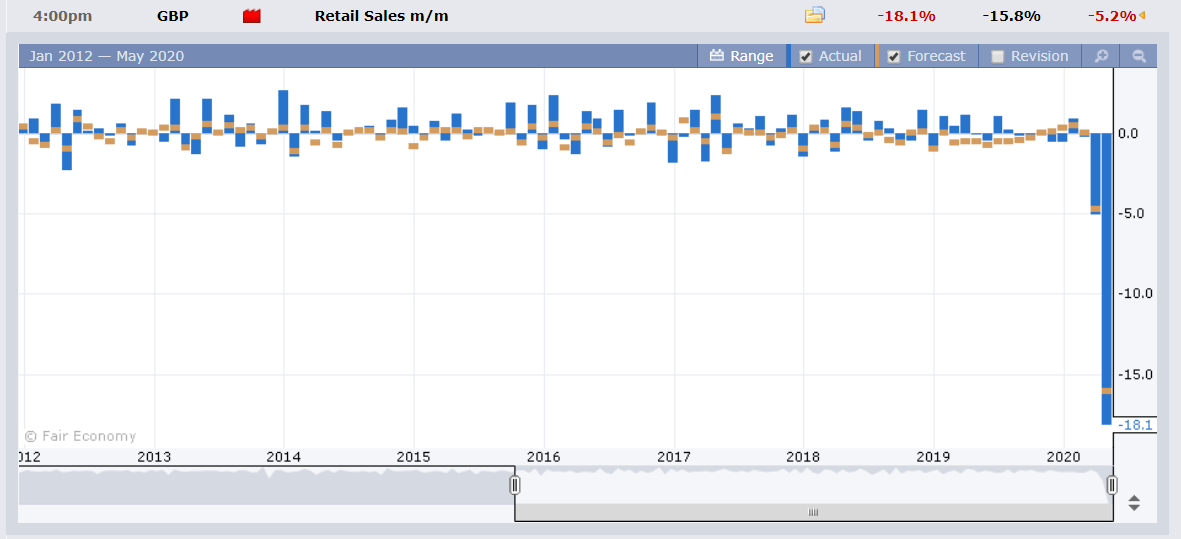

Summary: Hongkong became the focus of further tensions after China unveiled a plan to take a stronger stance on antigovernment protests in the territory. On Friday, President Trump said that Washington would address the issue “very strongly”. The Dollar Index (USD/DXY) extended its overnight gains in London trade, rising further in New York to 99.976 (99.428). Relations between the US and China have worsened since the coronavirus pandemic, lifting the market’s risk-off stance. The British Pound slumped 0.78% to 1.2167 (1.2225), finishing as worst performing major, after UK Retail Sales in April plunged to -18.1% from March’s -5.1%. Risk currencies, the Aussie and Kiwi were sharply lower. The Australian Dollar extended its drop by 0.55% to 0.6535 from 0.6567 Friday. The Kiwi fell 0.67% to 0.6095 (0.6122). The Euro retreated anew, down 0.6% to 1.0902 from 1.0948. USD/JPY finished little-changed at 107.60 from 107.62 Friday. Against the Offshore Chinese Yuan, the Dollar (USD/CNH) rose to 7.1500 from 7.1075. Wall Street stocks steadied at the New York close with modest gains. The DOW was up 0.17% to 24,520 (24,437) while the S&P 500 closed at 2,961 from 2,945 Friday. Yesterday White House Security Advisor Robert O’Brien said that the US government will likely impose sanctions on China if Beijing implements the national security law that would give it greater control over Hongkong. The key US 10-year bond yield steadied to 0.66% from 0.67%.

Canada’s Retail Sales fell to -10.0% in April from the previous month’s 0.4% but beating median forecasts at -10.4%. Core Retail Sales slipped to -0.4%, better than expectations of -4.8%.

On the Lookout: Expect trading to be cautious and thin today with the UK and US markets closed. The UK celebrates its Spring Bank holiday while the US celebrates Memorial Day. Asian markets will keep the spotlight on antigovernment protests in Hongkong against China.

There is little in the way of economic data releases today. Asia are quiet while Europe sees Germany’s Final GDP (Q1) released. Germany’s IFO Business Climate follows.

Trading Perspective: We can expect the Dollar maintain overall strength with tensions between China and the US running high and the market’s risk-off theme. Breakouts though are likely to be averted. Asian traders will focus on any escalation of tensions from China regarding the US response to its Hongkong national security law. Tensions are likely to remain heightened.

We take a look at the individual currencies.