Summary: The US Dollar jumped on strong demand from global financial institutions seeking short term funds in the world’s most liquid currency to finance their businesses. Which have been struggling to deal with the fallout from the coronavirus spread. US Treasury yields soared. The benchmark 10-year yield closed at 1.08%, a whopping 36 basis points higher. After an initial fall earlier this month due to a drop in US bond yields, the Dollar Index (USD/DXY), a favoured gauge of the US currency’s value against a basket of 6 foreign currencies was up 1.5% to 99.559 from 98.028 yesterday. The Euro, which carries the biggest weight in the Dollar Index, slumped to 1.09548, overnight and near 2-week low before climbing to 1.1000 in late New York. Traders knocked the Australian Dollar which is the most sensitive currency to global growth, down to 0.5959, February 2003 lows before rallying at the NY close to 0.6013, a loss of 1.5%. Against the Yen, the Greenback rallies 1.3% to 107.62 (106.02). The USD/CAD pair climbed to a fresh 4-year high at 1.42759 before easing to 1.4245 as oil prices extended their slide. Brent Crude Oil prices dropped another 4% after Saudi Arabia pledged to increase production. US stocks bounced after the Trump administration pursued a USD 1 trillion plus stimulus package alongside a Fed commercial paper funding facility, first used in 2008. The Dow was last trading at 21,100 (20,485), up 2.6%. The S&P 500 gained 3.35% to 2,528 from 2,425 yesterday.

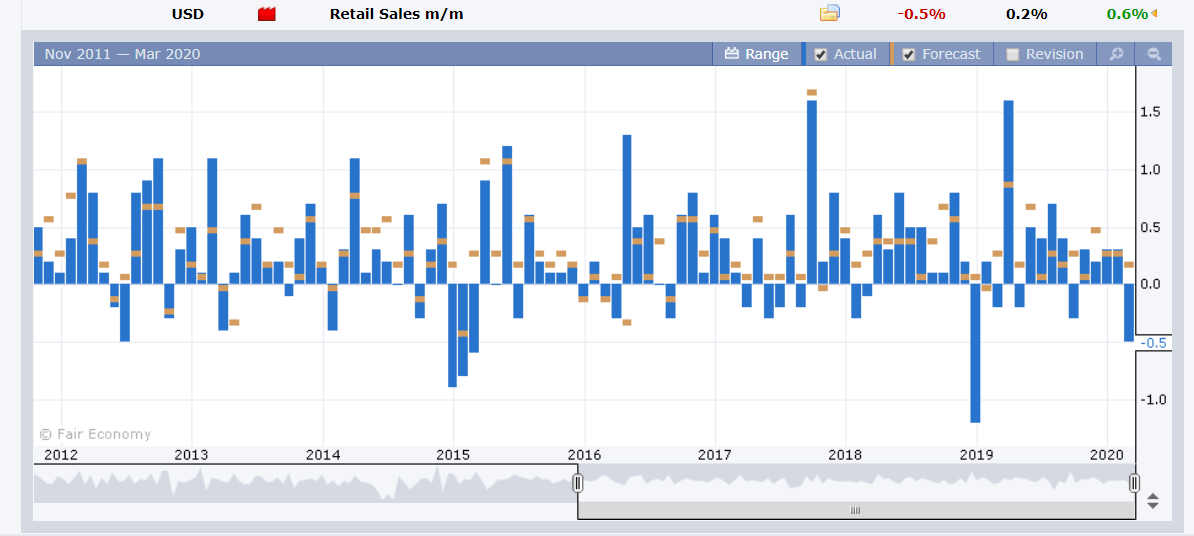

Data released yesterday saw Australia’s House Price Index (Q4) fall to 3.9%, missing forecasts of 4.5%. Japan’s Revised Industrial Production (February) climbed to 1.0%, beating expectations of 0.8%. The UK’s Average Earnings Index (Wages) rose to 3.1% against forecasts of 3.0% and a previous 2.9%. Britain’s Unemployment rate edged up to 3.9% against forecasts of 3.8%. Germany’s ZEW Economic Sentiment Index slumped to -49.5 against forecasts of -29.7. The Eurozone ZEW Economic Sentiment fared no better, falling to -49.5 versus expectations of -23.1. US Headline Retail Sales fell to -0.5%, missing forecasts of 0.2%, and its biggest drop in a year.

On the Lookout: The market’s risk tone improved after Wall Street’s recovery due to the White House stimulus measures and Fed’s relaunch of its financial crisis short term debt purchases. This will ease the pressure for offshore Greenbacks. Meantime the Covid 19 spread in the U.S. continues to grow. Fed Chair Jerome Powell said that the epidemic is having a “profound” impact on the economy. The weakness in sales to its biggest drop in a year is a start.

Trading Perspective: The bounce in the US Dollar and bond yields was the result of liquidity related demand in the commercial funding markets. The Fed has launched its first step to support the commercial paper market. Governments will continue to launch fiscal stimulus to stem the effects of an economic downturn. This will ease demand pressure for the US Dollar and bond yields.

Other global bond yields were also higher but not to the extent of the rise in US rates.

The Dollar’s climb slowed against all the Emerging Market currencies. Against the South African Rand, the USD gained 0.11% to 16.6170. The USD/TRY pair (Turkish Lira) dipped 0.4% to 6.3980. From this writer’s trading experience, the move in the USD/EMS often precedes the USD Majors.

US economic data continue to underperform. The slump in retail sales follows last week’s record fall in US Empire Manufacturing, which is the first regional survey out of the US for March.

Expect further falls in US economic activity as the coronavirus outbreak shuts down businesses in the country. King Dollar will have a difficult time keeping its crown in the days ahead.