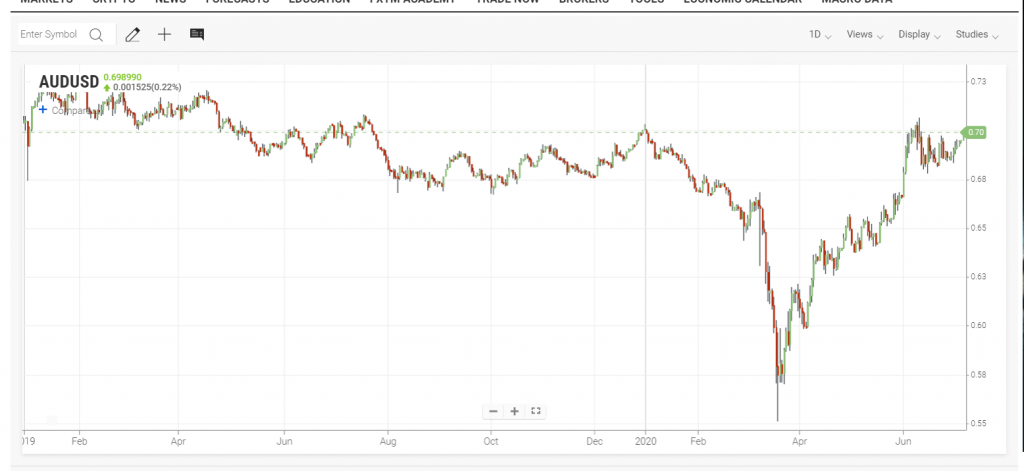

The Australian Dollar jumped 0.67% to finish at 0.6975 from 0.6945 yesterday boosted by the market’s risk-on stance. Yesterday’s lift in Chinese equities which saw the Shanghai Stock market soar 5.7% saw the Aussie Battler outperform most of its FX peers. Aussie traders ignored the closure of the border between New South Wales and Victoria for the first time in 100 years due to rising Covid-19 infections in several suburbs in Melbourne. There were 127 new cases reported yesterday, including two deaths in the southern state of 6.6 million people. A study by Deloitte economists saw the cost of a second wave of coronavirus infections to the Australian economy pegged at AUD 100 million.

The spotlight is on the RBA today where the Australian central bank is widely expected to leave its Overnight Cash Rate at its current all time low of 0.25%. Traders will look to the RBA rate statement and their outlook on the economy. This latest surge in Covid-19 infections in Victoria are likely to influence RBA Governor Phillip Lowe and his colleagues. We reported last week that the latest Aussie Dollar speculative short positioning was the lowest since 2018. This will see the 0.7000 cent area likely to cap any Aussie Dollar advances much beyond.

AUD/USD has immediate resistance at 0.7000 followed by 0.7030. Immediate support can be found at 0.6960 followed by 0.6930 and 0.6880. Look to sell into any rallies toward 0.70 cents in a likely consolidation within a 0.691-0.7010 range today. The Aussie is ripe for a downward correction.