up again. The total global coronavirus cases count is approaching the 17 million mark (16.871 million).