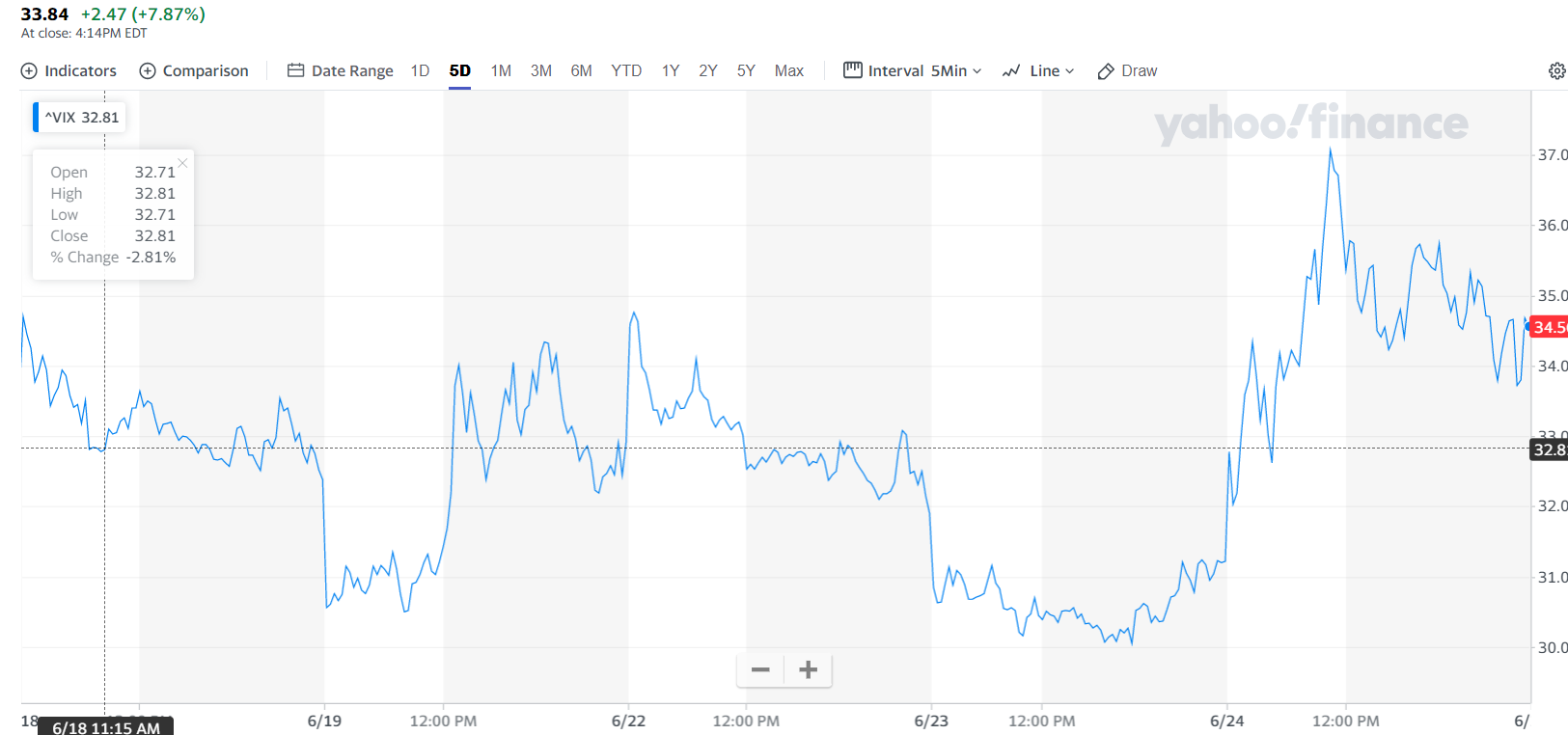

Summary: A resurgence in coronavirus infections in multiple US states hit risk appetite hard. California and Florida, the two largest economies in America reported a record number of new Covid-19 cases. Outside of the US, Brazil’s daily cases climbed by over 37,000. The US Dollar advanced against all of its rivals, including the haven associated Yen and Swiss Franc. The Dollar Index (USD/DXY) rebounded to 97.232 from 96.692, up 0.61%. Wall Street stocks took a beating, the S&P 500 slumped 2.6%. The CBOE VIX (Fear) Index jumped 8% to close at a one-week high. The IMF said it now expected global output to shrink by 4.9% instead of its April prediction of a 3.0% contraction. Elsewhere, the RBNZ kept its policy unchanged but kept the prospect of negative interest rates alive while signalling its displeasure on the recent rise of the New Zealand Dollar. The NZD/USD pair or Kiwi, as it is known among FX traders, plunged, losing 1.41% to 0.6407 (0.6500) and finish as worst performing currency. The Australian Dollar, the risk barometer of FX, slumped 1.11% to 0.6870 (0.6928). Against the traditional haven Japanese Yen, the US Dollar advanced 0.59% to 107.07 from 106.55. Broad-based US Dollar strength pushed the Euro down 0.55% to 1.1250 from 1.1310. Sterling fell 0.86% to 1.2420 (1.2518) after several UK health officials warned the British government about the risk of a second wave of Covid-19 infections as Prime Minister Boris Johnson continued to lift restrictions. The DOW finished at 25,522 from 26,110 yesterday for a loss of 2.16%. The S&P 500 slumped 2.6% to 3,057 (3,125). Global bond yields declined. The benchmark US 10-year yield was at 0.68% in late New York from 0.7% yesterday. Germany’s 10-year Bund yielded -0.45% from -0.41%. There were no major data releases yesterday.

Germany’s IFO Business Climate Index climbed to 86.2, beating forecasts of 85.0. The US House Price Index (HPI) rose to 0.2% from a previous 0.1%, but less than expectations of 0.3%.

On the Lookout: Risk aversion will remain elevated in Asia today. The resurgence of Covid-19 infections are outweighing the global stimulus efforts so far.

Today’s economic calendar picks up with New Zealand Trade Balance where the surplus is forecast to climb slightly from the previous month. Japan’s All Industry Activity Index follows. European reports kick off with Germany’s GFK Consumer Climate Index. The ECB releases its latest Monetary Policy Meeting Accounts. The UK follows with it Conference Board’s Realised Sales data. The US kicks off a busy calendar with Headline and Core Durable Goods Orders, with both seen improving. US Q1 Final GDP, Goods Trade Balance, Preliminary Wholesale Inventories and finally Weekly Claims for Unemployment Benefits round up the day’s reports.

Trading Perspective: FX can expect further choppy markets today. The resurgence in coronavirus cases in the US and around the globe will continue to be monitored which will see the risk-off theme extended in Asia. The US-China trade war is still an issue although it remains in the background for now. Tensions between the US and Europe are on the rise following reports that Europe might not allow visitors from the US when it opens. The US moved to put pressure on the European Union by flagging possible changes in tariffs on EU goods. In this risk-off environment the US Dollar will continue to win against all its rivals.