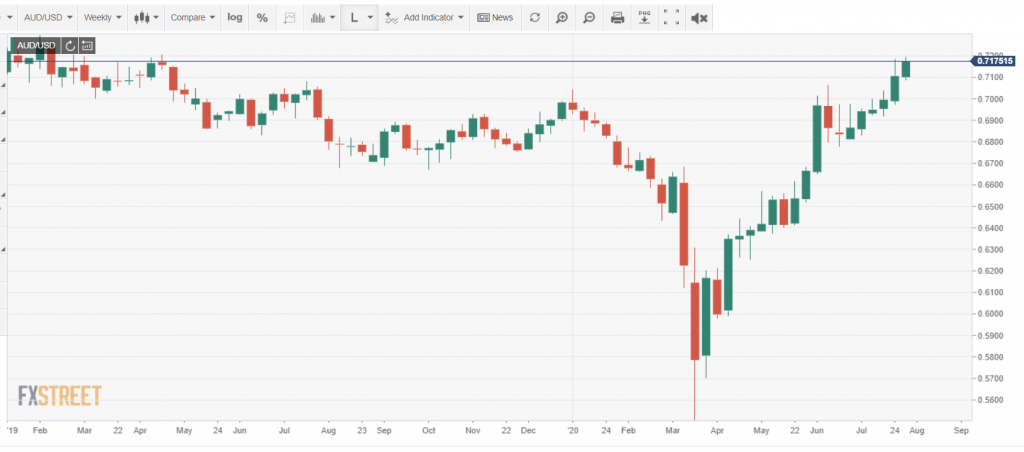

The Australian Dollar slid from its New York close at 0.7190 after trading to 0.7197 highs overnight after the Fed kept rates unchanged but signalled it will keep policy accommodative to battle Covid-19 in the US. In early Asia, the Aussie Battler slid to 0.7170 on breaking news that Victoria, Australia’s second largest state recorded a “horrifying spike in Covid-19 with a staggering 723 new cases and 13 deaths in the biggest surge in the country since the pandemic began. Other states, including Queensland are also seeing new virus climbs. This latest surge in the virus infections will impact the Australian economy and keep the Aussie under pressure.

AUD/USD has immediate resistance at 0.7200 followed by 0.7240. Immediate support can be found at 0.7150 and 0.7120. Look for the Australian Dollar to grind lower in a likely range today of 0.7090-0.7190. Prefer to sell rallies.