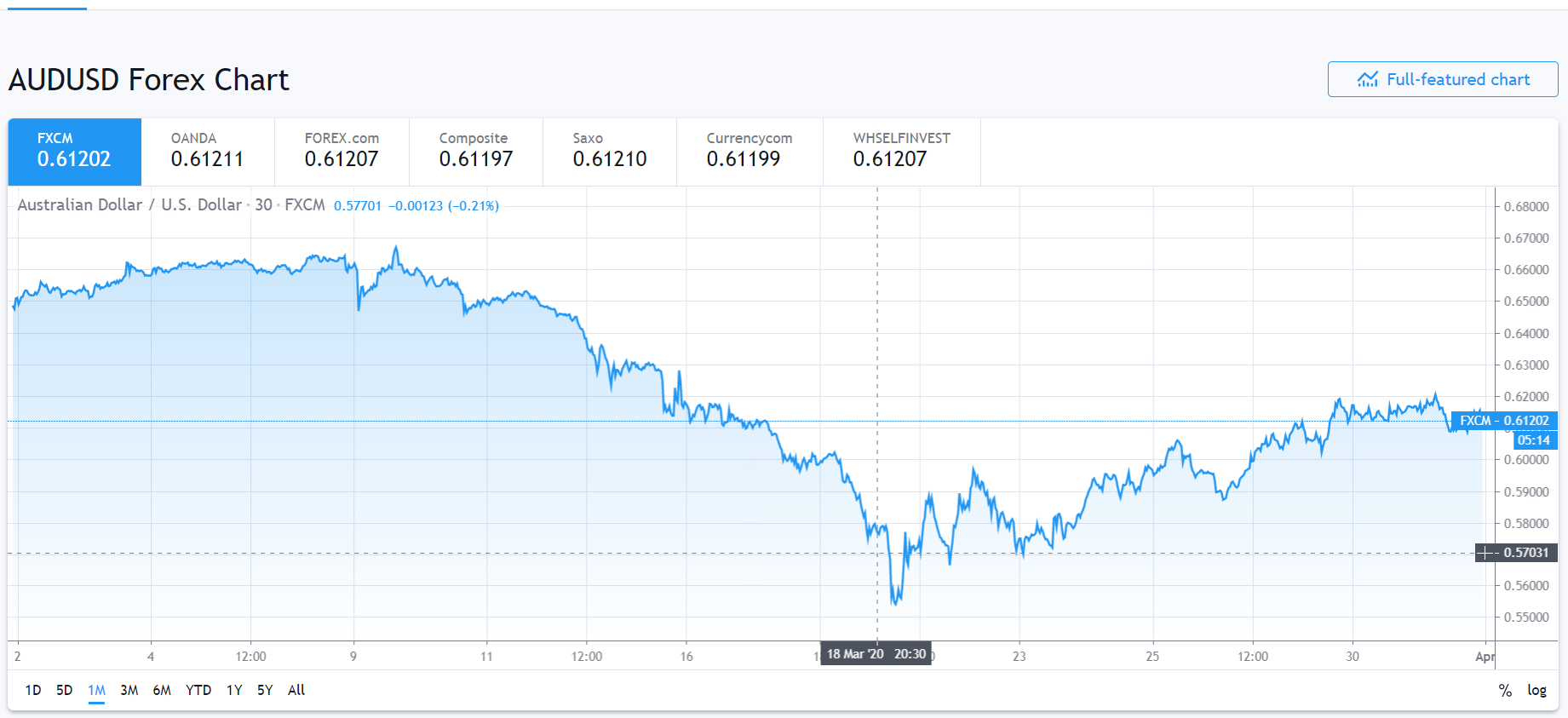

The Aussie eased off two-week and overnight highs at 0.62138, falling to 0.60706 in choppy trade to finish 0.25% lower in late New York to 0.6145. It was a case of risk-off against a slightly weaker US Dollar with the Aussie trying to find its way.

Traders viewed the upbeat March Chinese Manufacturing and Non-manufacturing PMI released yesterday with scepticism. Today, traders will focus on China’s official Caixin Manufacturing PMI, also forecast to improve. Australia’s AIG and Commonwealth Bank PMI’s are also due out as well as that of the US later today. At the end of the day, US Dollar will dictate where the Aussie goes.

The best way to approach the Aussie is to trade the recent range with discretion. The immediate resistance at 0.6200/20 is strong and a clean break of that could see 0.6250, 0.6280 and 0.6330. Immediate support lies at 0.6100 followed by 0.6070. A break of 0.6070 could see 0.6000/20 tested. Much depends on the upcoming data and the latest coronavirus reports. Be flexible and look to trade a similar 0.6070-0.6220 range. Prefer to be short near 0.6200 on the day.