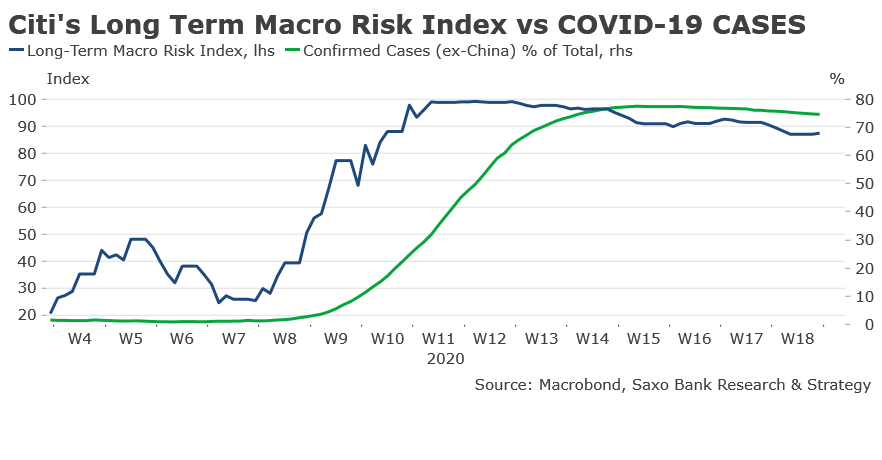

Tracking coronavirus cases: The global economy (ex-China) has not passed through peak yet, and the risk of the second wave remains. John Hopkins University has created an interactive map to track in realtime the spread of the pandemic.

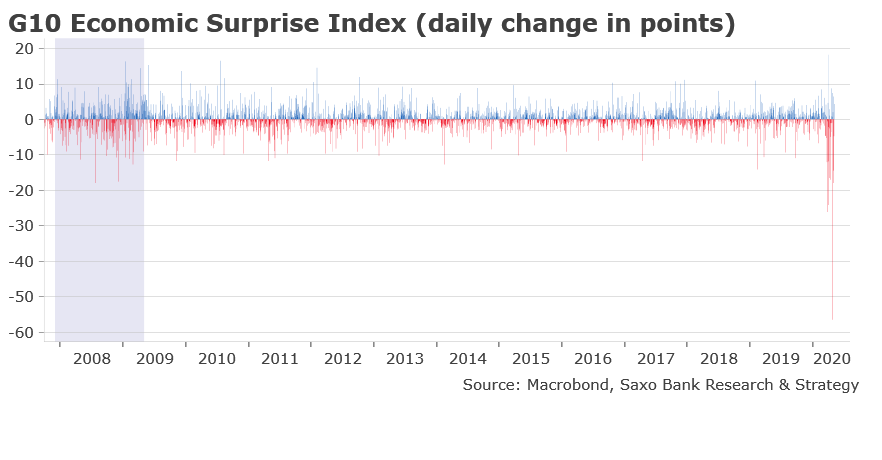

Coronavirus panic is bringing the global economy to its knees this year: World -3%, United States -5.9%, Japan -5.2%, Russia -5.5%, and the European Union -7.5%. Total economic losses are estimated at $9 trillion for 2020-21 (IMF forecasts).

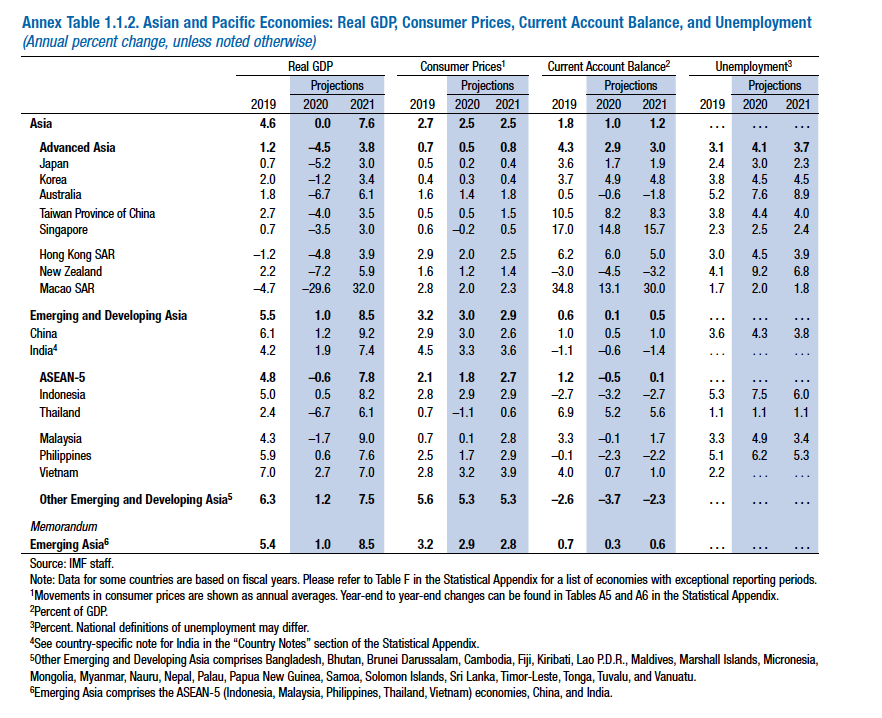

Asia will suffer zero growth this year for the first time in 60 years, versus +4.6% in 2019. Downward revisions are ranging from 3.5 ppts in the case of South Korea to over 9 ppts in the case of Thailand.

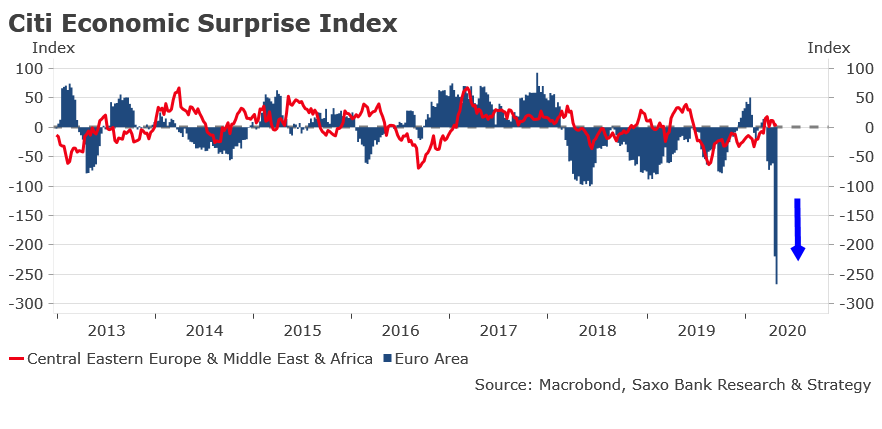

Better resilience of CEE countries: CESI for CEE at +5.4 vs -267 for the euro area. It is mostly explained by lower political risk, solid public finances, activism on the part of policymakers, effective containment (the tighter the lockdown, the lower the number of infections), etc.

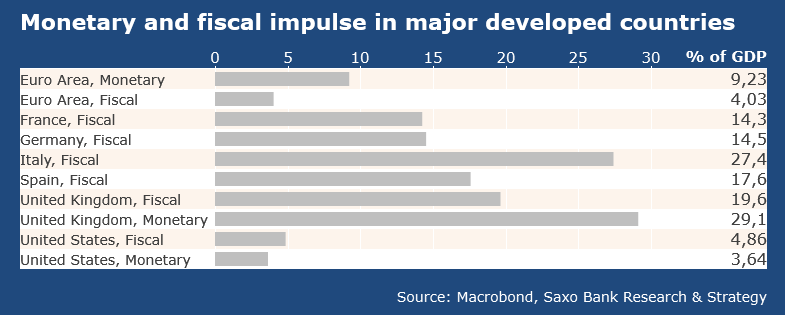

Go Big or Go Home: Very strong and fast policy response to the outbreak. Based on our calculations, the total stimulus package from G7-countries, including state guarantee, is about €5.5tr or 17% of combined GDP – a level that has never been reached in previous crisis. Adding to that, G-3 central banks have injected $2.76bn into financial markets since early March (x2 compared with the initial response in 2008).

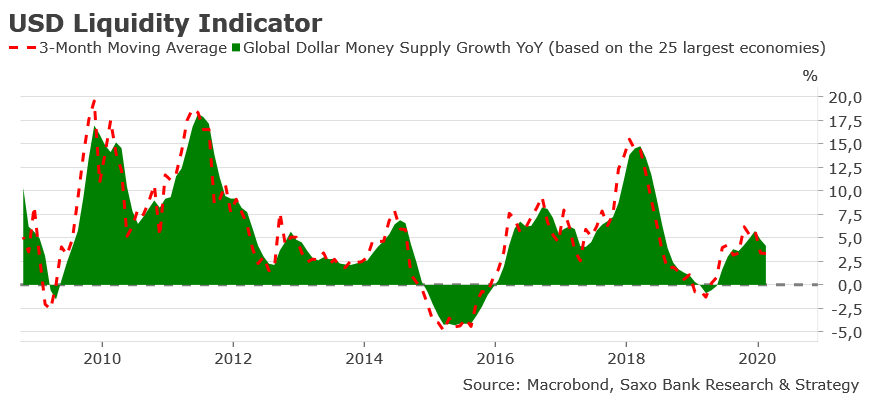

POSITIVE – The CB’s bazooka liquidity injections have managed to alleviate funding pressures in USD funding markets.

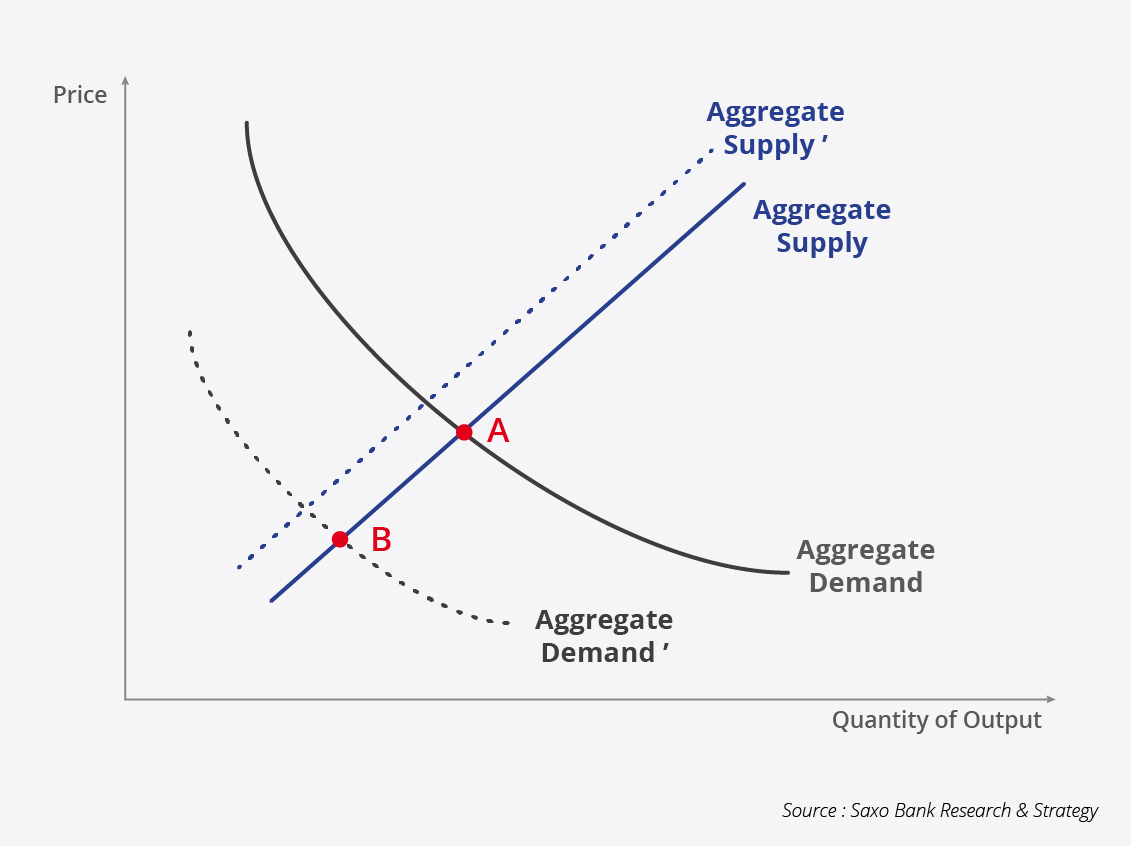

The initial supply shock is offset by a global aggregate demand shock. The fact that global commodity prices are plunging also speaks to the fact that we are dealing with a demand shock. This is represented in the chart by the shift in the demand curve to the right. The main risk is a deflationary shock in the short-medium term that could be amplified by a strong dollar.

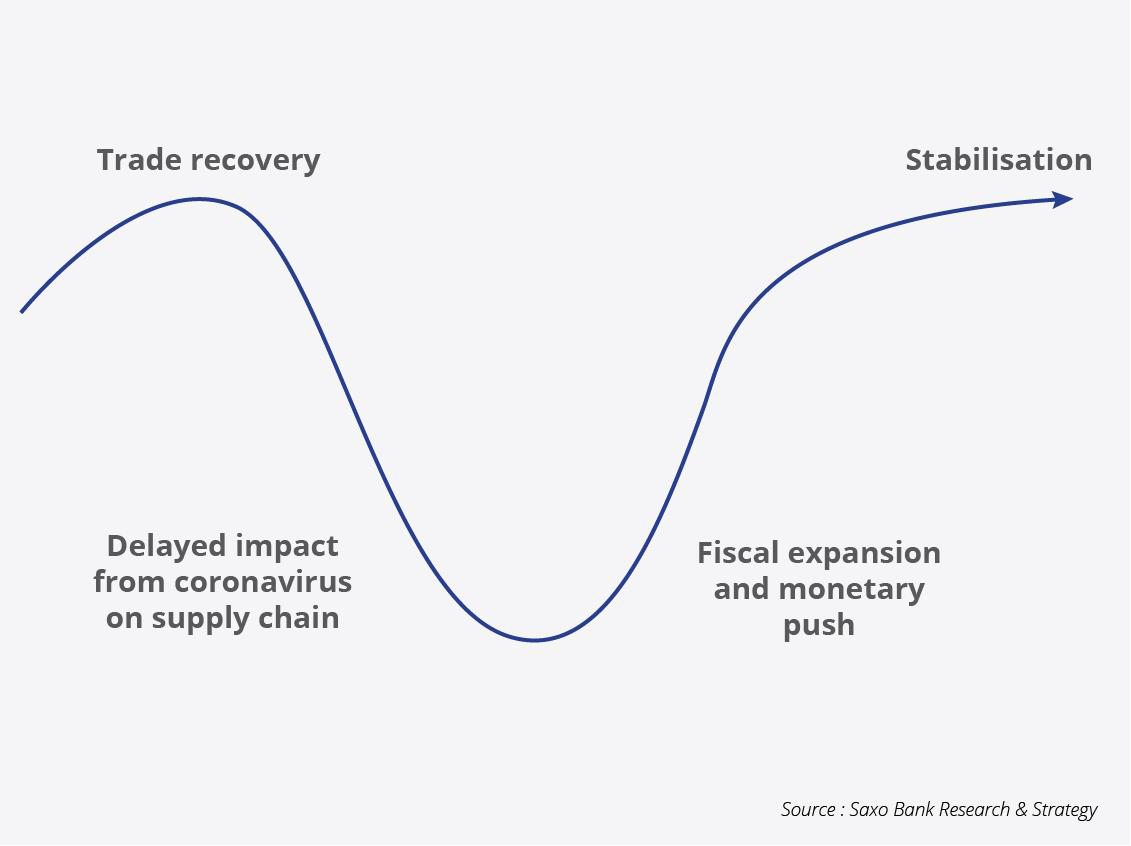

Baseline scenario: Worst recession since 1929 followed by a U-shape recovery. Production should get back to full capacity one or two months after the lockdown is lifted, but the service sector (especially tourism) will take more time to recover. Global growth back to normal in 2022-23.

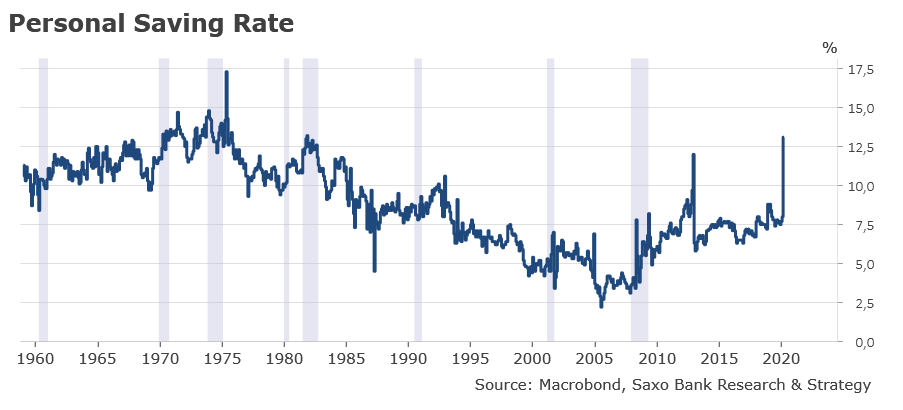

The speed of the recovery will highly depend on sentiment. Are we heading towards revenge consumption or an increase in saving due to the hysteresis effect? The latest U.S. statistics give us a clue. U.S. personal savings rate has surged by 5%. This is a huge negative for aggregate demand, and it is likely to amplify the current economic downturn.

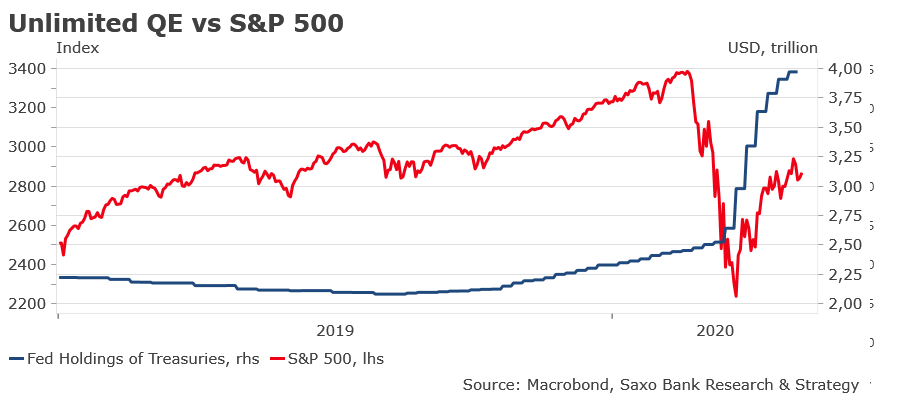

The creeping nationalization of financial markets

Central banks are becoming market markers in key segments (notably the sovereign debt market). They provide liquidity and fix the price, which pushes the equity market higher but also causes misallocation, mispricing, complacency, and muted volatility.

BANK OF JAPAN: JAPAN YIELD CURVE CONTROL REGIME

This is the NEXT step of monetary policy

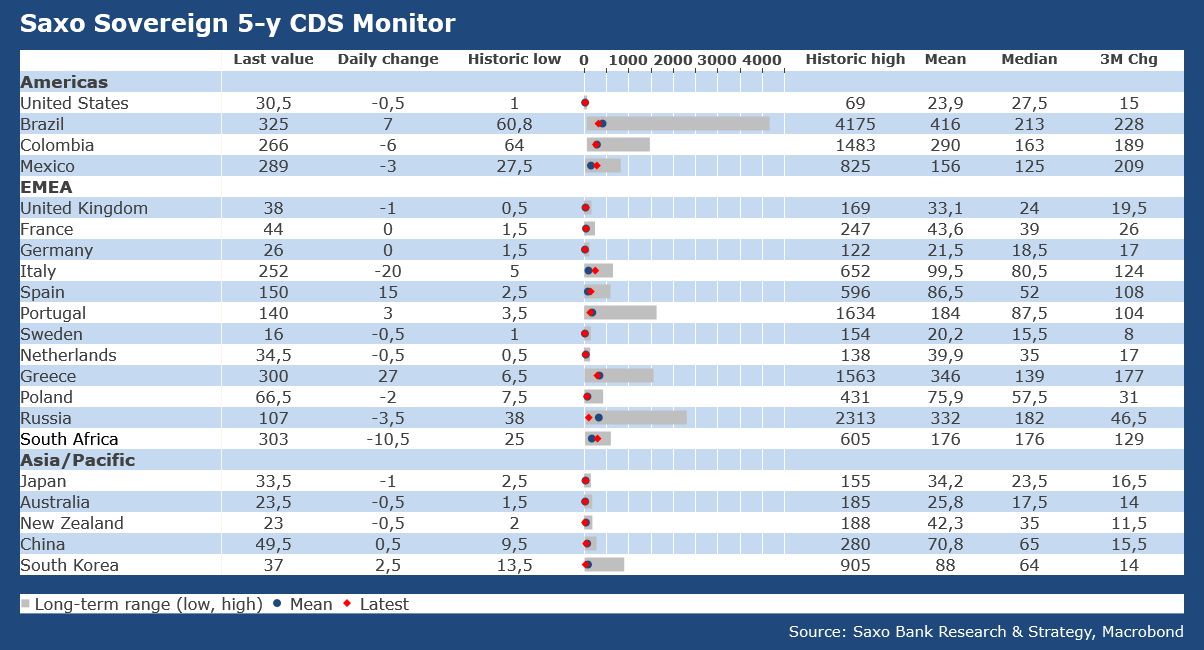

Market Risk: Introducing Saxo Sovereign CDS Monitor

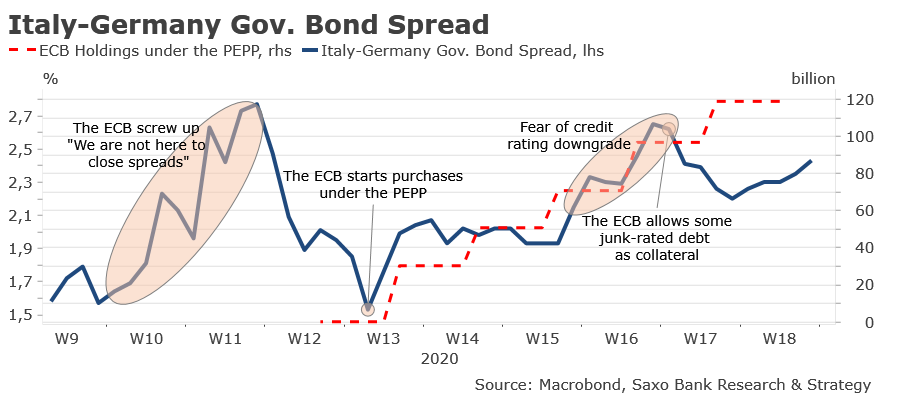

Market Risk: Italy

The ECB’s action has been decisive to limit sovereign debt risk. It is literally cleaning up all the secondary market, with a total amount of asset purchases that will likely be increased to ϵ1.5tr this year in order to absorb all new coronavirus debt issuance in the euro area.

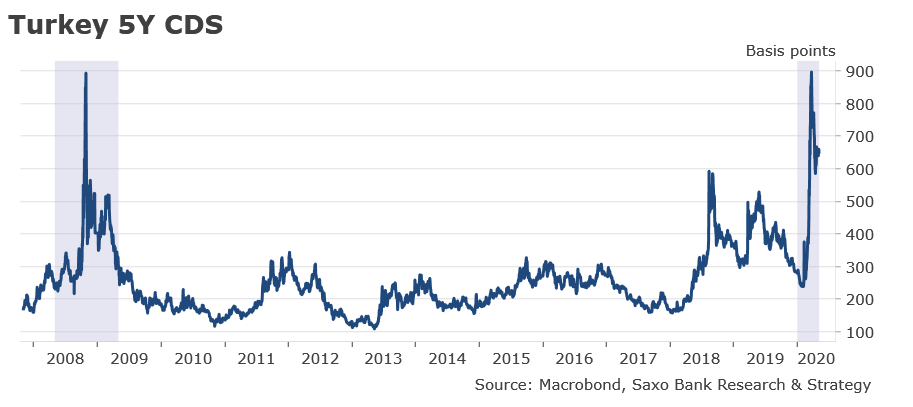

Market Risk: Turkey – A remake of 2008?

Market Risk: It’s a different story for CEE countries

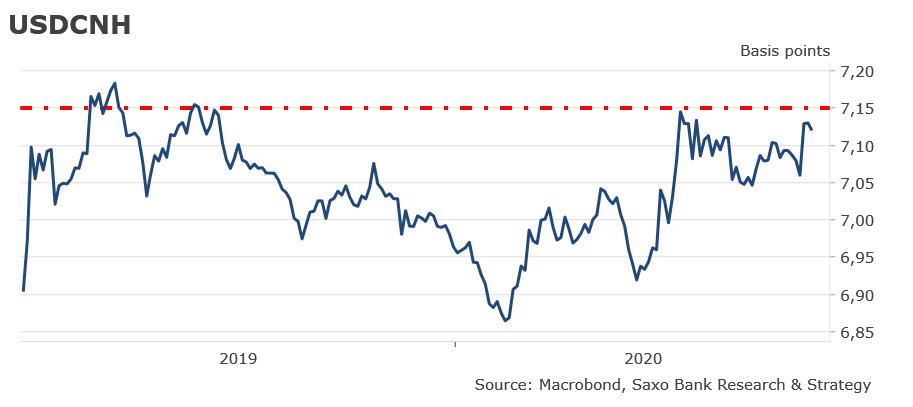

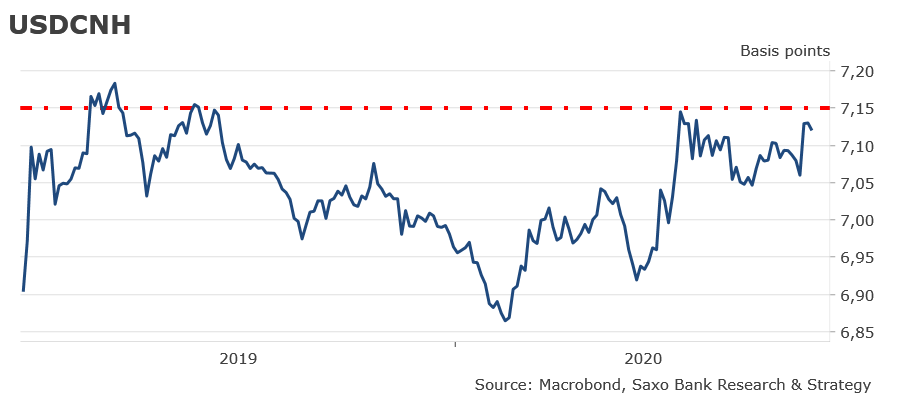

Market Risk: Chinese Yuan @Dembik_Chris @SaxoStrats The CNH – our ultimate barometer for US-China trade war – is on high alert again. Key technical resistance at 7.15. If broken, it could signal that China is ready to let go further its currency. It would induce a big move in the dollar and put negative pressure on equities and emerging-market assets.

Market Risk: Unbalanced oil market, fiscal impact and looming currency depreciation

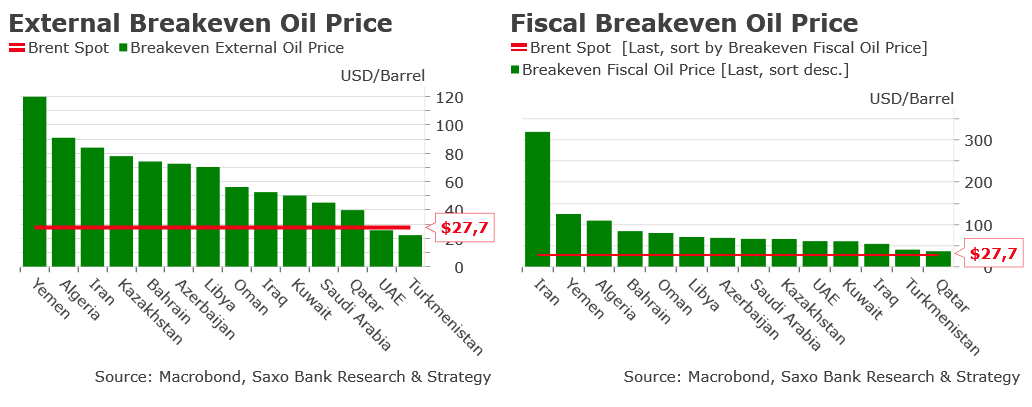

Most vulnerable oil-exporting countries based on breakeven oil price: Yemen, Algeria, Iran, Oman, Libya.

Market Risk: Chinese Yuan

The CNH – our ultimate barometer for US-China trade war – is on high alert again. Key technical resistance

at 7.15. If broken, it could signal that China is ready to let go further its currency. It would induce a big

move in the dollar and put negative pressure on equities and emerging-market assets.

Market Risk: Unbalanced oil market, fiscal impact and looming currency depreciation

Most vulnerable oil-exporting countries based on breaking oil price: Yemen, Algeria, Iran, Oman, Libya.

COVID-19 Market Research: Looking beyond the storm

Conclusion

An unprecedented crisis: Almost 100% of businesses are affected by the COVID-19 outbreak vs 60% in a « normal » recession.

Main downside risks to growth (from U-shaped recovery to L-shaped recovery): Weak global aggregate demand (hysteresis effect), tourism not back to normal before 2021-22 (more than 15% of direct GDP contribution in Spain, Portugal, and Greece), a wave of bankruptcies in the service sector.

New policy innovations: MMT, monetization, UBI to address social discontent and higher unemployment, YCC – Yield Curve Control to limit the appreciation in interest rates.

Regime shift back towards the 1950s: Big government and ultra-loose monetary policy (“lean against the wind” monetary policy). Long-term risk: higher inflation amplified by de-globalization forces, debt monetization, and the redirection of value chains. Higher taxation everywhere.

Governments will stop using nominal GDP and will refer to wellbeing indicators.