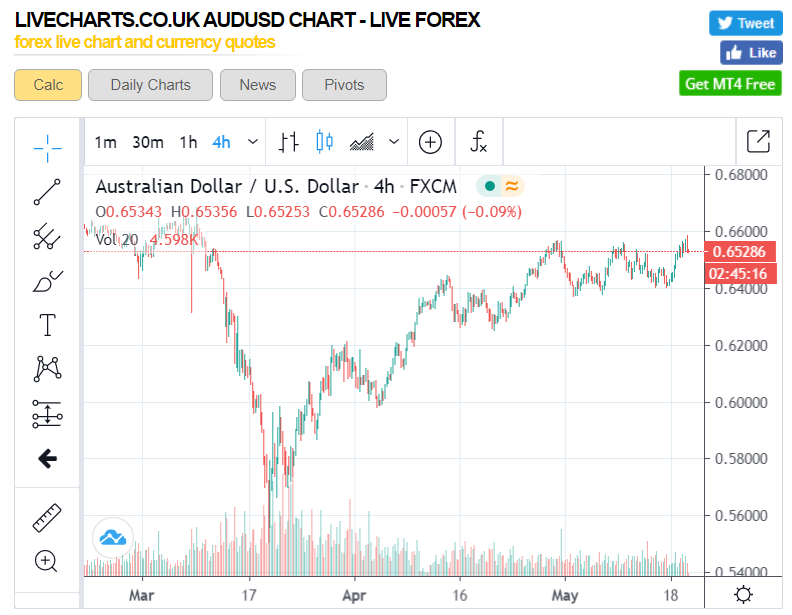

The Australian Dollar extended its rally, consolidating above the 0.6500 level after trading to 0.65849, overnight and 10-week highs. Broad-based US Dollar weakness supported the Battler while the ongoing Australia-China trade dispute prevented any meaningful gains. AUD/USD finished the New York session at 0.6535, up 0.2% from 0.6525 yesterday. China instituted an 80% tariff on Australian barley yesterday in retaliation for Australia’s call for an international investigation into the coronavirus spread. Traders will continue to monitor developments on this front.

The latest Commitment of Traders/CFTC report saw net speculative Aussie short bets increase slightly to -AUD 35,425 contracts (week ended May 12) from the previous week’s -AUD 33,455. The net short positions are 53% of the year’s high. There was little change in the market positioning.

The next significant event in the domestic Australian scene to have a possible impact comes tomorrow with RBA Governor Philip Lowe speaking in Sydney.

AUD/USD has immediate resistance today at 0.6600 which is formidable. The next resistance level can be found at 0.6630. Immediate support can be found at 0.6510 (overnight low 0.65094) which is followed by 0.6470. The Aussie’s upward momentum is slowing, and we see a likely range today of 0.6470-0.6570. Look to sell rallies.