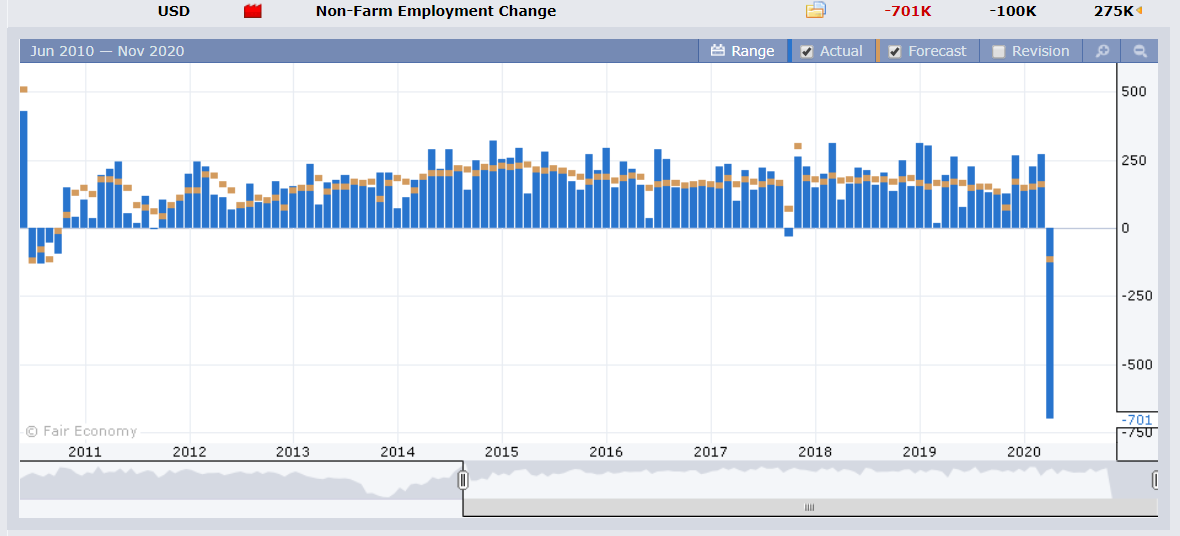

Summary: The Dollar Index (USD/DXY), a favoured gauge of the Greenback’s value against a basket of major currencies, extended it’s 3-day rally as the coronavirus spread continuing to take its toll on global economic developments. A risk-off theme pervaded which supported the US Dollar despite a massive -701,000 Payrolls drop for the first two weeks of March. Economists were looking for a fall of -100,000. The Unemployment rate jumped to 4.4% from 3.5%, higher than forecasts of 3.8%. The Euro extended its fall for the fifth day to 1.0815 (1.0850) on downwardly revised Euro area PMI’s and the overall stronger US Dollar. The Australian Dollar slid 1.3% to end at 0.5995 in late New York, leading all risk currencies lower. Against the Canadian Loonie, the Dollar advanced 0.45% to 1.4205 (1.4178) despite a 15% bounce in Brent Crude Oil prices to USD 35.10. Sterling dropped to 1.2270 from 1.2390. The Dollar was higher against the Yen to 108.45 from 107.95. Stocks slipped. The Dow fell 1.5% to 21,060 while the S&P 500 was 1.4% lower to 2, 492. The 10-year US bond yield fell two basis points to 0.59%. In early Asia the Dollar eased modestly as the latest health developments saw New York fatalities fall for the first time, Italy had the fewest deaths in over two weeks, Spain’s tally fell for the 3rd day running, and France reported the lowest number in 5 days. Meantime UK Prime Minister Boris Johnson has been hospitalised following ten days of self-isolation after he tested positive for Covid-19. BBC reported that Johnson “continues to have persistent symptoms of coronavirus.” Other data on Friday saw German Services PMI fall to 31.7, missing forecasts at 34.3. The Eurozone Final Services PMI slipped to 26.4, lower than expectations of 28.2. China’s Caixin Services PMI rose to 43.0 in March from 26.5 February, beating forecasts at 39.6.

On the Lookout: The massive fall in US Payrolls will only get worse in April as the U.S. did not go into full lockdown until the middle of March. While the European services PMI’s were lower and all of them missed forecasts, the extent of their fall was nowhere near the magnitude of the US data. Looking ahead, US economic reports should be negative for the US Dollar.

The only major US economic reports this week will be Thursday’s US CPI. The FOMC meeting minutes are due early Thursday morning (Sydney time). The week ahead sees the RBA (tomorrow) and ECB rate policy meetings (early Thursday morning). Today’s calendar is light. New Zealand kicks off with its ANZ Commodity Prices while Australia releases its ANZ Job Ads. Germany reports on its Factory Orders. Eurozone Sentix Investor Confidence data follow. UK Construction PMI’s round up the day’s reports.

Trading Perspective: The Dollar continues to strengthen despite the abysmal US Payrolls report and a weaker cross-currency swap loan demand. While the Greenback keeps drawing much of its strength from risk aversion, let’s not forget that the market’s positioning had turned short of US Dollars from the latest Commitment of Traders report. FX volatility remains elevated which is the one constant regardless of the Dollar’s direction. Marc Chandler, writer of Marc to Market, who has been covering global capital markets for more than 30 years wrote over the weekend while volatility remains high, we need to appreciate the change in the level of volatility over the past two months. Higher volatility requires lower confidence in demand (support) or resistance (supply). Nothing is obvious, which makes management difficult. One needs to be more flexible, and aware of levels.

The Bloomberg chart attached shows the change in implied volatility of the G10 currencies.