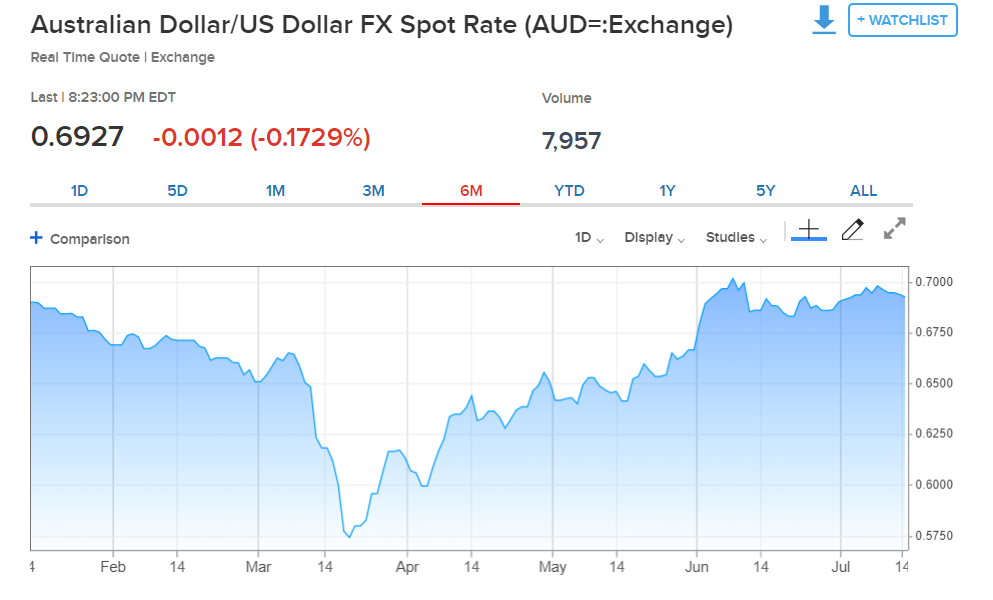

The Australian Dollar limped to a modestly lower close at 0.6942 (0.6955) despite an overall weaker Greenback after failing to bounce off a 3-day low at 0.6920. Early this morning, the Australian Business Insider reported that NSW Premier Gladys Berejiklian said more restrictions are on the table following a recent spike in new Covid-19 cases at a pub in south of Sydney. A popular casino, the Star was fined AUD 5,000 for breaching public health orders. Australia’s Treasurer Josh Frydenberg said the country’s real unemployment rate was 13.3%, more than double the official figure.

The latest Commitment of Traders report saw net speculative AUD short bets trimmed further to total -AUD 694 contracts from the previous week’s -AUD 2,908 bets for the week ended 7 July. Which means that speculators are virtually square in the Australian Dollar. The pressure is for a lower Aussie given the above news. Traders will look to today’s release of Chinese trade data where the surplus is expected to ease.

AUD/USD has immediate support at 0.6920 followed by 0.6880. Immediate resistance can be found at 0.6990 (overnight high traded was 0.69932) followed by 0.7010. Look to sell rallies in a likely range today of 0.6870-0.6970.